- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Live in VA, had W-2G of 9,055 from NJ. TurboTax says not to add anything already entered on Federal. I end up with a refund of what I withheld.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live in VA, had W-2G of 9,055 from NJ. TurboTax says not to add anything already entered on Federal. I end up with a refund of what I withheld.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live in VA, had W-2G of 9,055 from NJ. TurboTax says not to add anything already entered on Federal. I end up with a refund of what I withheld.

It depends.

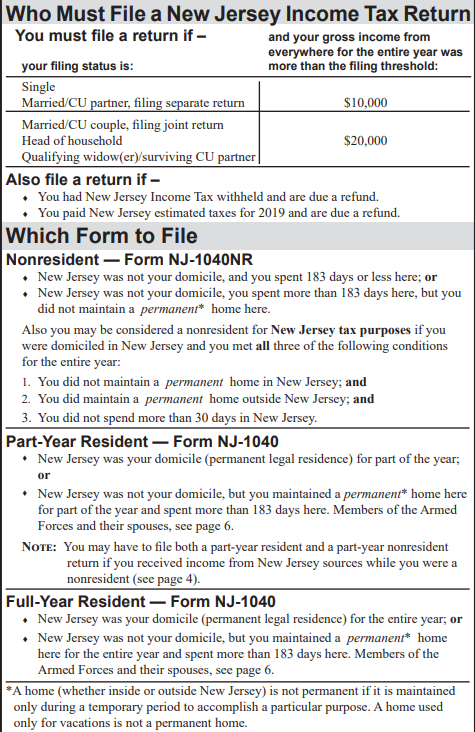

If you were a nonresident of New Jersey for the entire year, you may not have a filing requirement. See below for the threshold requirements for filing depending upon your income level and filing status.

If you determine you do need to file in New Jersey, try verifying your input using the following steps. This will ensure you are entering the income as earned within each state and are taxed accordingly.

You will make your entries in the "My Info"section of TurboTax.

Confirm that you have entered the correct state information:

- Click "Edit" to the right of your name

- Confirm your input under #2 "Tell us the state(s) you lived in"

- Do the same for your spouse if you are married filing jointly.

- Go back to the personal information section, and verify the mailing address and "Other state income" section. You would enter New Jersey in this section.

Once you enter this information, you should go back into the W-2 input under income.

Select Edit for this W-2 and scroll down to box 15, State & Local Taxes.

You will then continue to the state questions.

Prepare the Nonresident New Jersey state tax return first.

Once you have entered all of the New Jersey information, then start your Virginia return. Virginia taxes its residents on all income regardless of the source.

Once you have entered your information in the nonresident return, the information will pull into your resident return for Virginia to ensure you receive any credits for taxes on income which may have been taxed in both states. You will see this under the credit section as Credit for Taxes Paid to Other States.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

SB2013

Level 2

rsherry8

Level 3

RyanK

Level 2

tianwaifeixian

Level 4

catoddenino

New Member