- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Do you have to pay taxes to indiana for income made in louisiana before the move?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do you have to pay taxes to indiana for income made in louisiana before the move?

Do you have to pay taxes to Indiana for income made in Louisiana before the move to Indiana?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do you have to pay taxes to indiana for income made in louisiana before the move?

No. Go back to the Personal Info section and make sure that you indicated that you are a part-year resident for each state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do you have to pay taxes to indiana for income made in louisiana before the move?

I have it marked as to the date of residency change, but when I do an Indiana return, it is charging them income tax. Do I just not do an Indiana return since they have no income from Indiana?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do you have to pay taxes to indiana for income made in louisiana before the move?

Did you earn any income when you resided within Indiana?

If not, you will need to make your adjustments in the state interview section to ensure the income is all allocated to Louisiana.

You will make your state specific adjustment in the state interview section of the program this year.

- Select State in the black panel on the left hand side of your screen when logged into TurboTax.

- This will take you to a screen titled Let's get your state taxes done right. Click continue on this screen.

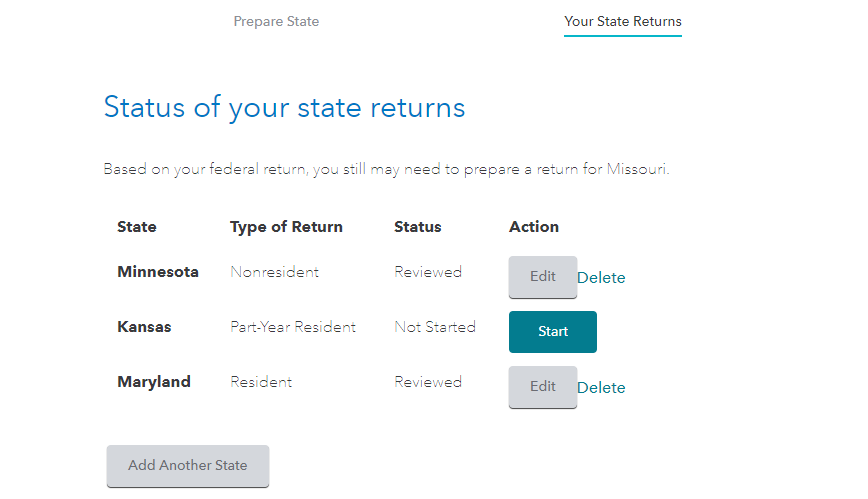

- You will see the following screen titled Status of your state returns. Select Edit to the right of Louisiana/Indiana to review your entries.

Be sure you go through each screen to ensure all of the income is allocated to the state where the income was earned. The other state should be prepared to only include the income either earned in that state or earned while a resident of that state.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

johanna-jauernig

New Member

partridgegale803

New Member

norlisha5

Level 1

ksbazzell1

New Member

BillC9

New Member