- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Help on answering some Pennsylvania state tax return questions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help on answering some Pennsylvania state tax return questions

Hi, we are using Turbotax for the first time to file this year and have three questions that we're hoping the nice folks on here can help us with.

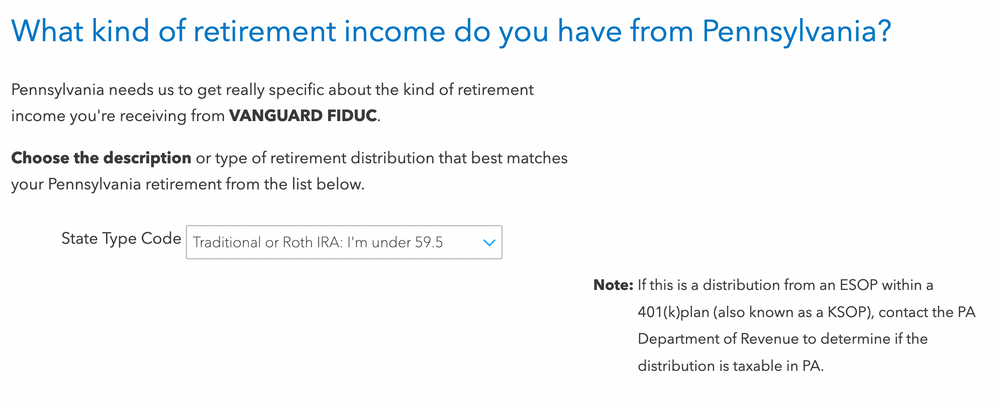

First, neither my wife nor I are retired (both in our 30s) and we're asked what kind of retirement income we have. We don't have any. There is an option: "I'm not eligible yet; plan's eligible in PA." What does the "plan's eligible in PA" mean? If we were to be retired, our income would come from our respective 401ks and IRAs but the currently selected box (as shown in the picture) also doesn't mention 401ks. What do we put here?

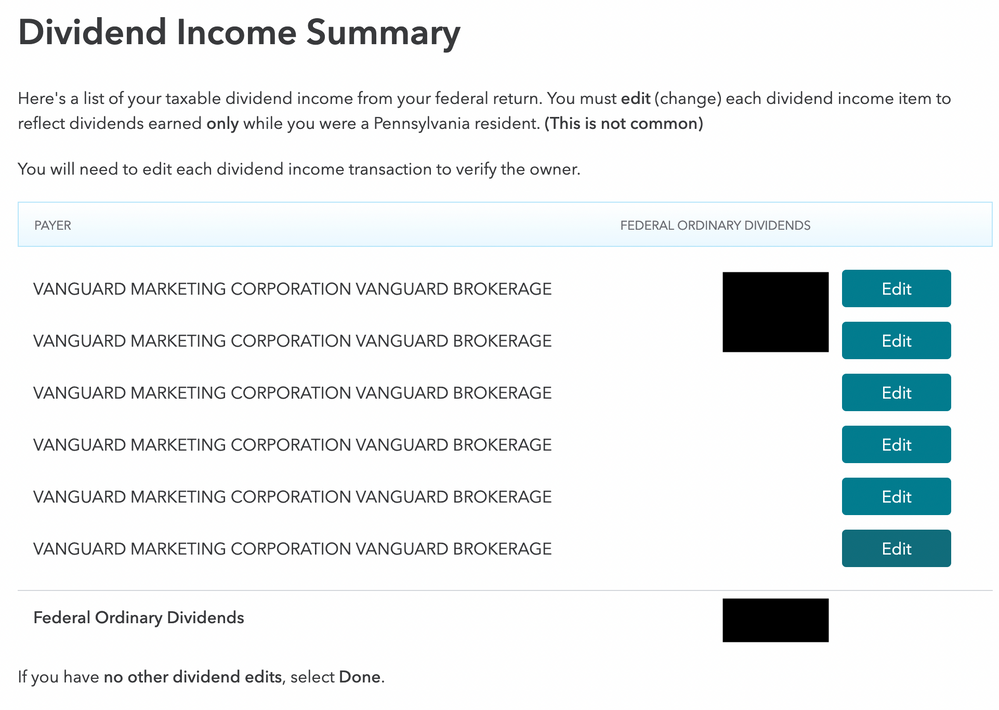

Second, we come to this screen and see 6 entries for dividend income. However, we only inputted two 1099-DIVs from our Vanguard brokerage (from our respective brokerage accounts). The two dividend amounts are recorded correctly in the top black box but what's with all the other ones? Clicking "Edit" on these extraneous entries gives a screen titled "Adjust federal dividend income" and a checkbox labeled "This dividend is a tax exempt interest dividend since it was issued by Pennsylvania (or a political subdivision within), Guam, Puerto Rico, Virgin Islands, or the Northern Mariana Islands. Or for another reason for which the state allows" being checked. Are these extra entries expected or did we do something wrong?

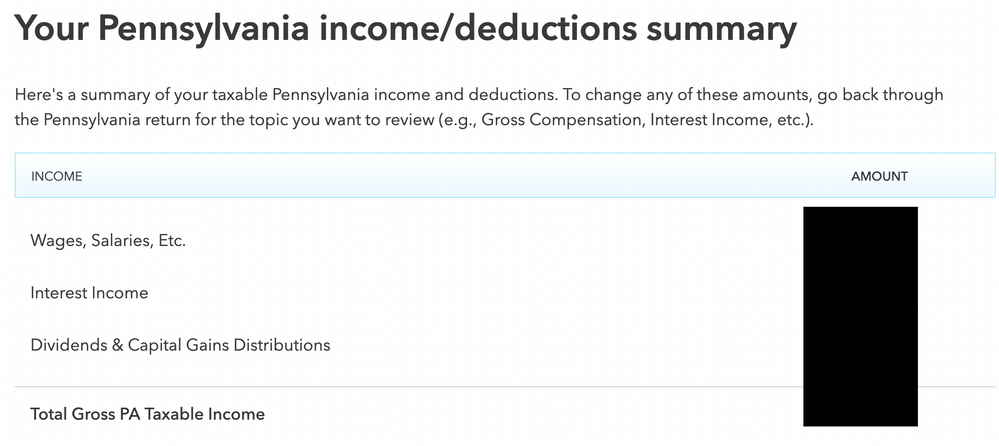

Lastly, we get to this page where it shows a summary of our income. Our wages and interest income appear correct. However, our dividend income is ~$3,000 higher than it showed in the total in the previous picture. Let's say the previous picture had "Federal Ordinary Dividends" as ~$1,000, this entry under "Divides & Capital Gains Distributions" in the below picture has ~$4,000. We didn't have any capital gains distributions as we reinvested dividends back into the market. Why is there a discrepancy in this total?

Thank you for all your help!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help on answering some Pennsylvania state tax return questions

First - If you are entering a Form 1099-R because you withdrew any funds from a retirement account, regardless of your age, TurboTax will ask questions to determine whether the amount is taxable and whether it is subject to the 10% early withdrawal penalty. Be sure to enter information in the correct form.

See here for information from Pennsylvania, where most types of retirement income are not taxed.

Second - if you didn't make duplicate entries for Forms 1099-DIV, what you are seeing may be because some of your dividends are treated differently because they are tax-exempt interest dividends. Be sure to enter all of the information on your Forms 1099-DIV.

Third - Reinvested dividends are taxed when earned and then added to your cost basis in the investment for capital gains purposes.

For example, you invested $1,000 in a mutual fund and have earned and reinvested $50 in dividends. As a result, your cost basis is $1,050. If you sell all of your fund shares for $1,110, your taxable capital gain would be $60, not the $110 difference between what you originally paid for the fund shares and your selling value.

See this TurboTax article for more information on the taxation of dividends.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hojosverdes64

New Member

jenniferbannon2

New Member

ddi92234

New Member

Callisto

New Member

dc-fleming62

New Member