- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- "What kind of retirement income do you have from Pennsylvania?" Which to choose?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"What kind of retirement income do you have from Pennsylvania?" Which to choose?

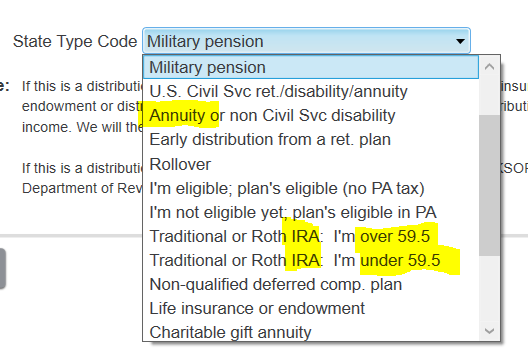

Hi I am working on the PA state return and I am having trouble classifying assets with the available choices in the pulldown menu for "What kind of retirement income do you have from Pennsylvania?". What state type code do I choose?

Asset 1:

1099R from Bankers Life that shows payout of whole asset of my father;s (over 60) part of Medicaid paydown) to my mother (over 60) and deposited in her bank account. Described by fund manager as non-qualified (non) IRA annuity. Box 1 $27,000 Box 2a $1130 Box 5 $26000. Total distribution checked. Box 7 (7D) Box 15 has info. Box 16 $1130.

I was told the 1130 was taxable.

Asset 2:

1099R from Bankers Life. Qualified IRA of my dad (over 60) which was then rolled over (under 60 day rule) with another company to create an annuity for my mom (a form 5498 was generated by the new company with the IRS). Box 1 and 2A both have 90,000. Taxable amount not determined is checked. Total distribution is checked. Box 7 has code 7. IRA box is checked. Box 15 has info Box 16 has 90,000.

Asset 3:

1099R from Elco Mutual Life and Annuity. The money from the previous asset is now here being paid out monthly to my mother. qualified ...but ..elder care lawyer says monthly payments are taxable. Box 1 13,000 Box 2a: 13,000 Box 2B: taxable amount not determined checked DIST code 7 IRA box checked. no info in box 15 and 16.

So which things in the pull down menu for retirement assets on the PIT best match these?

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"What kind of retirement income do you have from Pennsylvania?" Which to choose?

You will make a choice for each asset entered.

Asset 1 - yes box 2a is the taxable amount of your annuity. Select annuity from the dropdown.

Asset 2 -1099-R Banker's Life was IRA over age 59.5. You said it was rolled over but your form shows all taxable and regular distribution, code 7. In the federal section, you needed to tell the federal entry of the 1099-R in the program that you rolled the money over so that it is not taxable.

The 5498 from the new company is your proof of rollover, keep transaction information safe.

Asset 3- 1099-R Melco Annuity. Select annuity. Yes, annuity payments are taxable. Any pre-taxed dollars that funded the annuity would reduce the taxable amount. The program will ask.

When finished, the program will show a summary screen. You can verify the order of the answers against the order on the screen. Be careful you to choose the IRA for over 59.5

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

nex

Level 1

hasalaph

New Member

sam992116

Level 4

chinyoung

New Member

TMM322

Level 2