- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Why did turbo tax deduct the 600 stimulus from my tax returns. I'm making poverty level income counting my SS check. So why if it's not taxable did I pay it back?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why did turbo tax deduct the 600 stimulus from my tax returns. I'm making poverty level income counting my SS check. So why if it's not taxable did I pay it back?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why did turbo tax deduct the 600 stimulus from my tax returns. I'm making poverty level income counting my SS check. So why if it's not taxable did I pay it back?

You may be seeing the result of a calculation that included the stimulus payment due to other entries in the program and when you indicated that you had received $XX it removed that same amount. Here is how to verify that it is correct:

In the panel at the left select Tax Tools

- Tools

- Tax Summary

- Now on the left you can select Preview My 1040

In the 1040 look at line 30.

That is the amount of the stimulus that is added to your tax return.

If the amount is not correct then follow these steps to let TurboTax know which stimulus payments you have received:

At the top of your tax return select Federal Review

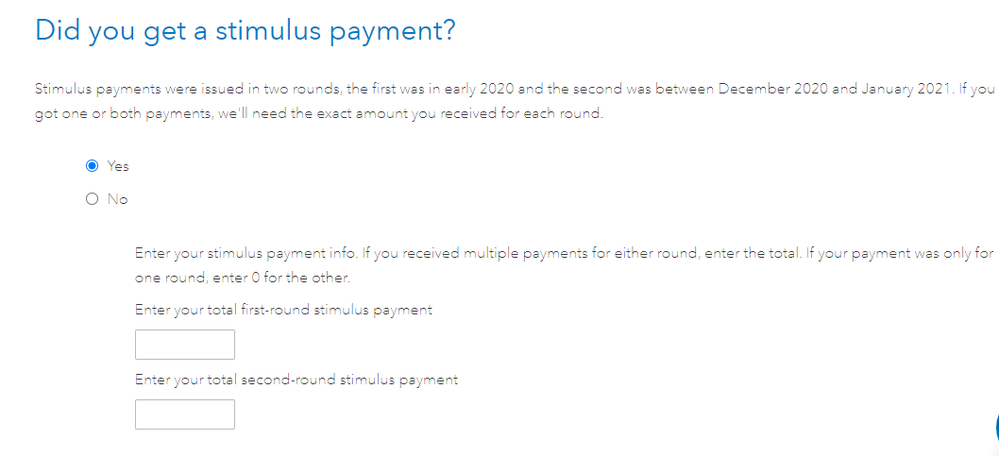

That will take you to this screen where it asks if you have already received your stimulus payments. If you received the first or second payment already, then select Yes and fill in the information. If you did not receive any payment select No. If you received the first payment only, fill in that amount and put zero (0) for the second payment.

When the screen is correct, you refund will be adjusted for the amount of stimulus payment that will be added to your 2020 refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why did turbo tax deduct the 600 stimulus from my tax returns. I'm making poverty level income counting my SS check. So why if it's not taxable did I pay it back?

How can I get it back if possible

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why did turbo tax deduct the 600 stimulus from my tax returns. I'm making poverty level income counting my SS check. So why if it's not taxable did I pay it back?

No, you can't get it back because you already received it and the software just made the adjustment in the Recovery Rebate Credit Section. You aren't entitled to get it twice and you already received it per information provided.

The Recovery Rebate Credit Section uses the information provided about the first two IEP checks you received and the 2020 return information to determine the amount you are entitled to get and it if reduced the anticipated refund amount by an amount you already received in a check then it is just adjusting it for you already having received it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why did turbo tax deduct the 600 stimulus from my tax returns. I'm making poverty level income counting my SS check. So why if it's not taxable did I pay it back?

I do not believe it is correct for the program to reduce the amount of a refund by the value of the stimulus payment. Even in the note above it states that the Stimulus amount you are owed will be added to your refund but in my case, it was deducted. I did not receive the 2nd stimulus check and the program indicated that I qualified for it but when I selected this radio button in the program my refund was reduced by $1800.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

evoneiff3

New Member

Brownshoes1992

Level 1

cboise

New Member

jfeder89

Level 1

philiptpoling

Level 1