- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Where do I report a loss on an excess deferral to 401(k) ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I report a loss on an excess deferral to 401(k) ?

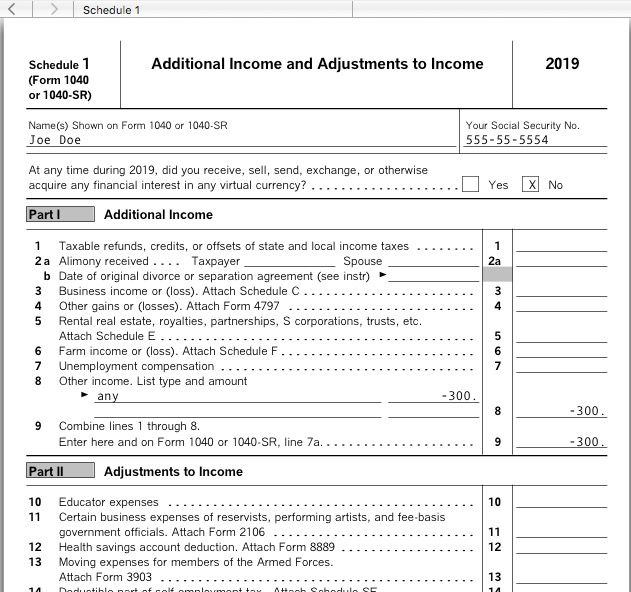

Turbotax identified that I contributed an excess of $910 to my 401(k) in 2018. I requested the excess to be returned from my plan administrator and was given $839.17 due to a loss of $70.39 on the investment. I was able to follow the instructions for reporting the net gain of $839.17 as additional income, however, I cannot figure out where to report the loss of $70.39. The only instruction I can find, state to report it as a negative number on line 21 of form 1040 with the description of "Loss on Excess Deferral" but in Turbotax I don't see a way to get to line 21. What steps in Turbotax do I use to report this loss? Thank you in advance for your time, energy, and effort to answer this question.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I report a loss on an excess deferral to 401(k) ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I report a loss on an excess deferral to 401(k) ?

When I enter negative amount as described above, Turbotax is not allowing me to eFile my Federal tax returns. It says I need to fix the return and 'Wages, Salaries & Tips worksheet: TP other earned inc shouldn't be less than zero." Please help!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I report a loss on an excess deferral to 401(k) ?

Does smart error check find that. When I try it I do not get any errors.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I report a loss on an excess deferral to 401(k) ?

Yes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I report a loss on an excess deferral to 401(k) ?

All I can suggest is delete and re-enter. Be sure that there are no other errors in smart check.

It might be only a problem in the online version (I am using desktop). This should be allowed since it is what the IRS says to do.

You can call customer support, but I doubt that they will be able to do anything.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

xiaochong2dai

Level 3

jliangsh

Level 2

Talhakhan104

Returning Member

neutron450

Level 3

srtadi

Returning Member