- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Bug with New York state return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with New York state return

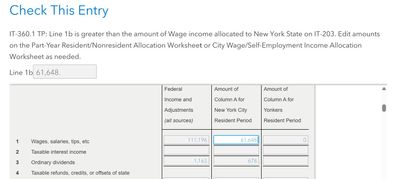

Hello, I'm going a little crazy with what I think is a bug in Turbotax that has prevented me from filing my 2024 NY state taxes. The submission process goes smoothly until I get to the end, when the review says there is an issue that needs resolving: "IT-360.1 TP: Line 1b is greater than the amount of Wage income allocated to New York State on IT-203. Edit amounts on the Part-Year Resident/Nonresident Allocation Worksheet or City Wage/Self-Employment Income Allocation Worksheet as needed."

It shows me a number to edit, but the number is correct, as far as I can tell. And I have no idea what number it is comparing it to on the IT-203. Here is a screenshot:

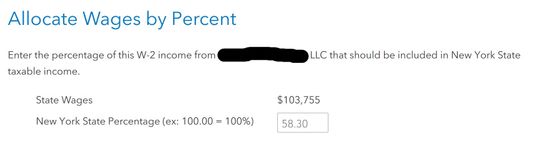

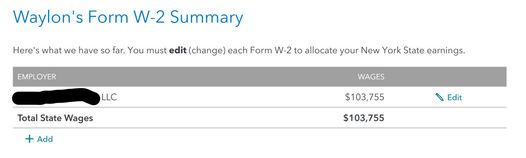

I suspect I know where the issue arises. I moved from Texas to New York state (specifically New York City) part-way through the year. I had the same employer, but I changed work contracts. So while I was previously a TX employee, I became a NY employee. Turbotax asks me to allocate my New York State wages from my total wages. I chose to allocate it as a percentage to the be easy, and the percentage is about 58.30%. However when I would tell Turbotax to allocate it by percentage this way, it is not reflected in the state wage summary.

Strangely, though, the 58.30% allocation does show up in the New York City allocation screen, as shown below:

Does anyone know what the issue is here? Is Turbotax bugged in allocating money for the state income? I read somewhere else that Turbotax won't actually show the percentage-allocated state income even while it actually is updated on the IT-203, but I can't figure out how I would actually check this.

When I initially ran into this issue, I thought it was because my W-2 was wrong, since it shows 100% of my income as having come from New York. After a lot of back-and-forth with my employer though, they say the W-2 isn't the issue. NY apparently always wants their line on the W-2 to match the federal income. And Texas apparently wasn't even included on my W-2 since it has no income tax. I figure that if NY raises an issue about my part-time residency, I can show them TX pay stubs.

In case it is important, my wife made a small amount of money toward the end of the year when she got a job in NYC, but her income was entirely in-state.

My token number is 1312300.

Any help is greatly appreciated! I've been pulling my hair out for weeks over this.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with New York state return

The total inputted as NY resident income, which is flowing to your IT-203, does not match the IT-360.1. Please adjust the amount in the interview for the IT-203 accordingly.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

matto1

Level 2

angelagaddy7

New Member

resplendent

New Member

chroberts

New Member

whitty12

New Member