- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- W-2 Box 12 I have two separate entries 401K contributions two tax years

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W-2 Box 12 I have two separate entries 401K contributions two tax years

On my 2023 W-2 I have two different "D" elective 401K contributions, on for 2023 tax year and one that is retroactive for 2022 tax year. On W-2 shows up as D 22 $3357 and D $30,000. Turbotax has no method to code for contribution for prior tax year only option is D. By IRS regulations each contribution must be reported separately and should be coded based on the tax year its earmarked for yet there is no method to do this in the tax program. You can go to the forms mode and include comment, but those comments are never sent to the IRS. Turbotax identifies this as an error, "two entries with same code" and even if I was allowed to combined the two entries it would then be above the maximum allowed for 2023 for people over 50. Therefore, what can I do to correct the error in turbotax. Please don't tell me to print out my tax forms, write sometime in on the tax forms and mail my taxes to IRS because my taxes are usually 80+ pages long and I have had several issues with some of my recent amended returns reaching the IRS so I prefer not to have write something in and mail them.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W-2 Box 12 I have two separate entries 401K contributions two tax years

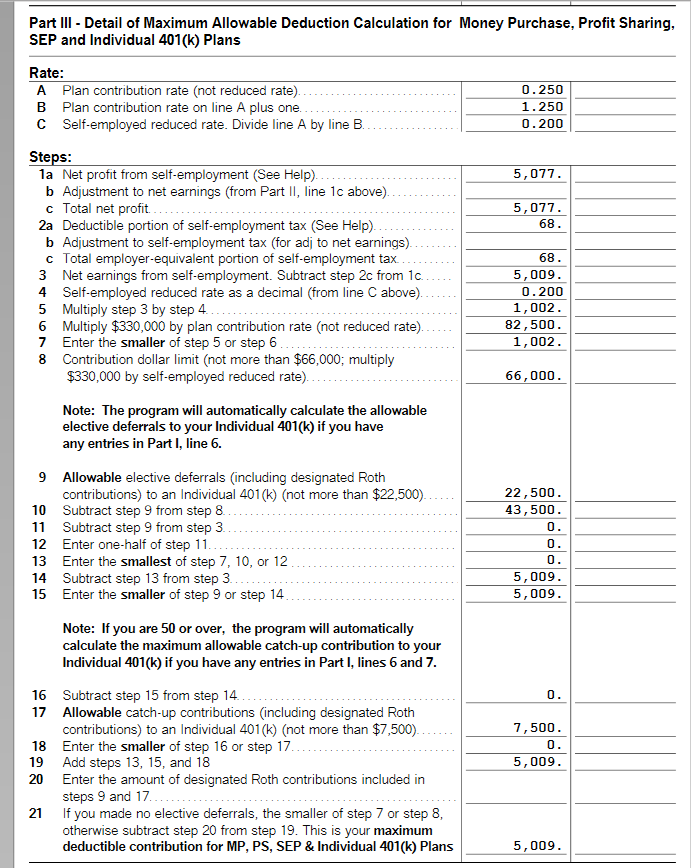

Because you've maxed out the employee elective deferral at your W-2 employer, you can't use the Maximize option for a solo 401(k) contribution because the Maximize function for a 401(k) contribution assumes no employee contributions to any other 401(k), 403(b) or SIMPLE plan. As you observed, the Maximize function is incapable of taking into account amounts reported in box 12 of a W-2. You'll instead need to use the maximize option for a SEP-IRA contribution to calculate just the permissible employer contribution to the solo 401(k).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W-2 Box 12 I have two separate entries 401K contributions two tax years

There are many posts here each year regarding this issue. Unfortunately, the only solutions in TurboTax are either to omit the entry of the prior-year amount or to combine the amounts on a single code-D entry and then ignore the warning about overcontributing. The warning about overcontributing has no effect on your ability to file. Omitting the prior-year amount would be extremely unlikely to affect your tax return since doing so would almost certainly not affect your eligibility for a Retirement Savings Contributions Credit given that the combined deferrals exceed the annual deferral limit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W-2 Box 12 I have two separate entries 401K contributions two tax years

If I enter 2 different D than Turbotax returns with error message telling me I have two identical code D entries, if I add the amounts together the Turbotax program will erroneously assume here was an excess 401K contribution for current tax year. If I omit the D22 amount, then I will get an error regarding the differential between taxable wages in Box 1 and Box 3 (i.e. the data entered on my W-2 form shows exactly why a portion of Gross Wages-Box1 was not taxable which is done by the entries listed in Box12. My W-2 shows that my combined elective 401k deferral for 2023 (the D-30,000 for 2023) and retroactive deferral for 2022 (D22 3357) were deducted from my Gross Wages from 2023 which is the same amount shown for Medicare wages in Box 3--- and Taxable wages in Box 1 is 33,357 less than Box 3. Although TT home and Business desktop version allows you to enter "additional information sheets" this information is never transmitted to IRS and simply acts as notes for the tax-payer. There should be something somewhere in the Turbotax program to allow a taxpayer to properly document the information on their W-2 to account for retroactive retirement deferrals for a prior tax year. I know the situation is not common, but its not unheard of and it is in the tax code/regulations. I also have a solo-401K plan because I also work as an independent contractor and I am allowed to contribute 20% of my net income minus 1/2 self-employment tax as an "employer" to my solo-401K, yet when I attempt to use the auto-calculate (maximize contribution to individual 401K) the turbotax program incorrectly comes up with an amount that would be equal to the amount I could have contributed as an "employee" had I not already contributed and maximized my employee contribution via my W-2 job. I am uncertain if the box in tubotax only works to calculate the maximum amount an "employee" can contribute, or if the turbotax program is not properly "seeing" the amounts I already enter in box 12 on my W-2. Any suggestions for either issue?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W-2 Box 12 I have two separate entries 401K contributions two tax years

Because you've maxed out the employee elective deferral at your W-2 employer, you can't use the Maximize option for a solo 401(k) contribution because the Maximize function for a 401(k) contribution assumes no employee contributions to any other 401(k), 403(b) or SIMPLE plan. As you observed, the Maximize function is incapable of taking into account amounts reported in box 12 of a W-2. You'll instead need to use the maximize option for a SEP-IRA contribution to calculate just the permissible employer contribution to the solo 401(k).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W-2 Box 12 I have two separate entries 401K contributions two tax years

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W-2 Box 12 I have two separate entries 401K contributions two tax years

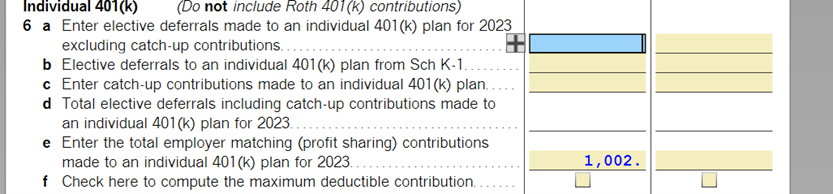

There is no need to unmark the SEP Maximize box and enter the $1,002 as an employer 401(k) contribution instead, although you can if you like. Your tax return will have $1,002 on Schedule 1 line 16 either way. The worksheet itself is not part of your filed tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W-2 Box 12 I have two separate entries 401K contributions two tax years

Sorry I was fixing my post to better clarify at the same time you were answering.

The bottom line deductions come other the same as you mentioned with I leave the SEP max checked or manually put in employer contribution, but I just wasn't certain if "employer contribution (employer matching profit sharing) contribution" was the correct box to enter the information because I thought that some 401-k plans also allowed employer "matching" which was different than the regular employer contribution.

In regards to the W-2 and having two separate 401K for two different tax years ( D for 2023 tax year, and D22 for 2022 tax year) at this point Turbotax is not throwing up a red flag tell me I have to correct and error. I simply got a message telling I had entered two separate amounts using same code (D) and was that information correct or something along those lines. Anyway I simply moved pas that screen to the next and in the form mode it shows the two amounts entered with the same code, so I'll just have to wait until I get all my other tax documents so I can finalize my taxes to see if all the calculations work out correctly and then see if Turbotax allows me to efile since occasionally if the program does not like sometime even if it does not show as a red flag it prevents you from filing (for example last year I had an issue with Form 1116 and turbotax did not red flag an error for the form, but it also did not like how I had entered the information or maybe there was a glitch in the program, and eventually after deleting original forms and readding Turbotax eventually allowed me to efile) . Long story longer sometimes you have to manipulate things in Turbotax to get the program to recognize how it should enter the information on the tax forms.

Thanks for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W-2 Box 12 I have two separate entries 401K contributions two tax years

I tried to combine the 2 Code Ds (regular D and D22) and it gave me an error of excess contribution for 2023. Which was not the case since my actual 2023 contribution was only $29,900 (including my catch-up contribution since I am more than 50 yrs old). I also noticed that I was being charged additional tax for this (I was watching the Federal number on top and it added more than $1000 in taxes to my totals). Should I just omit the entry for D22 (that was in my 2023 W2?) Would it not be considered by IRS as unreported since it was showing in my W2?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W-2 Box 12 I have two separate entries 401K contributions two tax years

Unfortunately, there is no workaround. As you mention if you include both contributions coded "D" for 2023 and "D22" retroactive contributions for tax year 2022. You get two error messages one stating 2 D codes cannot be entered and other that you over contributed for tax year 2023 which inaccurate. If you add them together and just use D code which is incorrect way to enter you get you over contributed for tax year 2023 .

I tried uploading PDF of my W-2 from my computer and got error message stating not connected to internet, which doesn't make any sense given that I have a download version of turbotax and the PDF was on my computer; furthermore, I was connected to internet. I also tried uploading W-2 with only one copy of W-2 on PDF, and no other information (i.e. my W-2 has copy 1 and copy 2 on same page and second page with explanation) and still got same error message. Tried to go to forms mode to see if there was a way to write in and there is not, and there is no method to include explanation statement to IRS or attach form 8275 (taxpayer disclosure statement which really is applicable to this situation) using turbotax. I spoke to a "tax specialist, supposedly CPA" at turbotax and they said since D22 applies to the prior tax year and does not affect 2023 tax lability leave it off the 2023 taxes and IRS will get a copy of the W-2 and will see which tax year the additional 401k or in my case TSP contribution went. Anyway I realize this is not the best answer; however, there is no method to enter this information other than if you submitted paper copies of your taxes which is not advisable. Sorry I cannot be more helpful.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W-2 Box 12 I have two separate entries 401K contributions two tax years

The IRS has your w2 information along with your account balances on Dec 31st. Leaving off a line in an informational box that does not affect your tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W-2 Box 12 I have two separate entries 401K contributions two tax years

Thank you. Since this was not the first time that this issue was brought up, I am hoping that Turbo Tax would consider updating their tax program accordingly to avoid confusion.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

toddrub46

Level 4

xiaochong2dai

Level 3

atlg8or

New Member

Rockpowwer

Level 4

Dusit

New Member