- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- 85% of my income was in the final quarter. How do I file Arizona Form 221 to eliminate the underpayment penalty?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

85% of my income was in the final quarter. How do I file Arizona Form 221 to eliminate the underpayment penalty?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

85% of my income was in the final quarter. How do I file Arizona Form 221 to eliminate the underpayment penalty?

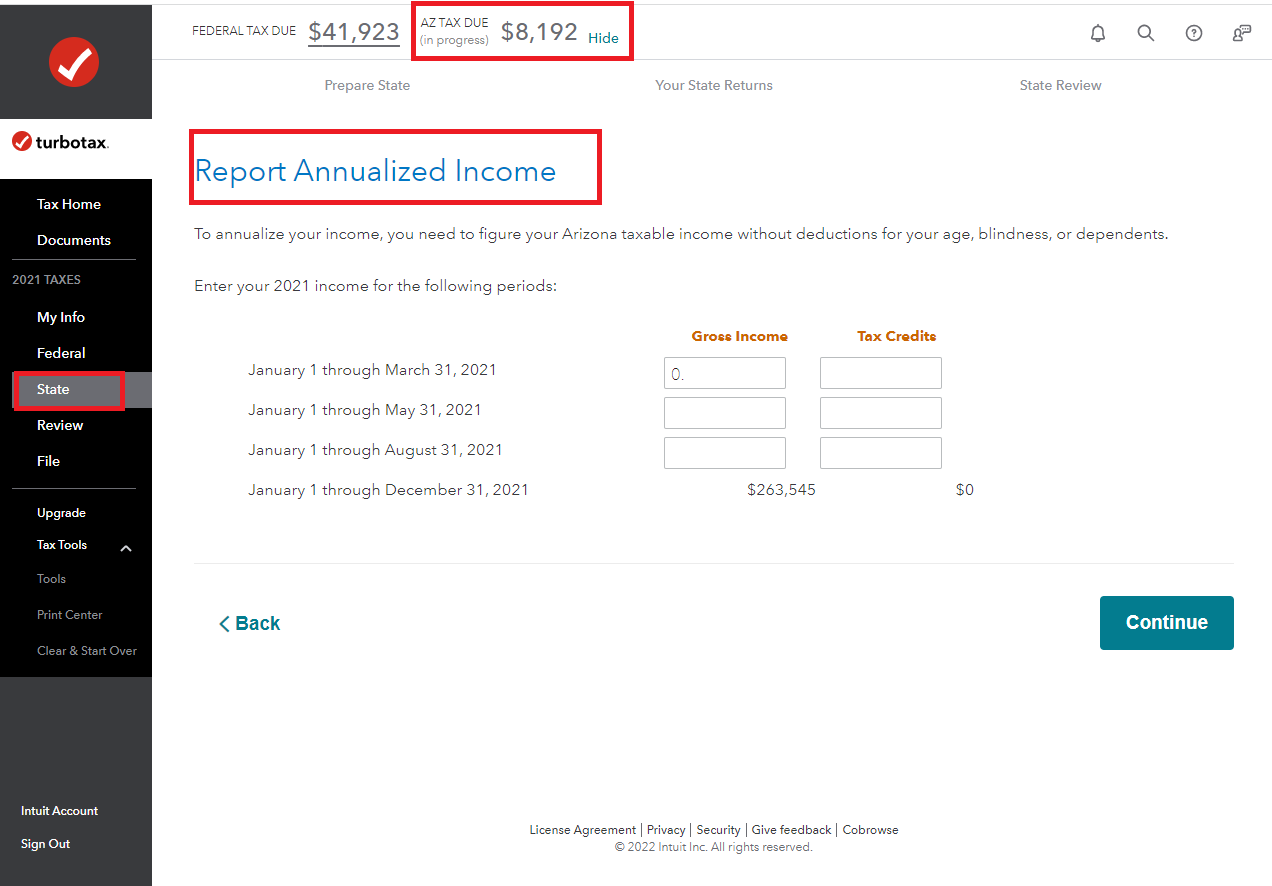

You could annualize your 2021 income. As you're going through the AZ state entry forms:

- On the Annualized Income screen, answer Yes.

- On the Report Annualized Income screen, enter your income.

- Continue with the onscreen interview until complete.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

85% of my income was in the final quarter. How do I file Arizona Form 221 to eliminate the underpayment penalty?

I see this is 2 years old and for the On-line app, but I thought I would ask anyway. How did you get to the "Annualized Income" screen for Arizona? I have the same problem. (I am using TurboTax Premier 2023 for Windows.) Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

85% of my income was in the final quarter. How do I file Arizona Form 221 to eliminate the underpayment penalty?

If you are showing an underpayment penalty on your Arizona return, in TurboTax Desktop, go back through the Arizona interview section and review all of the input screens. Towards the end, you will encounter an Underpayment Penalty screen. Review the topic and answer the questions to determine whether the penalty can be reduced or eliminated.

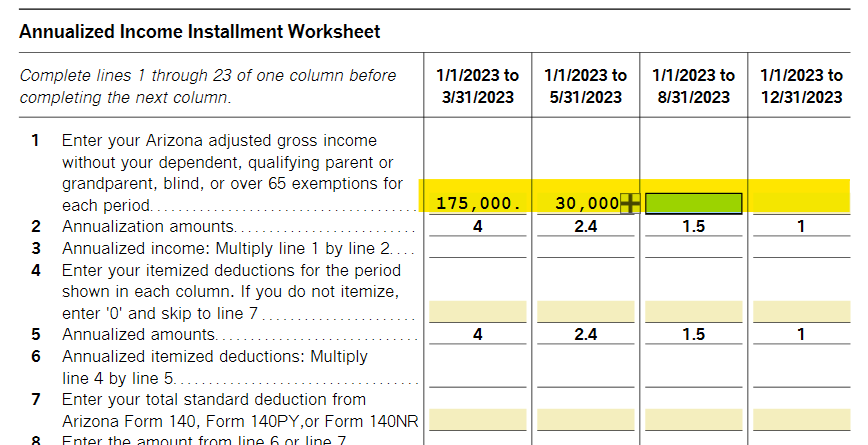

You could also go into Forms mode and look for Arizona Form 221, Underpayment of Estimated Tax by individuals. The Annualized Income Installment Worksheet is on page 2 of the form. It is preferable to fill out the questionnaire rather than enter information in Forms mode if at all possible. You especially should avoid overriding a numerical entry. as this could invalidate your Accurate Return Guarantee.

If you made any estimated payments, they should be recorded in the Federal return section.

See here for more information about the underpayment penalty from the State of Arizona.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

85% of my income was in the final quarter. How do I file Arizona Form 221 to eliminate the underpayment penalty?

Thank you, MonikaK1. Where will I find the "Underpayment Penalty" screen in the Arizona section? (Note I have been through these screens about 30+ times with and without Turbotax reps.) The first (and only) time the penalty crops up is on the "Your Arizona Bottom Line" screen, which states the penalty and only allows you to continue. (Also note, a few years ago another community member suggested looking after the "Donate to a Fund" screen, but when I go through the AZ screens, I see that screen, then the individual funds screens that I have checked (e.g. Special Olympics Fund), then the "Your Arizona Bottom Line" screen.) (Note 3: I have already filled out the Federal annualized income screens and they work fine (and got rid of my penalty). Thanks again for your assistance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

85% of my income was in the final quarter. How do I file Arizona Form 221 to eliminate the underpayment penalty?

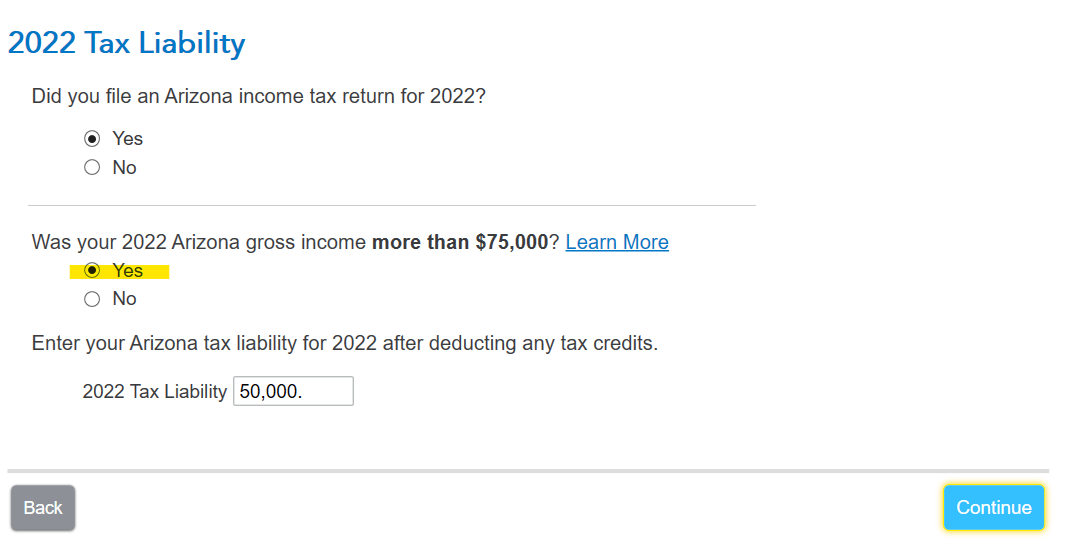

I had to mark yes to gross income over $75,000 to get through. Follow these steps:

- At the 2022 Tax liability screen, select yes to income over $75,000.

- The next screen you must mark that there are no penalty exceptions.

- Continue

- Penalty exception, select neither situation applies,

- Continue

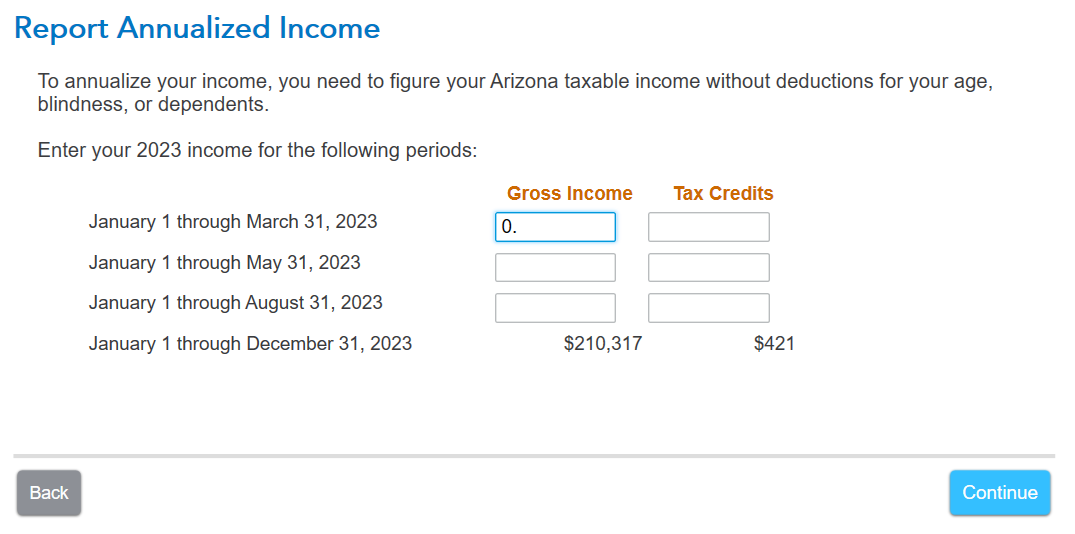

- Do you want to annualize your income? Select yes

- Enter the amount for the first 3 months of income and tax

- Enter the amount for the first 5 months

- Enter the amount for the first 8 months

- Enter your annual income and tax paid

- Continue

@george.tyler

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

85% of my income was in the final quarter. How do I file Arizona Form 221 to eliminate the underpayment penalty?

Thanks, AmyC. Where is this "2022 Tax Liability" screen that you enclosed? What screen is before it? (Note: I did fill out the similar "2022 Tax Liability" screen in the Federal section under Federal Taxes > Other Tax Situations > Underpayment penalties. Filling the Federal portion out lead to TurboTax to zeroing out my federal tax penalty.)

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

85% of my income was in the final quarter. How do I file Arizona Form 221 to eliminate the underpayment penalty?

Start at the beginning of AZ

Pass itemized deduction

Pass Income Adjustments

Pass Credits

Pass Adjustments

Pass Arizona Tax Payments

Pass taxes and credits summary

Underpayment of Estimated Tax

Farmer or Fisherman, I selected no

2022 Tax Liability and the screens I showed above begin 🙂

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

85% of my income was in the final quarter. How do I file Arizona Form 221 to eliminate the underpayment penalty?

Thanks. I don't seem to have the same sequence. I do not have a screen for "Underpayment". I have this sequence:

20 screens (deductions, credits, adjustments...), then

Adjustments Summary

AZ Tax Payments

No Increased Excise Tax Credit

Family Tax Credit

Taxes Paid to Another State or County

School Tax Credits

22 screens on AZ-only Tax Credits (e.g. Foster Care...)

Apply Overpayment to 2024 Taxes

Donate to a Fund

1 screen for each chosen fund

Your Arizona Bottom Line (which lists my penalty, but only shows Back and Continue buttons at the bottom)

Estimated Taxes for 2024

File an Extension for AZ

SBI Tax Extension Payment

About Amended Tax Return

About Small Business Amended Tax Return

Ready to Review Your State Return

Any idea on how I can get the Underpayment screen to pop up?

(Sorry for the length of this post.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

85% of my income was in the final quarter. How do I file Arizona Form 221 to eliminate the underpayment penalty?

If you are on the desktop version, you can switch over to forms mode. If you are online, follow these steps:

A full or corrupted cache can cause problems in TurboTax, so sometimes you need to clear your cache (that is, remove these temporary files).

For stuck information follow these steps:

- Delete the form 2210, see How to Delete

- Log out of your return and try one or more of the following:

- Log back into your return.

- Enter the information again.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

85% of my income was in the final quarter. How do I file Arizona Form 221 to eliminate the underpayment penalty?

Thanks, again, AmyC. Per your inquiry: I am on the Windows Download version (not the On-line version). I can definitely see the correct form in the Forms section (AZ Form 221 Page 2: Annualized Income Installment Worksheet). Part A of the form (Calculation of Underpayment) is filled out and Page 2 has the same yellow cells waiting to be filled out. I cannot seem to find how to fill it out in the Step-by-Step, though.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

85% of my income was in the final quarter. How do I file Arizona Form 221 to eliminate the underpayment penalty?

What cells are you trying to fill in? Since you have desktop and forms, you can enter the data directly onto the form to show your income later in the year. The plus sign showing in the 3rd column indicates no override is necessary, just enter the income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

85% of my income was in the final quarter. How do I file Arizona Form 221 to eliminate the underpayment penalty?

Thanks. I have been told in the past, by an Intuit rep, not to manually enter data in the Forms section because Intuit will then not stand behind the submission. (I realize that Intuit was not providing me any sort of legal protection anyway.) Are you thinking that manually entering data is ok? (fwiw, I am comfortable enough with the tax rules and my numbers that I am fine doing that. I was just trying not to disobey that advice from the Intuit rep. I do feel that TurboTax has been designed with a way to enter this data via the Step-by-step process, but that I have just not found the Intuit rep who knows where those Step-by-step questions are at and/or why they are not being asked.) Do you know of any downsides of entering data manually? Do you know if TurboTax will still allow me to file electronically if I change the data manually in the Forms section? (Sorry for my delay in commenting, btw. I do appreciate your responses and suggestions.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

85% of my income was in the final quarter. How do I file Arizona Form 221 to eliminate the underpayment penalty?

You can enter data in Forms mode. It is when you override calculations and cells in Forms mode that you will not be able to e-file and will void your guarantee. Any entry that is overridden will be red. Yellow fields allow user input. Anything you enter here shows up in blue.

For more information, please see What do all the different colors in Forms mode mean? and How do I override (replace) an amount calculated by TurboTax?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

az148

Level 3

jstan78

New Member

sakilee0209

Level 2

douglasjia

Level 3

garne2t2

Level 1