- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- As NJ resident, Do I have to file PA non-resident return if no PA state tax withheld but local PA municipality tax withheld ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

As NJ resident, Do I have to file PA non-resident return if no PA state tax withheld but local PA municipality tax withheld ?

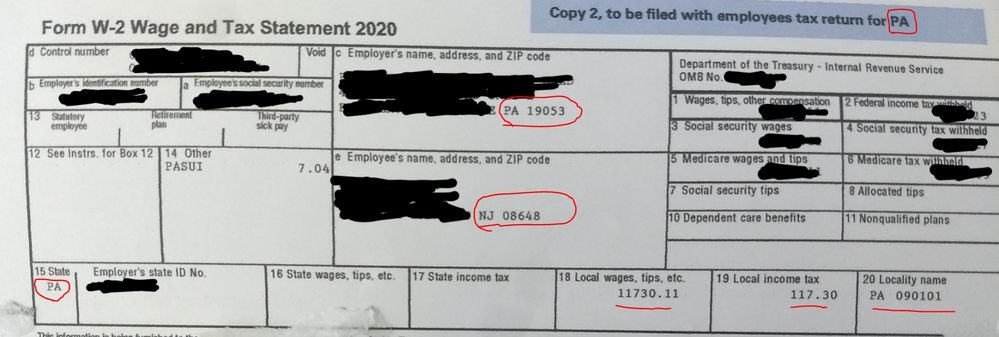

I live in NJ and work in PA. In addition to federal copy, I received W2 copies of NJ, PA, and local municipality in PA. I have attached PA copy of my W2. My question is, I don't have any PA tax withholdings on my W2, but I do have tax withholding for local PA municipality (Bensalem). See attached picture.

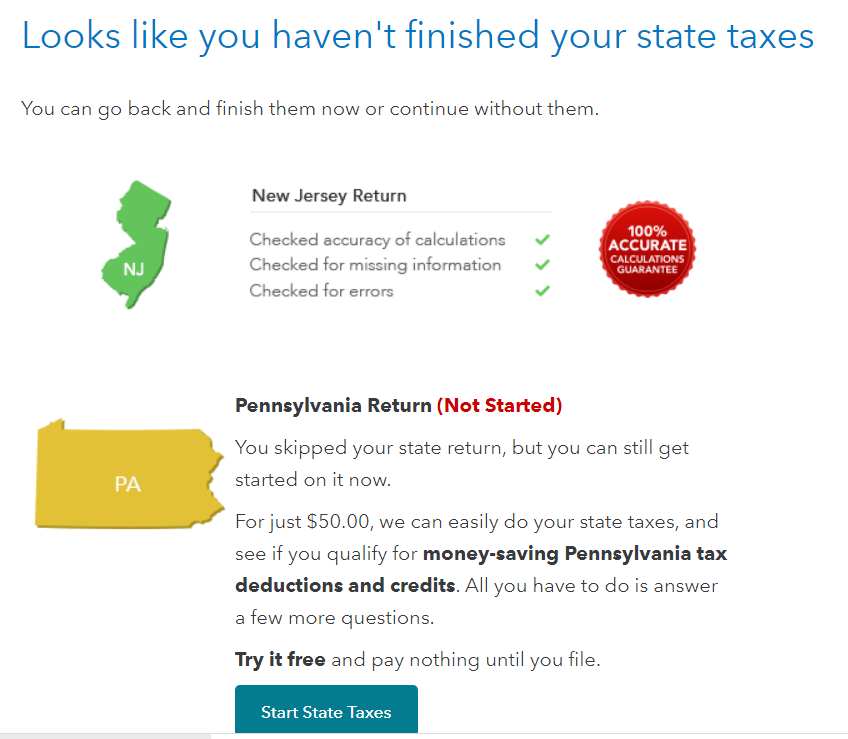

After finishing the federal and NJ state tax returns, at the last step, Turbotax is telling me that I haven't completed the PA state return yet.

Do I have to file a nonresident return for PA? Like I said I don't have any tax withholding by PA state. I already added Bensalem tax on NJ to get credit for that. If I don't have to file it, then I don't want to pay $50 extra to file PA return for no reason.

Turbotax screenshot

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

As NJ resident, Do I have to file PA non-resident return if no PA state tax withheld but local PA municipality tax withheld ?

If your NJ return shows a credit for this amount, there is no point to filing a PA return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

As NJ resident, Do I have to file PA non-resident return if no PA state tax withheld but local PA municipality tax withheld ?

No. A PA return is not required because you had no income other than wages earned in PA and NO PA w/h

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

balld386

New Member

ajm2281

Level 1

bongon

New Member

Waylon182

New Member

at333

Returning Member