- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- I am a resident of Michigan. I earned money while staying in Ohio in 2020. Columbus city tax was taken out, do I have to file a Columbus city return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a resident of Michigan. I earned money while staying in Ohio in 2020. Columbus city tax was taken out, do I have to file a Columbus city return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a resident of Michigan. I earned money while staying in Ohio in 2020. Columbus city tax was taken out, do I have to file a Columbus city return?

Q. Do I have to file a Columbus city return?

A. No, but you may want to. See below*. The only time a non resident is required to file a city return is when an improper amount was withheld and that is very rare.

Although MI & OH have a reciprocity agreement on state taxes, that agreement does not apply to city tax. Columbus is allowed to withhold from your pay and you cannot get that refunded.

*But, Michigan will give you credit for that on the state return, but you have to attach a copy of the city return. So, even though the Ohio city does not require you to file a return, you have to file one to get the MI credit, even though there will be no tax due or refunded from the Ohio city.

Columbus forms (you want IR-25) https://www.columbus.gov/IncomeTaxDivision/TaxForms/Individuals/

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a resident of Michigan. I earned money while staying in Ohio in 2020. Columbus city tax was taken out, do I have to file a Columbus city return?

Yes. Per the State of Ohio, non-residents who work or conduct business in Columbus owe 2.5% tax on the income they earn in Columbus and must file IR-25. Although Michigan and Ohio have a reciprocal agreement on wages, it does not include city returns.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a resident of Michigan. I earned money while staying in Ohio in 2020. Columbus city tax was taken out, do I have to file a Columbus city return?

Thank you for your reply. My Ohio employer did take the 2.5% out of my check and report it on my W2's. I was wondering if I also needed to file some sort of paperwork. Do you know if I am supposed to and where I can get the forms?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a resident of Michigan. I earned money while staying in Ohio in 2020. Columbus city tax was taken out, do I have to file a Columbus city return?

It depends. Per the City of Columbus, you have to consider four things when deciding whether or not you have to file a city income tax return. Although the answer to the question 2, 3 and 4 below indicate that you do not have to file a Columbus return, I am not sure about question 1.

- Did I file a previous year return in which additional tax was due?

- Am I a resident of the City of Columbus or a non-resident working in Columbus? Yes

- Was less than 2.5% of my total wages withheld for city tax? No

- Did I have other earnings from which city tax totaling at least 2.5% was not withheld? No

If you answered "yes" to question 1 you are required to file a return.

Unfortunately, TurboTax does not support the filing of Columbus, Ohio city tax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a resident of Michigan. I earned money while staying in Ohio in 2020. Columbus city tax was taken out, do I have to file a Columbus city return?

Thank you very much. That answers my question. I appreciate your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a resident of Michigan. I earned money while staying in Ohio in 2020. Columbus city tax was taken out, do I have to file a Columbus city return?

Q. Do I have to file a Columbus city return?

A. No, but you may want to. See below*. The only time a non resident is required to file a city return is when an improper amount was withheld and that is very rare.

Although MI & OH have a reciprocity agreement on state taxes, that agreement does not apply to city tax. Columbus is allowed to withhold from your pay and you cannot get that refunded.

*But, Michigan will give you credit for that on the state return, but you have to attach a copy of the city return. So, even though the Ohio city does not require you to file a return, you have to file one to get the MI credit, even though there will be no tax due or refunded from the Ohio city.

Columbus forms (you want IR-25) https://www.columbus.gov/IncomeTaxDivision/TaxForms/Individuals/

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a resident of Michigan. I earned money while staying in Ohio in 2020. Columbus city tax was taken out, do I have to file a Columbus city return?

Thank you very much. I did already file my Michigan return. I guess I am wondering if I can amend it with the city return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a resident of Michigan. I earned money while staying in Ohio in 2020. Columbus city tax was taken out, do I have to file a Columbus city return?

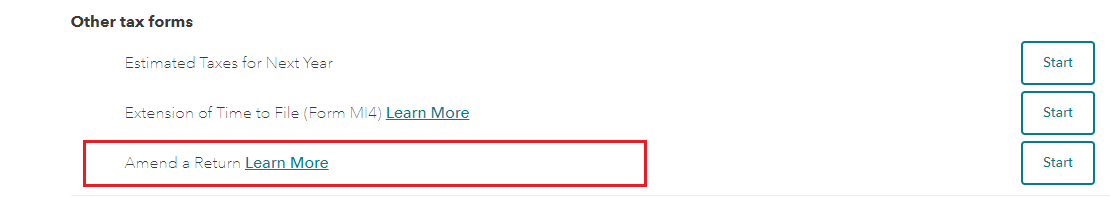

Yes, you can amend the Michigan (MI) return if you did not take the credit as indicated by @Hal_Al.

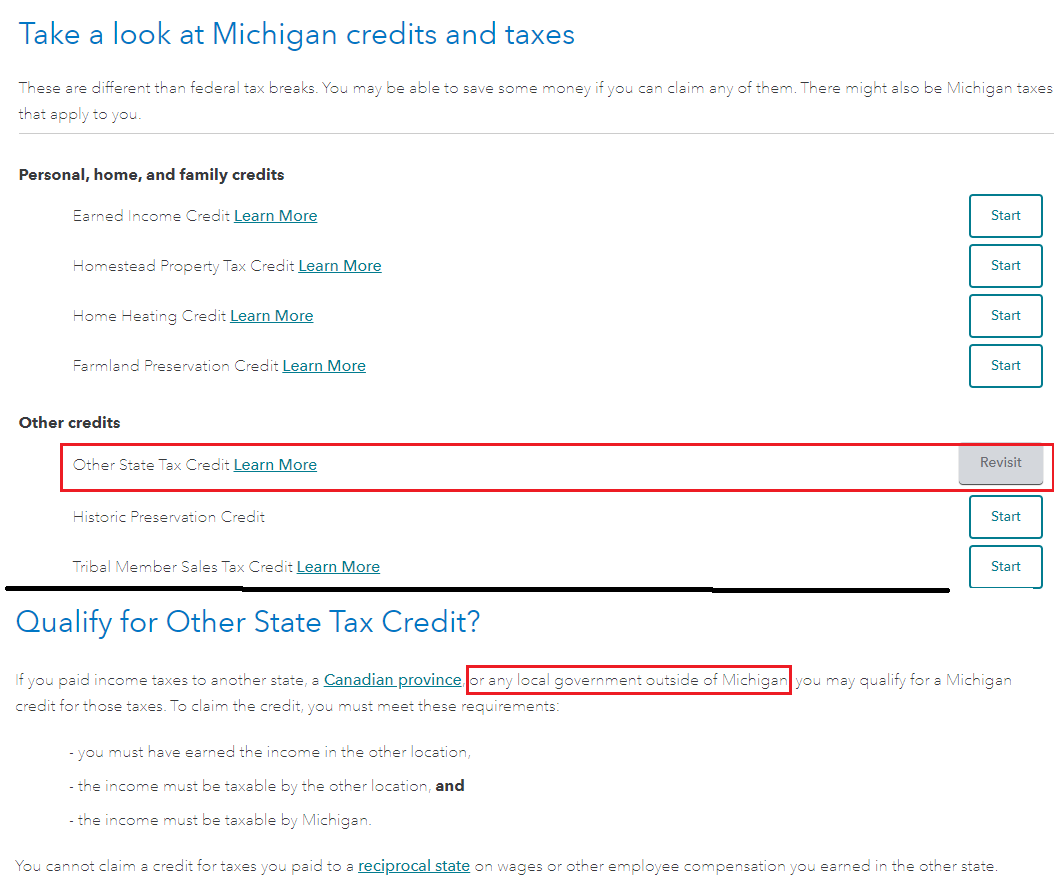

When you are in the MI return, you will see the screen images when you get to the screen labeled: Take a look at Michigan credits and taxes

- Use this link when you are ready to amend. I need to amend my state return

In the MI return, when you get to the screen A few things before we wrap up your state taxes, you can select to amend your state return. See the images below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a resident of Michigan. I earned money while staying in Ohio in 2020. Columbus city tax was taken out, do I have to file a Columbus city return?

Thanks again for all your very good help in this situation.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

user114670

New Member

just650073

New Member

mrodrig54

New Member

karajeanwillis

New Member

dckeithjr

Level 2