- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- How to pay State of Kansas

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to pay State of Kansas

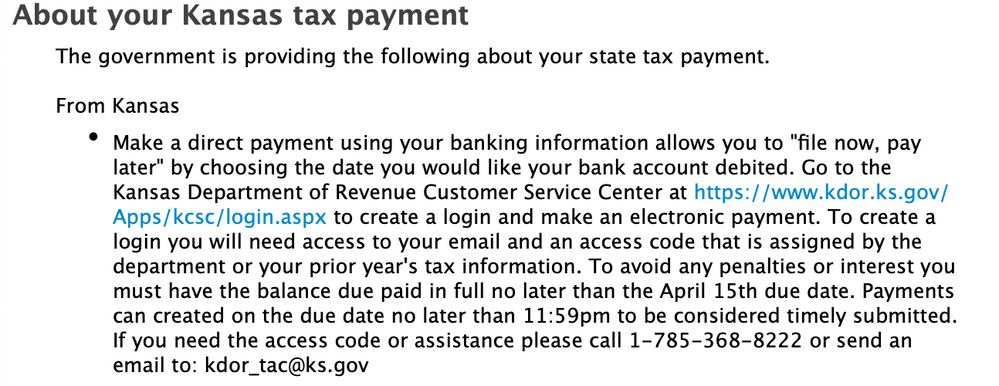

We owe a small tax to a non-resident state, Kansas (We live in California). We are wanting to just have Turbo Tax automatically debit the same account we have already entered for TT to get us our Federal Refund. We are at that step in TT but even though it is asking us for all the same info (and autofilled it in for us since we've already entered this bank info for the Fed return) we also see a note that speaks of going to a certain Kansas website and setting up an account to be able to electronically pay... See screenshot attached... Are we ok to just go ahead and request TT to pay the small tax we owe and we will NOT need to heed the rest of what you will see in this attached screenshot??? thanks...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to pay State of Kansas

@diitto Correct. All you need is the voucher and check and mail them to the Kansas tax authorities.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to pay State of Kansas

If you want to pay the Kansas taxes owed by direct debit from your bank account you will need to follow the instructions you posted.

Or pay the Kansas taxes owed using the other options given for paying the KS taxes.

Many states do not allow you to pay the taxes owed by direct debit from personal tax preparation software, Kansas is one of those states.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to pay State of Kansas

Thank you very much for your quick response... We were knee deep in trying to do our Fed, Ca and Ks taxes when the question I posted came up. Your response of,

"Many states do not allow you to pay the taxes owed by direct debit from personal tax preparation software, Kansas is one of those states."

changed the situation for us and we are now opting to do Kansas with electronic file (done) but we will soon send them in a check for a very small, one time amount, owed... Along with the payment voucher Turbo Tax created...

All we need to send in is that K40V voucher along with the check, correct??? Nothing else since we've already electronically filed Kansas??? Holler back on that... thanks again for the help.....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to pay State of Kansas

@diitto Correct. All you need is the voucher and check and mail them to the Kansas tax authorities.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

chrisromero

New Member

hasalaph

New Member

michael_s_peterson

Level 2

unlimited_reality_designs

New Member

test5831

Returning Member