- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Kentucky non-resident Form 750-NP

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Kentucky non-resident Form 750-NP

Turbo tax Deluxe 2019 imported my Federal tax info into Kentucky Form 740-NP. Kentucky income for non-resident for 1 weeks work is $1639.04. TT form will not allow me to change income and wants to tax us on all income earned from all sources. Completed form as resident of Pennsylvania full year.

How do I clear the incorrect info to be taxed on only the $1639.04?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Kentucky non-resident Form 750-NP

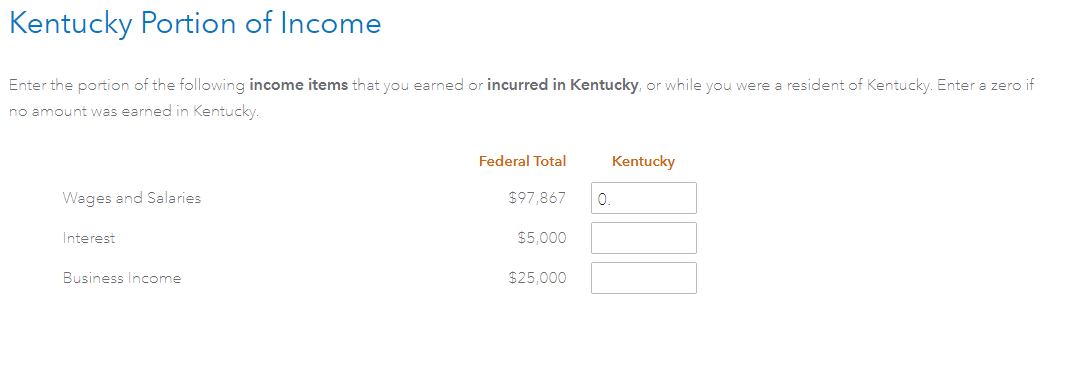

Restart the Kentucky state return by deleting the return and then adding it back in. This will reset the entire interview. Near the beginning, look for the screen "Kentucky Portion of Income" which will allow you to enter the amount of federal income was earned in Kentucky. The screen will look like this:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Kentucky non-resident Form 750-NP

Appears that in order to delete KY return, entire return must be deleted including Fed and PA. What am I missing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Kentucky non-resident Form 750-NP

No, just delete the Form 750-NP

1) Open your tax return.

2) Go to the left side of the screen and click on Tax Tools, then Tools

3) From the pop-up Tools Center menu, select Delete a form

4) Scroll to find the Form 750-NP and Delete it.

5) Scroll to the bottom of the list and hit the button to Continue My Return

That should do it.

- How do I view and delete forms in TurboTax Online?

- How do I delete a tax form in the TurboTax CD/Download software?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

balld386

New Member

ajm2281

Level 1

sburner

New Member

ambermcmillan6

New Member

Questioner23

Level 1