- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- How is California Tax Exempt interest calculated? Seems incorrect (too high)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How is California Tax Exempt interest calculated? Seems incorrect (too high)

I'm confused with the number TT is giving me for CA Tax Exempt Interest. It seems too high (greater than the amount of TE itemized for CA on 1099-int and 1099-oid). The amount for Federal is correct. I can't find on Schedule B how they determine the number used for California.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How is California Tax Exempt interest calculated? Seems incorrect (too high)

OH...and dealing with the bond Premiums?

Yeah, I've done that. I subtract all of the tax-exempt $$ belonging to my state out of box 8 & 13 in the original 1099-INT, and put them in a separate 1099-INT form as-if from the same brokerage. You would do that for your CA bonds (and any US Territory bonds). That way, only the proper amount of amortized premium gets assigned to the CA bonds. Also, I guess it allows you to declare all of the box 8 (&13) $$ as being CA bonds on the new-separate 1099-INT....and they are now the proper amounts.

AND do similar if you have OID to report for any CA bonds you own...create two, one for CA, and another for everything else.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How is California Tax Exempt interest calculated? Seems incorrect (too high)

I think I've found the problem. TurboTax isn't using the detailed information from the downloaded 1099-INT, only the percentages. It's saying, California is 75% of the Bonds, so it gets 75% of the TE Bond Premium. But that's NOT the case, when I looked at the details, California has 84% of the TE Bond Premium. It was giving me a higher number for CA Tax Exempt Interest than it should be.

I was wary this year because we recently received a demand notice (bill with tax due + interest penalty) for our 2019 taxes that we incorrectly reported CA TE Bond Income. When I looked back, everything was entered in TT correctly, with the correct states identifying the Bond Income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How is California Tax Exempt interest calculated? Seems incorrect (too high)

(Maybe best jump to my next post about the amortized Premium adjustments for your CA-specific bonds)

______________________

,,,,,,,,,,,,,more generally. what follows may not answer your specific issue, but now that I've posted it, it may help others

________________________________

For the 1099-INT, those details need to be entered by you, on the follow-up page after the 1099-INT form. The details you see in the supplemental sheets do not get entered with the import (The various software companies and the brokerages haven't found a way to do that accurately (yet)).

____________________

The procedure for Tax-Exempt $$ reported a 1099-INT and a 1099-DIV are somewhat different for CA residents.

_________________

1) SO, for a 1099-INT with $$ in box 8: You need to total the $$ that came specifically from individual CA bonds and any US Territory bonds (like Puerto Rico) that you hold at that Brokerage. (NOT Mutual funds).

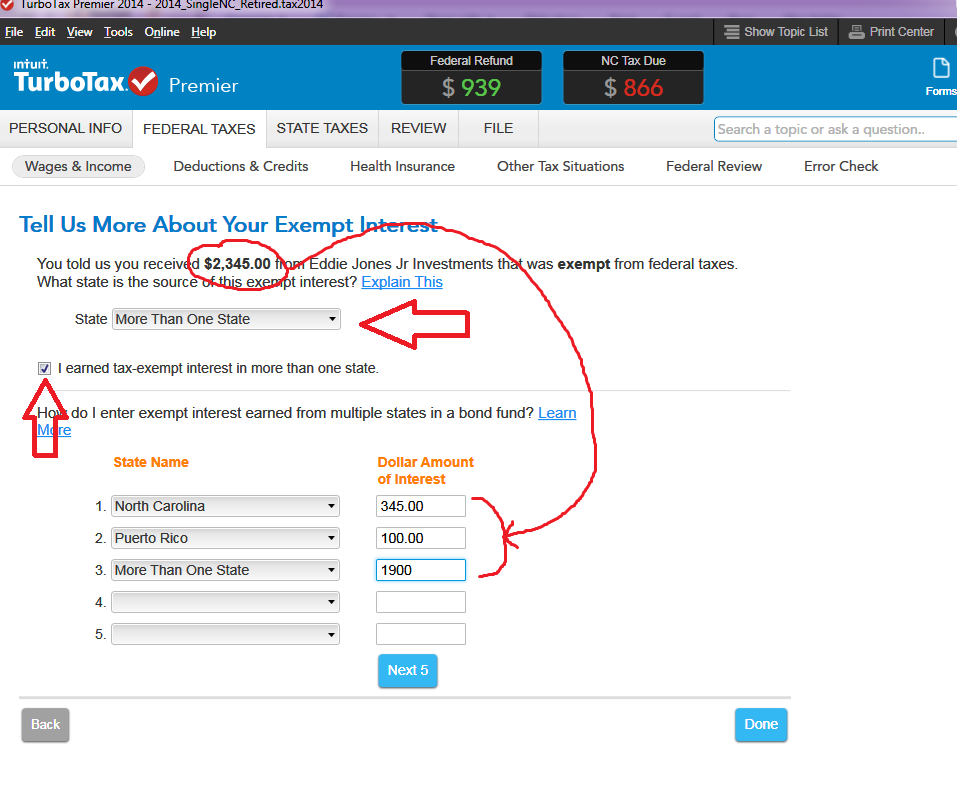

Then on one of the pages after the 1099-INT you will break out eh CA&US Territory interest...like shown in the picture below for an NC resident.

2) For 1099-DIV forms, the tax-exempt $$ are noted in box 12....but for CA residents, they are not allowed to break out the CA-bond $$ unless the fund you owned contained more than 50% of it's "assets" in CA bonds. Generally, unless you held a CA-Specific mutual fund, you won't be able to do that breakout for a 1099-DIV....if you do hold a CA-specific bond fund, then the procedure is the same as the picture below for a follow-up page after the main 1099-DIV form. If you didn't have any CA-specific bonds, you would just assign all of the box 12 $$ to "More than one state" (or "Multiple States" if you are using the Online software).

3) I've never dealt with 1099-OID forms in this situation...but I suspect it is similar...you'd need to ID the OID $$ in box 11 that belonged only to CA bonds you own....then enter the amounts in the follow-up page similar to the picture below....but again, I've never actually done it on a real 1099-OID ((Though I just went thru it on my desktop software in a test file)

__________________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How is California Tax Exempt interest calculated? Seems incorrect (too high)

OH...and dealing with the bond Premiums?

Yeah, I've done that. I subtract all of the tax-exempt $$ belonging to my state out of box 8 & 13 in the original 1099-INT, and put them in a separate 1099-INT form as-if from the same brokerage. You would do that for your CA bonds (and any US Territory bonds). That way, only the proper amount of amortized premium gets assigned to the CA bonds. Also, I guess it allows you to declare all of the box 8 (&13) $$ as being CA bonds on the new-separate 1099-INT....and they are now the proper amounts.

AND do similar if you have OID to report for any CA bonds you own...create two, one for CA, and another for everything else.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How is California Tax Exempt interest calculated? Seems incorrect (too high)

Thanks for your reply. I did follow through and enter the detailed amounts for California and Other States (tried both itemizing every state and lumping into ONE for others). That's how TT calculated the percentages (76 for CA and 24 for Other), but there wasn't anywhere (that I could see at least?) to enter the amounts for the Bond Premium amounts associated with those numbers. Am I missing something?

Your suggestion to break out the 1099-INT into 2 - one for CA and one for non-CA seems like a better idea than overriding the numbers on Schedule B (which is where I'm at right now). Seems really annoying that they can't get the information from the download, since Intuit used to own accounting software Quicken, QuickBooks and they handled that information for Bonds in that software. UGH. Might as well type everything in myself and NOT give them my credentials. Especially with all the data breaches going on.

thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How is California Tax Exempt interest calculated? Seems incorrect (too high)

No, you didn't miss anything. Each state return interview does also provide a section to make adjustments where the state income differs from Federal, but setting up a separate Form 1099-INT also works.

See also this discussion regarding the topic of allocating exempt interest among states, and this TurboTax tips article.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

AJSR111

New Member

rpmm

Returning Member

cbward

New Member

zomboo

Level 6

g213

Level 1