- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- I received the 1099 - G from unployement but the form does not contain boxes 10a / 10b / 11

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received the 1099 - G from unployement but the form does not contain boxes 10a / 10b / 11

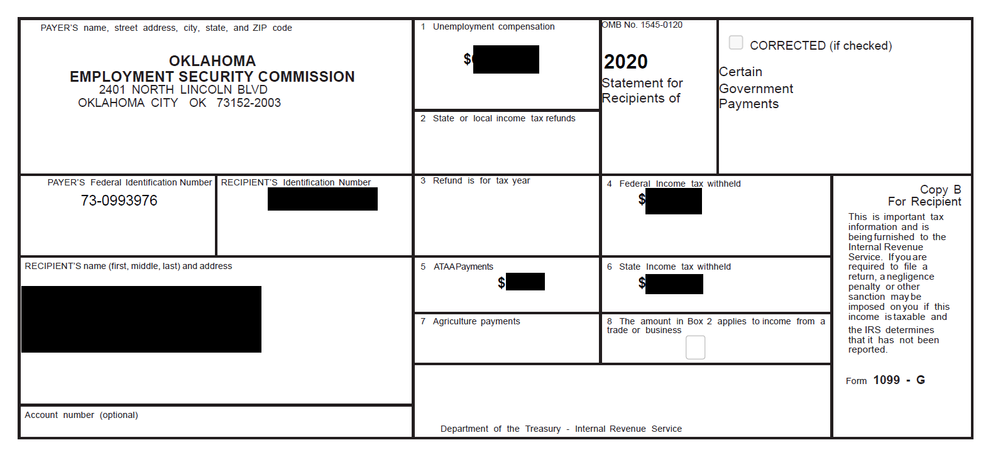

I just received the 1099 - G from unemployment in Oklahoma

.

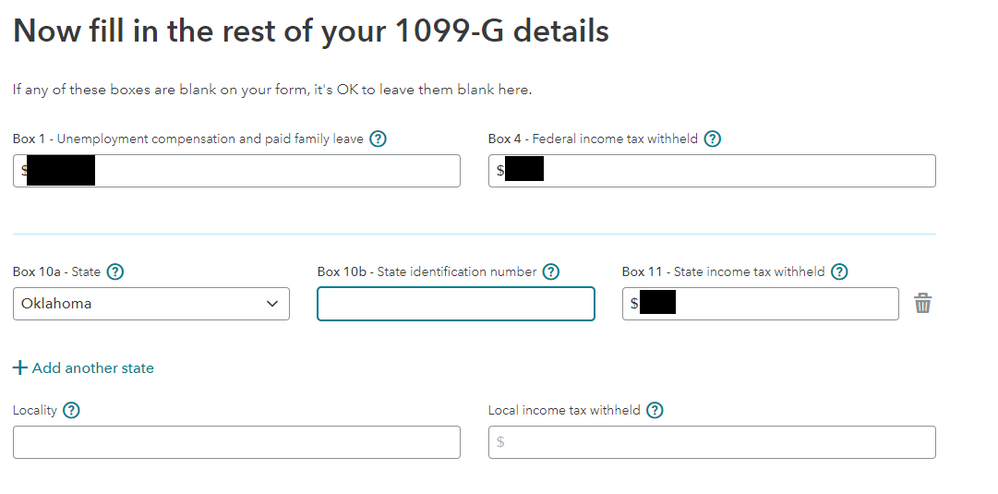

In turbo tax, I am asked to fill information from box 10a and 10b and 11

I don't know the state identification number, but I guess that for 10a, I should put Oklahoma, and for 11b, I should put State Income tax withheld.

Is what I am doing correct? and what should I do for 10b box?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received the 1099 - G from unployement but the form does not contain boxes 10a / 10b / 11

10a - should probably "OK" (without the quotes).

10b - We in the Community do not know what the state identification number of Oklahoma is, but it is likely to be the same or similar to the Payer's Federal Identification Number on the left.

11 - yes, box 11 should be the amount of state tax withheld.

Note that if there is no state tax withheld, you should make sure to blank out 10a and 10b.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received the 1099 - G from unployement but the form does not contain boxes 10a / 10b / 11

10a - should probably "OK" (without the quotes).

10b - We in the Community do not know what the state identification number of Oklahoma is, but it is likely to be the same or similar to the Payer's Federal Identification Number on the left.

11 - yes, box 11 should be the amount of state tax withheld.

Note that if there is no state tax withheld, you should make sure to blank out 10a and 10b.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received the 1099 - G from unployement but the form does not contain boxes 10a / 10b / 11

10b asks for State ID number. Could that be the Recipient Number. It doesn't call out Payer ID number to what they want.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received the 1099 - G from unployement but the form does not contain boxes 10a / 10b / 11

If your form 1099-G does not have boxes 10a, 10b, or 11, please leave them blank on the Turbo Tax entry screen.

Not all states tax these benefits and may not include these boxes on the form (or may leave both boxes blank). If that's the case, you can leave them blank here.

@iazona1

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

courtmattina

New Member

Kellyriley890

New Member

20rualcung

New Member

kazionlittle24

New Member

Tiffany22115

New Member