- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Your software says my wife made an excess contribution to her Roth IRA last year when her contribution was $6500. How can that be?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Your software says my wife made an excess contribution to her Roth IRA last year when her contribution was $6500. How can that be?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Your software says my wife made an excess contribution to her Roth IRA last year when her contribution was $6500. How can that be?

There are income limitations. Did she work and earn at least that amount?

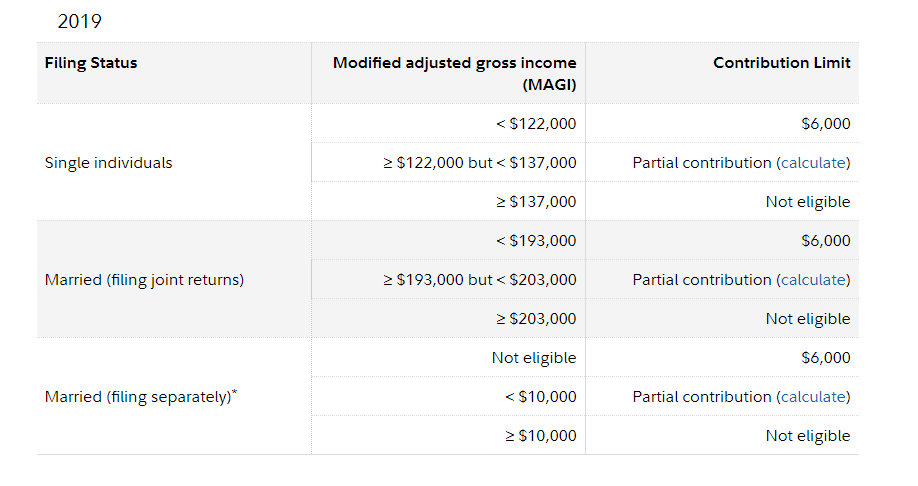

Please see the screen shot below.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Your software says my wife made an excess contribution to her Roth IRA last year when her contribution was $6500. How can that be?

Hi Colleen,

Thank you for your response! We are married filing jointly and the amount of income we reported in Box 1 for Wages is $198,103. My wife is 56, volunteers, and doesn't earn any income. I / we contributed $6500 to her Roth IRA for 2019 and contributed $1000 to her Traditional IRA, so the way I figure it, we over-contributed $500 to her retirement accounts. I did not contribute to my Trad IRA and don't have a Roth IRA. I believe the problem started when I was asked to declare the total value of the account (as of 12/31/19), and the value was $15,867. TurboTax then calculated that we / she over-contributed by $4600 - how can that be? Can you please help with this? Thanks ~John

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Your software says my wife made an excess contribution to her Roth IRA last year when her contribution was $6500. How can that be?

If your income is too high then your contribution is limited.

If you are Married Filing Joint and your income is less that $193,000 the you are allowed to contribute the full $6000 if your income is between $193,000 to $203,000 then your contribution is limited and above the $203,000 you may not make a contribution to a Roth IRA directly.

With the level of income that you have she is not eligible to contribute to a Traditional IRA account. The income limits in contributing to a Roth or a regular IRA account are based on the Married Filing Joint Income.

You can work around this for both of either one of you by contributing to a Traditional IRA and the converting it to a Roth IRA during the same year. This is called a Back Door Roth IRA and by passes the income limits placed on contributing to a Roth IRA directly.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Your software says my wife made an excess contribution to her Roth IRA last year when her contribution was $6500. How can that be?

I have the same question about my taxes. I am single and over 55 my income was way less than the maximum and turbo tax told me that my 2400 roth ira contribution was not allowed. My friend told me the same thing. What is going on? Is there a bug in turbo tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Your software says my wife made an excess contribution to her Roth IRA last year when her contribution was $6500. How can that be?

Here are the roth contributions rules:

- Only earned income can be contributed to a Roth IRA.

- You can contribute to a Roth IRA only if your income is less than a certain amount (under $139,000 for singles, $206,000 for married couples in 2020)

- The maximum contribution for 2020 is $6,000; if you’re age 50 or over, it is $7,000.

- You can withdraw contributions tax-free at any time, for any reason, from a Roth IRA.

If your only income is pensions, stock and bonds etc., then your contribution may not be allowed because you have no earned income for the year. Earned income includes income such as W2 income or self-employment income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tianwaifeixian

Level 4

ir63

Level 2

vicente

Level 3

user17538294352

New Member

tcondon21

Returning Member