- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- How do I claim the deduction for Long Term Care Insurance premiums on my Virginia State tax return (Form 760, Line 14)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I claim the deduction for Long Term Care Insurance premiums on my Virginia State tax return (Form 760, Line 14)?

In past years, I have been able to deduct Long Term Care Insurance premiums on my Virginia State tax return (Form 760, Line 14). Is that deduction no longer available for Tax Year 2017? If it is, how do I enter it into TurboTax?"

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I claim the deduction for Long Term Care Insurance premiums on my Virginia State tax return (Form 760, Line 14)?

Yes - You can claim a deduction for long-term care insurance premiums on your Virginia return as long as you did not include them as an itemized deduction on your federal return. [Either you didn't itemize, or your medical expenses didn't exceed the 7.5% floor.]

- Go into your VA return.

- Continue to the screen, Here's the income that Virginia handles differently.

- In the Medical section, click on the Start/Revisit box next to Long-Term Care Premiums Credit Carryover and Deduction. [See Screenshot #1, below.]

- On the next screen, Long-Term Care Insurance Premiums Paid, mark the Yes button and enter the amount of your premiums in the box. [Screenshot #2]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I claim the deduction for Long Term Care Insurance premiums on my Virginia State tax return (Form 760, Line 14)?

When entering the premium info in the application, is it looking for per month cost or total year cost? Tks in advance. TCW1

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I claim the deduction for Long Term Care Insurance premiums on my Virginia State tax return (Form 760, Line 14)?

@TCW1 It is looking for the cost for the entire year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I claim the deduction for Long Term Care Insurance premiums on my Virginia State tax return (Form 760, Line 14)?

I could not find that there was a credit for long term insurance premiums in VA for 2021. Has this credit been eliminated?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I claim the deduction for Long Term Care Insurance premiums on my Virginia State tax return (Form 760, Line 14)?

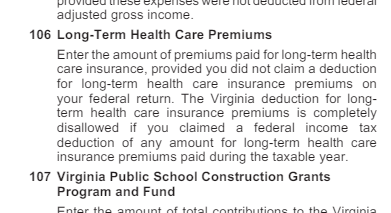

No, the credit has not been eliminated. But you can only take the credit for long-term insurance premiums on your Virginia return if you did not claim a deduction for long-term health care insurance premiums on your federal return. See Page 22, section 106 of Virginia tax instructions for details.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I claim the deduction for Long Term Care Insurance premiums on my Virginia State tax return (Form 760, Line 14)?

In TurboTax how do I enter long term care premiums

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I claim the deduction for Long Term Care Insurance premiums on my Virginia State tax return (Form 760, Line 14)?

In TurboTax Online, in the Virginia income tax return, at the screen Here's the income that Virginia handles differently, select Start/Revisit to the right of Long-Term Care Premiums Deduction.

The deduction is reported as code 106 here.

See Virginia 2023 Form 760 Resident Individual Income Tax Instructions here, page 23.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

amy

New Member

willowpoe

New Member

swick

Returning Member

shikhiss13

Level 1

mc510

Level 2