- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

(Maybe best jump to my next post about the amortized Premium adjustments for your CA-specific bonds)

______________________

,,,,,,,,,,,,,more generally. what follows may not answer your specific issue, but now that I've posted it, it may help others

________________________________

For the 1099-INT, those details need to be entered by you, on the follow-up page after the 1099-INT form. The details you see in the supplemental sheets do not get entered with the import (The various software companies and the brokerages haven't found a way to do that accurately (yet)).

____________________

The procedure for Tax-Exempt $$ reported a 1099-INT and a 1099-DIV are somewhat different for CA residents.

_________________

1) SO, for a 1099-INT with $$ in box 8: You need to total the $$ that came specifically from individual CA bonds and any US Territory bonds (like Puerto Rico) that you hold at that Brokerage. (NOT Mutual funds).

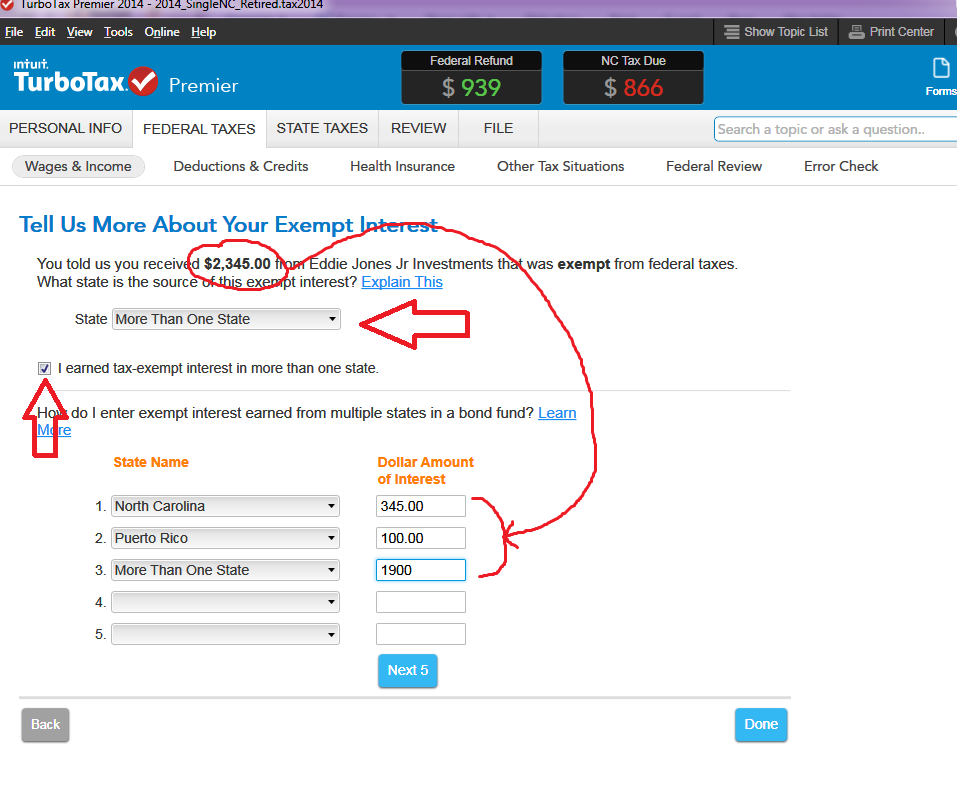

Then on one of the pages after the 1099-INT you will break out eh CA&US Territory interest...like shown in the picture below for an NC resident.

2) For 1099-DIV forms, the tax-exempt $$ are noted in box 12....but for CA residents, they are not allowed to break out the CA-bond $$ unless the fund you owned contained more than 50% of it's "assets" in CA bonds. Generally, unless you held a CA-Specific mutual fund, you won't be able to do that breakout for a 1099-DIV....if you do hold a CA-specific bond fund, then the procedure is the same as the picture below for a follow-up page after the main 1099-DIV form. If you didn't have any CA-specific bonds, you would just assign all of the box 12 $$ to "More than one state" (or "Multiple States" if you are using the Online software).

3) I've never dealt with 1099-OID forms in this situation...but I suspect it is similar...you'd need to ID the OID $$ in box 11 that belonged only to CA bonds you own....then enter the amounts in the follow-up page similar to the picture below....but again, I've never actually done it on a real 1099-OID ((Though I just went thru it on my desktop software in a test file)

__________________________