- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Annualizing Income to avoid underpayment (CT vs. Federal)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Annualizing Income to avoid underpayment (CT vs. Federal)

To start with, we did not underpay state or federal estimated taxes. Rather we had *very* uneven Schedule C income, with virtually all of that income in the third and fourth quarters.

Our preliminary numbers show that we do not have any underpayment penalties with our Federal return, and no Form 2210 was generated by TT for the Fed return (no prompts, no form 2210 in fed form list). However, we *do* show underpayment penalties for our CT state return.

I'm absolutely certain we would benefit from filling in an "Annualized Income Installment Schedule" on CT's form 2210, but the CT 2210 forms in TurboTax do not appear to include the annualized income schedule (CT-2210 Schedule A). I'm wondering if this is because no Form 2210 with Schedule AI was generated for the Federal return?

Is there a way to force a Form 2210 at the Federal level, with Schedule AI? And if so, would that be carried over to the appropriate CT form?

Any advice? I'm really eager to avoid a paper filing...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Annualizing Income to avoid underpayment (CT vs. Federal)

The Form CT-2210, Schedule A, Annualized Income Installment Schedule is not yet ready for release. It is scheduled for release on February 9th.

However, you can select the annualized income method when preparing your Connecticut (CT) return. You must wait to file the return electronically until the release date.

When you arrive at the screen 'A few things before we wrap up your state taxes'

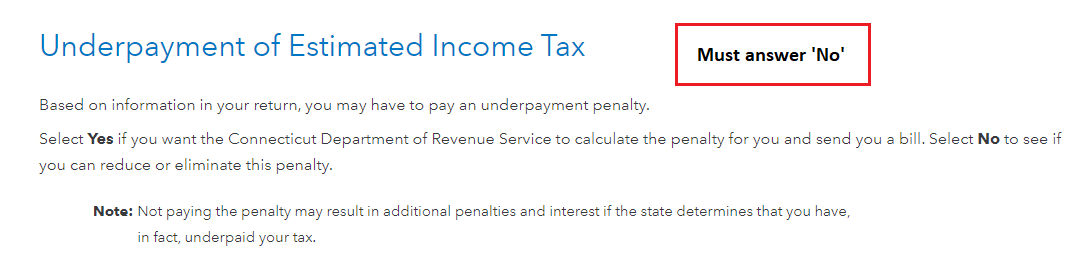

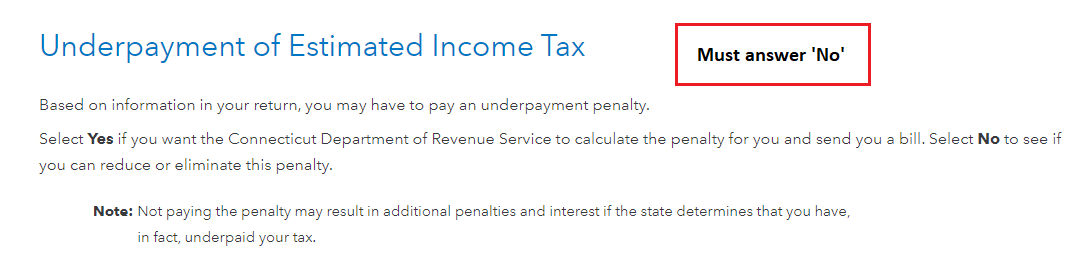

- Select 'Underpayment of estimated tax'

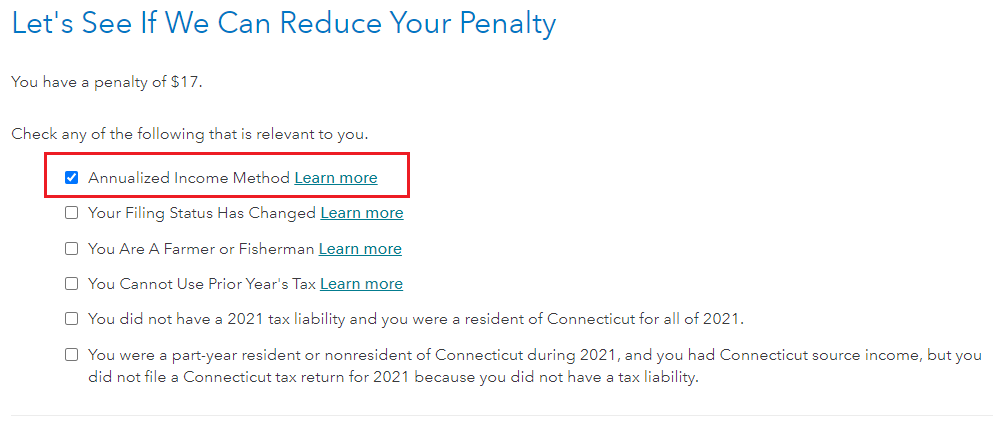

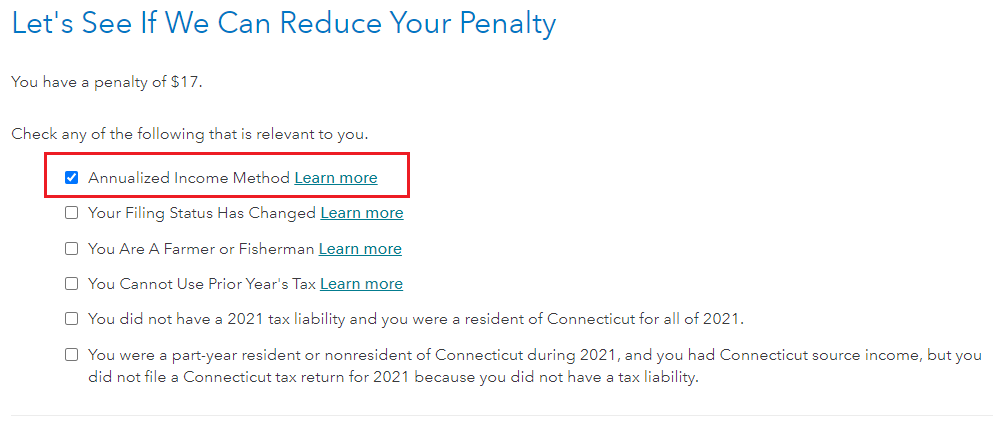

- On the next screen answer 'No', then be sure to select Annualized Income Method as shown below.

- Continue to follow the screen prompts to enter your income in the periods received (net income after expenses for each period).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Annualizing Income to avoid underpayment (CT vs. Federal)

The Form CT-2210, Schedule A, Annualized Income Installment Schedule is not yet ready for release. It is scheduled for release on February 9th.

However, you can select the annualized income method when preparing your Connecticut (CT) return. You must wait to file the return electronically until the release date.

When you arrive at the screen 'A few things before we wrap up your state taxes'

- Select 'Underpayment of estimated tax'

- On the next screen answer 'No', then be sure to select Annualized Income Method as shown below.

- Continue to follow the screen prompts to enter your income in the periods received (net income after expenses for each period).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sakilee0209

Level 2

user17518667980

New Member

Sweet300

Level 1

resplendent

New Member

p_r_s_90

New Member