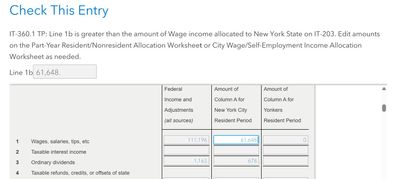

Hello, I'm going a little crazy with what I think is a bug in Turbotax that has prevented me from filing my 2024 NY state taxes. The submission process goes smoothly until I get to the end, when the review says there is an issue that needs resolving: "IT-360.1 TP: Line 1b is greater than the amount of Wage income allocated to New York State on IT-203. Edit amounts on the Part-Year Resident/Nonresident Allocation Worksheet or City Wage/Self-Employment Income Allocation Worksheet as needed."

It shows me a number to edit, but the number is correct, as far as I can tell. And I have no idea what number it is comparing it to on the IT-203. Here is a screenshot:

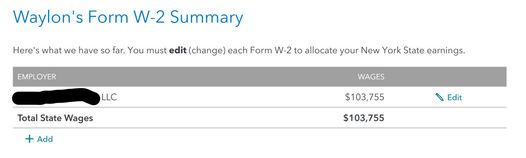

I suspect I know where the issue arises. I moved from Texas to New York state (specifically New York City) part-way through the year. I had the same employer, but I changed work contracts. So while I was previously a TX employee, I became a NY employee. Turbotax asks me to allocate my New York State wages from my total wages. I chose to allocate it as a percentage to the be easy, and the percentage is about 58.30%. However when I would tell Turbotax to allocate it by percentage this way, it is not reflected in the state wage summary.

Strangely, though, the 58.30% allocation does show up in the New York City allocation screen, as shown below:

Does anyone know what the issue is here? Is Turbotax bugged in allocating money for the state income? I read somewhere else that Turbotax won't actually show the percentage-allocated state income even while it actually is updated on the IT-203, but I can't figure out how I would actually check this.

When I initially ran into this issue, I thought it was because my W-2 was wrong, since it shows 100% of my income as having come from New York. After a lot of back-and-forth with my employer though, they say the W-2 isn't the issue. NY apparently always wants their line on the W-2 to match the federal income. And Texas apparently wasn't even included on my W-2 since it has no income tax. I figure that if NY raises an issue about my part-time residency, I can show them TX pay stubs.

In case it is important, my wife made a small amount of money toward the end of the year when she got a job in NYC, but her income was entirely in-state.

My token number is 1312300.

Any help is greatly appreciated! I've been pulling my hair out for weeks over this.