- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

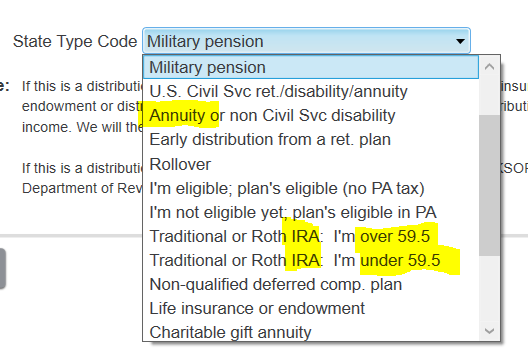

You will make a choice for each asset entered.

Asset 1 - yes box 2a is the taxable amount of your annuity. Select annuity from the dropdown.

Asset 2 -1099-R Banker's Life was IRA over age 59.5. You said it was rolled over but your form shows all taxable and regular distribution, code 7. In the federal section, you needed to tell the federal entry of the 1099-R in the program that you rolled the money over so that it is not taxable.

The 5498 from the new company is your proof of rollover, keep transaction information safe.

Asset 3- 1099-R Melco Annuity. Select annuity. Yes, annuity payments are taxable. Any pre-taxed dollars that funded the annuity would reduce the taxable amount. The program will ask.

When finished, the program will show a summary screen. You can verify the order of the answers against the order on the screen. Be careful you to choose the IRA for over 59.5

**Mark the post that answers your question by clicking on "Mark as Best Answer"