- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Joint return where residence is KS but one spouse earned income in MS

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Joint return where residence is KS but one spouse earned income in MS

I live in Kansas but am employed in Missouri. As a result, I pay state tax in both states. My wife is unemployed but has taxable income through her investments. We file a joint return. Does Missouri have any claim on my wife’s investment income? For example, my wife purchased a Kansas municipal bond to avoid paying both federal and state taxes. However, TurboTax does not offer an obvious way to exclude non-qualified income from the Missouri tax return.

- Is this an error in TurboTax?

- Or is there a way to do this on the Missouri return?

- Or based on the state rules does Missouri have a legitimate claim to this money on a joint return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Joint return where residence is KS but one spouse earned income in MS

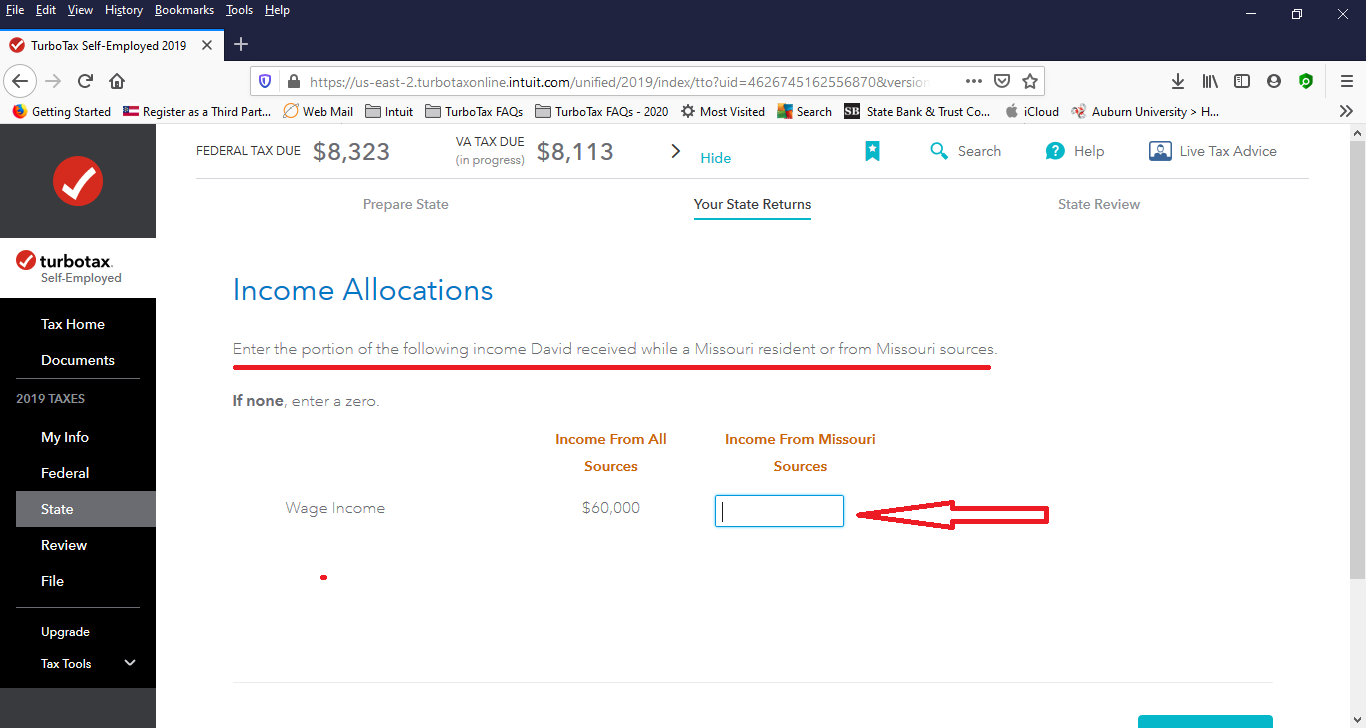

As Kansas residents, you do not have to pay Missouri tax on any of your income other than what was earned in Missouri. There is a section in the Missouri non-resident return in TurboTax where you allocate your income to Missouri. See the screen shot below:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Joint return where residence is KS but one spouse earned income in MS

Thank you DavidD66 for your reply. I also looked at this issue a bit further and believe the problem lies in the answer TurboTax writes to boxes 28Y and 28S on the MS state tax form. I followed the approach shown in your screenshot but regardless 100% is posted in boxes 28Y and 28S. The answer in this box is supposed to be the percentage of Missouri income divided by the Federal adjusted gross income. However, as noted it is 100% regardless of how the interview questions are answered so I think this is a bug in TurboTax.

The amounts shown on the Form MO-NRI correctly reflect was was entered on the interview questions but boxes 28Y and 28S show 100%. To me the percentage in these boxes should be based on what is captured in Form MO-NRI.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Joint return where residence is KS but one spouse earned income in MS

Please disregard my previous answer. In looking at boxes 28Y and 28S, they now reflect the correct percentage. Apologies for any inconvenience.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rodiy2k21

Returning Member

girishapte

Level 3

bgoodreau01

Returning Member

dpa500

Level 2

jimshane

Level 1