- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Do I need to file Wisconsin Taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to file Wisconsin Taxes?

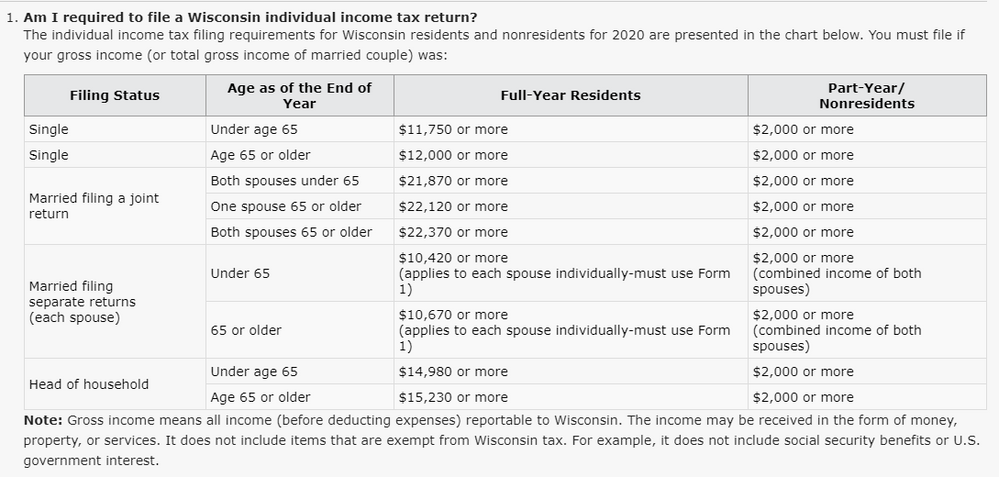

I Live and work mostly in New York. I had a short job scheduled in Wisconsin in 2020 that was canceled for the pandemic. I never went to Wisconsin. The company paid me one week's pay ($500) as a cancellation fee. TurboTax says I owe $1198 in Wisconsin taxes. Does that make any sense at all? I read that I don't have to file in Wisconsin if my Wisconsin income is less than $2000. Please help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to file Wisconsin Taxes?

You are correct. You do not have to file a nonresident Wisconsin income tax return because you gross income reportable to WI is below $2,000.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to file Wisconsin Taxes?

You are correct. You do not have to file a nonresident Wisconsin income tax return because you gross income reportable to WI is below $2,000.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to file Wisconsin Taxes?

did you get a w-2 or 1099. regardless neither should show Wisconsin Compensation and you should not be filing a nonresident return or any return for Wi.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mread6153

New Member

ilian

Level 1

tdendy

New Member

Jolmp

Level 1

fieldsmichelle70

New Member