- Community

- Topics

- Community

- :

- Discussions

- :

- Groups

- :

- Self employed

- :

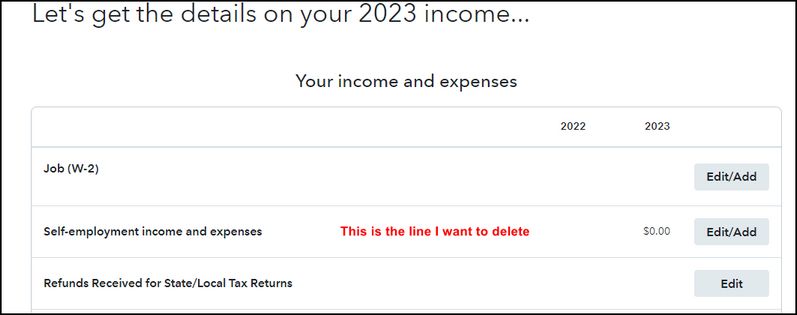

- Can I remove the "Self-employment income and expenses" line item from my "Your income and expenses" page? I cannot see a way to do this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I remove the "Self-employment income and expenses" line item from my "Your income and expenses" page? I cannot see a way to do this.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I remove the "Self-employment income and expenses" line item from my "Your income and expenses" page? I cannot see a way to do this.

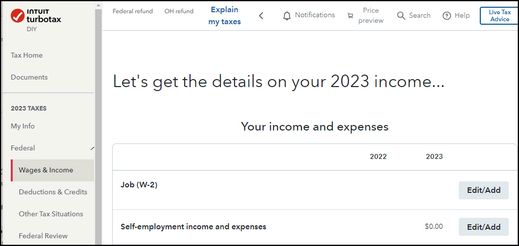

TurboTax Online has a new look this season and acts a bit differently.

It seems that the worksheets and categories are set up partially on the answers you give during the initial interview, as well as last year data and the forms you enter for this season.

I was able to get Self-Employment ON the summary screen, but afterwards could not remove it.

I cleared and started over but that did not eliminate that item.

That category is reporting zero, so it does not matter as far as your return is concerned.

The program is trying to be "smarter" and know what you'll need before you ask for it. In your case, it thinks you'll need to address Self-Employment income. Even if you won't be using this category of income, it may prove impossible to delete it once the program has assigned it.

It may disappear once you finish the return and are ready to file.

Regardless, if there is no Self-Employment income, there will be no mention of Schedule C or Self-Employment income on the final return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I remove the "Self-employment income and expenses" line item from my "Your income and expenses" page? I cannot see a way to do this.

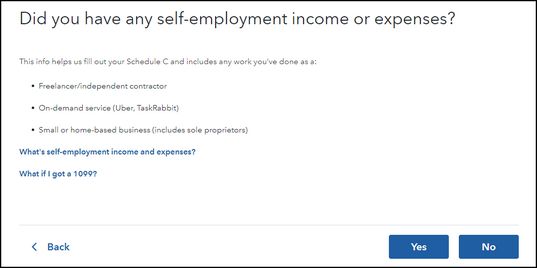

Do you have Self-Employment income?

If not, you could delete Schedule C if that is in your list of forms but not needed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I remove the "Self-employment income and expenses" line item from my "Your income and expenses" page? I cannot see a way to do this.

Thank you for the help.

Unfortunately, I do not see a Schedule C.

When I click on Edit/Add for Self Employment, there is no option to delete that I can locate.

Thank you

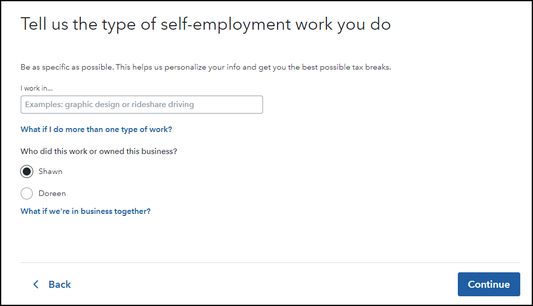

Shawn

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I remove the "Self-employment income and expenses" line item from my "Your income and expenses" page? I cannot see a way to do this.

No. The sch C will "NOT" appear in your input but rather in forms mode like this

On the top of the screen, select "Forms."

On the top of the screen, select "Forms."

then on the side panel, select sch C

then on the bottom of the form, you'll hit "Delete form"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I remove the "Self-employment income and expenses" line item from my "Your income and expenses" page? I cannot see a way to do this.

Thank you for your help.

Unfortunately, I do not see "Forms." on the top of my screen. I do see it under Tools, but no option for a Schedule C.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I remove the "Self-employment income and expenses" line item from my "Your income and expenses" page? I cannot see a way to do this.

Yes, on the screen image you show here, you can simply click the trash can icon to remove the self employment activity. Select Edit/Add and on the next screen you should see the image below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I remove the "Self-employment income and expenses" line item from my "Your income and expenses" page? I cannot see a way to do this.

Thank you for the guidance. I tried, but I do not see the option to delete. When I click no, there is no change.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I remove the "Self-employment income and expenses" line item from my "Your income and expenses" page? I cannot see a way to do this.

On the screen that you referenced in your question, try answering 'yes' instead of 'no'. Then, the next screen should show you any Schedule C entries that were made or carried over from prior years.

If you do see an entry on that next screen, click the trash can icon beside it to remove the Schedule C and underlying forms.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I remove the "Self-employment income and expenses" line item from my "Your income and expenses" page? I cannot see a way to do this.

Thank you for the help. When I click yes, it starts leading me through steps to enter data. No option to delete. I never had self-employment .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I remove the "Self-employment income and expenses" line item from my "Your income and expenses" page? I cannot see a way to do this.

Since you do not have self-employment income this year (and didn't last year), you may need to delete the related forms.

Here are the steps in TurboTax Online to delete Schedule C and all forms that have Schedule C in the name:

- Sign into your account.

- Open your return and continue until you see Federal >> Wages & Income on the left menu.

- On the left menu, Select Tax Tools and then Tools.

- In the pop-up window Tool Center, choose Delete a form.

- Click Delete next to the form or Schedule and follow the instructions to remove the form/schedule from your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I remove the "Self-employment income and expenses" line item from my "Your income and expenses" page? I cannot see a way to do this.

Thank you for the help.

I went through the process of entering data just to create a schedule C. After completing, I went to Tools / Forms, and then deleted Schedule C. This item is still listed. Is there another form that maybe I need to delete?

I'm guessing I can clear and start over, but prefer not to that option.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I remove the "Self-employment income and expenses" line item from my "Your income and expenses" page? I cannot see a way to do this.

TurboTax Online has a new look this season and acts a bit differently.

It seems that the worksheets and categories are set up partially on the answers you give during the initial interview, as well as last year data and the forms you enter for this season.

I was able to get Self-Employment ON the summary screen, but afterwards could not remove it.

I cleared and started over but that did not eliminate that item.

That category is reporting zero, so it does not matter as far as your return is concerned.

The program is trying to be "smarter" and know what you'll need before you ask for it. In your case, it thinks you'll need to address Self-Employment income. Even if you won't be using this category of income, it may prove impossible to delete it once the program has assigned it.

It may disappear once you finish the return and are ready to file.

Regardless, if there is no Self-Employment income, there will be no mention of Schedule C or Self-Employment income on the final return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I remove the "Self-employment income and expenses" line item from my "Your income and expenses" page? I cannot see a way to do this.

Thank you.

I appreciate the guidance and your feedback after clearing and staring over, that you could not remove "Self-employment income and expenses". That saved me the time of trying that option.

Maybe there will be an option in the future that when you add something and decide it is not needed it can be removed.

Shawn

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I remove the "Self-employment income and expenses" line item from my "Your income and expenses" page? I cannot see a way to do this.

You are in the Online version. Which version are you using? Deluxe or Premium? If you are in Premium you might really want to know about downgrading to Deluxe or Free Edition?

To go back to Deluxe or Free you can try to clear and start over https://ttlc.intuit.com/community/using-turbotax/help/how-do-i-clear-and-start-over-in-turbotax-onli...

If a line or section like self employment income shows zero why are you worried about it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I remove the "Self-employment income and expenses" line item from my "Your income and expenses" page? I cannot see a way to do this.

Thank you.

I'm online and I think the free version? I think the DIY (Do It Yourself) is the free version.

Why - I understand it is zero and will have no impact on my taxes. If no impact and not needed, I'm thinking there should be a way to remove it. I just like to clean up all items not required and this items I cannot remove.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.