- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Does the order of state I enter in Turbo Tax matter for partial year residency?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does the order of state I enter in Turbo Tax matter for partial year residency?

We moved to WI in May of 2021 from MN. My husbands employer is in MN so 100% of his earnings were reported to MN and taxed. It does not appear that WI taxes are calculating a credit for the taxes paid to MN for the portion of income he earned while we were living in WI. Does Turbo Tax require that I enter an MN return before WI? I entered WI first, so if I was supposed to enter MN first, how do I resolve?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does the order of state I enter in Turbo Tax matter for partial year residency?

Yes. The MN must be done first to create the tax liability in order to get the correct credit on WI. You may want to delete both states. Do MN first, then WI.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does the order of state I enter in Turbo Tax matter for partial year residency?

Yes. The MN must be done first to create the tax liability in order to get the correct credit on WI. You may want to delete both states. Do MN first, then WI.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does the order of state I enter in Turbo Tax matter for partial year residency?

I am unable to determine the steps necessary to delete the MN and WI returns so I can renter them. Do I have to delete the federal as well and start over?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does the order of state I enter in Turbo Tax matter for partial year residency?

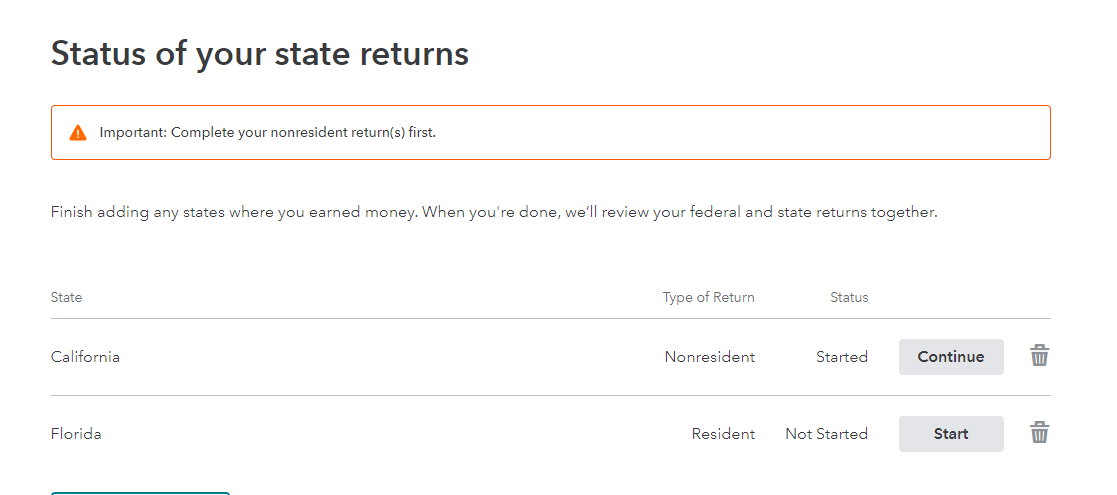

From the menu on the left, click on State.

You will see Status of your state returns. Click on the trash cans to Delete the state returns.

You can then click on Add Another State to add them back.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does the order of state I enter in Turbo Tax matter for partial year residency?

The menu in the screen print provided does not appear in the Desktop version of Turbo Tax Deluxe. I attempted to delete them but both wisconsin and minnesota still appear in the order I originally added them, just without the data elements. Also, if I try to add a new state, it prompts me to pay again or add a confirmation number for the download I already paid for which wasnt provided within deluxe. Is there a way to manually move the order through some type of data entry.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does the order of state I enter in Turbo Tax matter for partial year residency?

Using TurboTax Desktop, with your return open in TurboTax, switch to Forms mode by clicking the Forms menu. From the File menu, choose Remove State Return (This won't delete your state program, just the state tax return) Select the return you want to delete and click Remove. Answer Yes to confirm.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

shanesnh

Level 3

cniclaus

New Member

hno4

Level 2

erwolfe87

New Member

ChicagoJ

Level 3