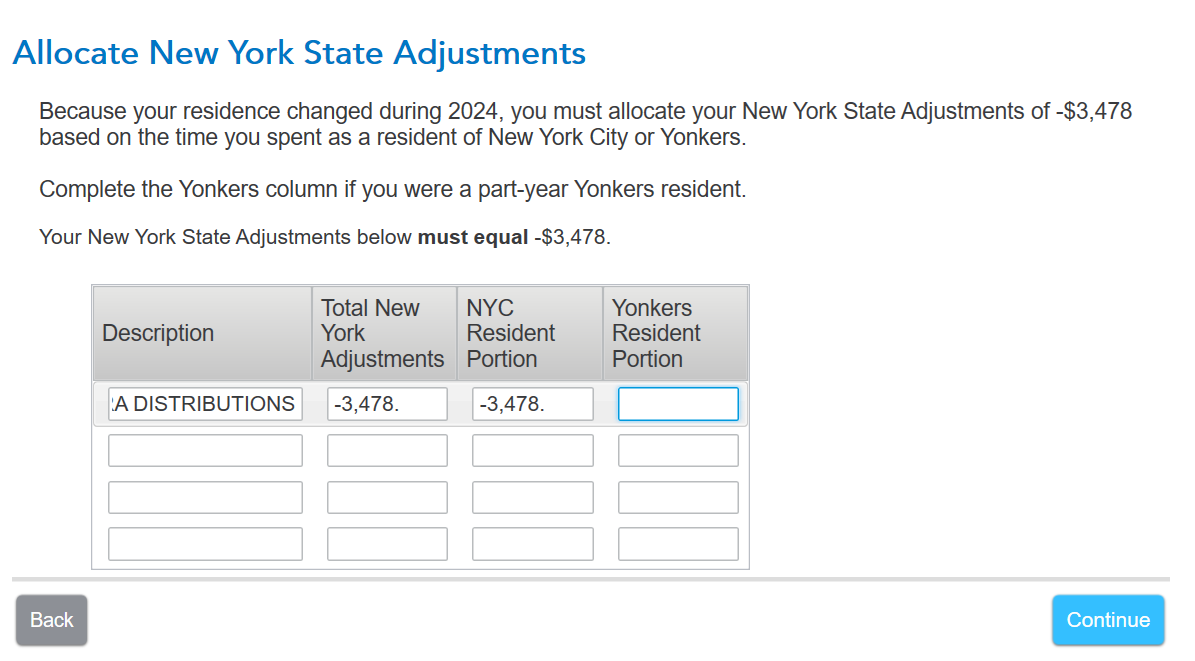

On the NYS Allocate NYS Adjustments screen, it states your NYS adjustments below must equal -$3,478. This is the taxable IRA distributions. Since you allocated 100% to NYC on the state screen, I allocated the same on this screen. The modification is due to the income and annuity exclusion. Therefore, your screen should appear as follows:

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"