- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- First year Married filing joint state. 2 different residency

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

First year Married filing joint state. 2 different residency

My husband and I got married in September of 2024 and are trying to filing joint for both federal and state taxes we both live in Pennsylvania currently. He lived in New York and has income from New York for 2024 before we got married. I lived in Pennsylvania all of 2024, and he moved down right before we got married. My income is from a full year in Pennsylvania. What do we put for residency status for both New York and Pennsylvania state return and what does the process look like for doing a state return as married filing jointly in two states? I’d appreciate any help!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

First year Married filing joint state. 2 different residency

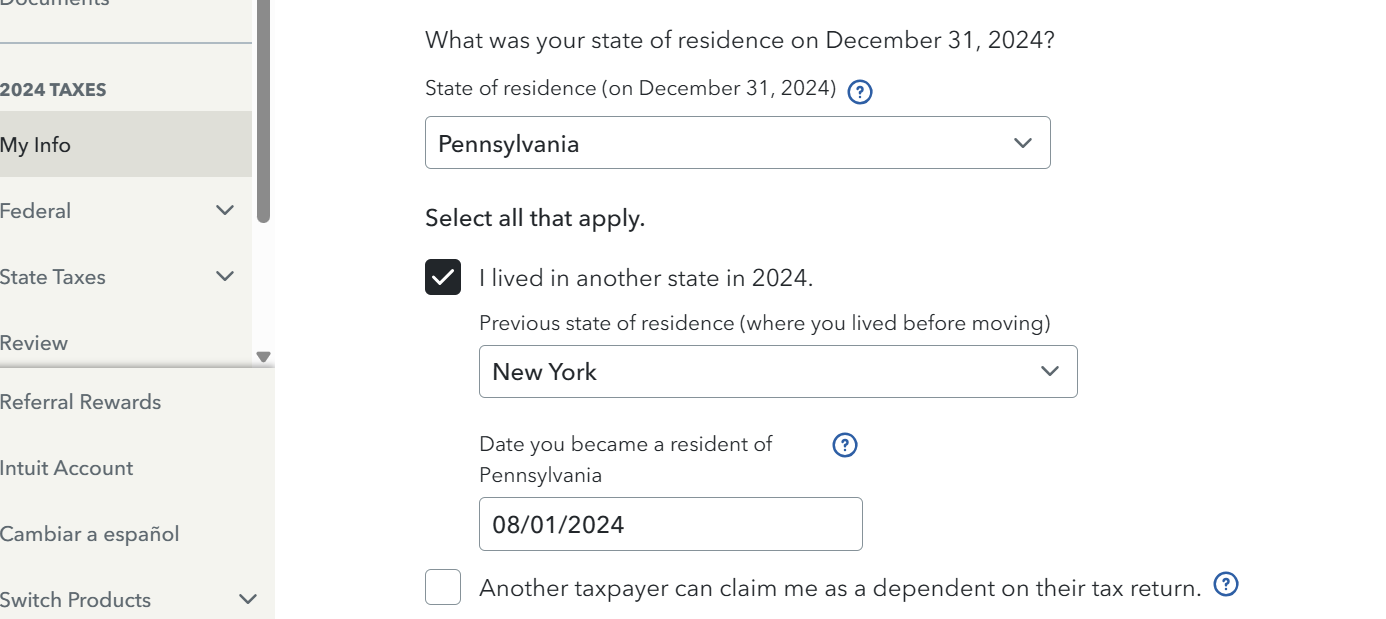

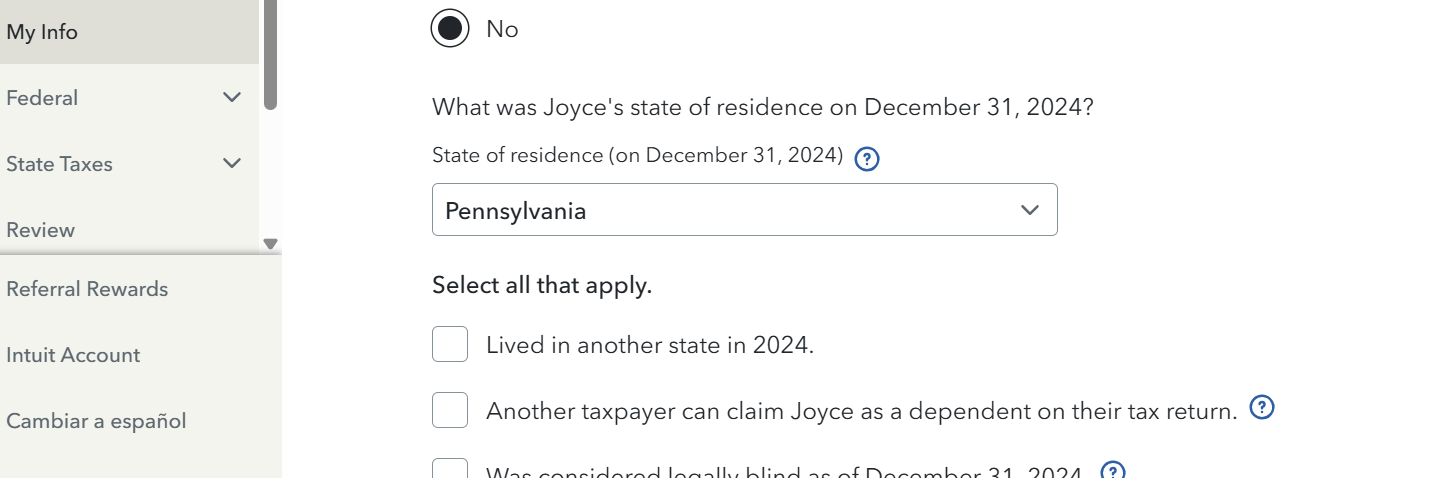

Just be sure to fill out your "My Info" section correctly for both of you. Your financial information will flow correctly to the appropriate state tax returns (after your federal return is completed). See example images below.

Always complete the nonresident return first (New York in your case) if filing in multiple states because your resident state might give you a credit for any taxes paid in that situation.

(Unfortunately, New York and Pennsylvania do not have a reciprocal agreement, also called reciprocity -- an agreement between two states that allows residents of one state to request exemption from tax withholding in the other (reciprocal) state. This can save you the trouble of having to file multiple state returns.)

If one of you was a New York State resident and the other was a nonresident or part-year resident, you must each file a separate New York return. The resident must use Form IT-201. The nonresident or part-year resident, if required to file a New York State return, must use Form IT-203. However, if you both choose to file a joint New York State return, use Form IT-201 and both spouses’ income will be taxed as full-year residents of New York State.

2024 Instructions for Form IT-203 Nonresident and Part-Year Resident Income Tax Return (pg. 4)

You could try filing a Joint New York return to see if the part-year resident income is allocated correctly. If it is broken out on W-2's as such, it may not be a problem.

Otherwise, you would need to prepare a 'dummy' separate Federal return (in another online account) for each of you to have the info flow into separate New York returns properly, or use the TurboTax desktop product.

For additional information about Married Filing Separate Returns, please see this TurboTax FAQ: How do I prepare a joint federal return and separate state returns?

For example, if your spouse goes first on your tax return (or if you want your name first, be sure to always use this same order every year).

I know this is a lot of information to throw at you, but just take your time filing out your personal and financial information into the software.

And remember, you can always post additional questions to our forum as you proceed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rodiy2k21

Returning Member

ir63

Level 2

user17538710126

New Member

sakilee0209

Level 2

girishapte

Level 3