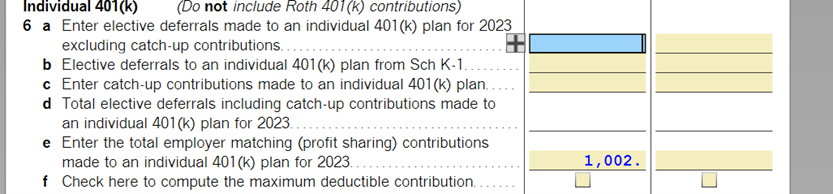

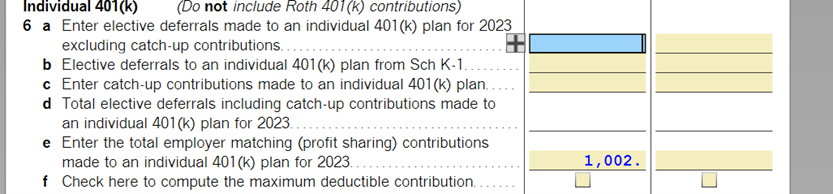

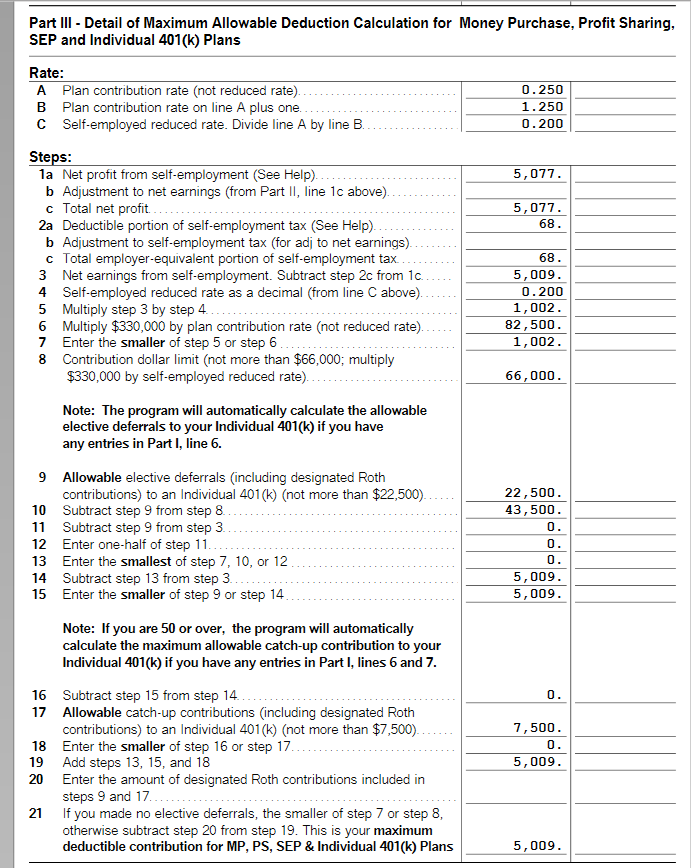

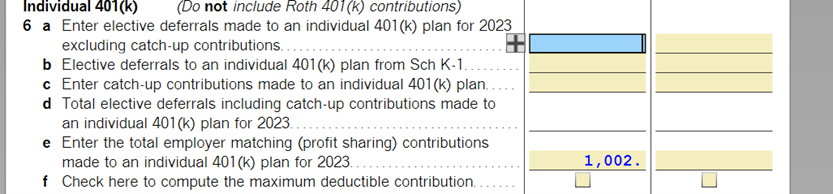

My net income as an independent contractor this year is small 5077 and utilizing the calculator on the following website https://obliviousinvestor.com/solo-401k-contribution-calculator which allows you to enter both business net profit and information from W-2 (wages and 401k contributions) it appears I can contribute 1002.00 as an "employer". When I checked the maximize box under 401K or SEp/Koegh it also shows that 1002 in box 5 and 7 of the worksheet and the worksheets only differ in regard to box 21 (when maximize checked under 401k section shows 5009 and when maximized checked under Sep/Keogh box 21 show 1002). So it appears I can contribute 1002 as the "employer" contribution and if I had not already maximized contribution to my employee W-2 401k contribution I could have contributed 5009 as an employee. Now I have confirmed amount I can contribute 1002 as an "employer" I just need to ensure it gets entered into the correct box on the tax forms. Since this is a solo-401K plan do I now uncheck the maximize box in turbotax and manually enter the 1002 as a employer contribution (employer matching profit sharing) contribution under 401k section so that the information gets filled out in the correct boxes?

My net income as an independent contractor this year is small 5077 and utilizing the calculator on the following website https://obliviousinvestor.com/solo-401k-contribution-calculator which allows you to enter both business net profit and information from W-2 (wages and 401k contributions) it appears I can contribute 1002.00 as an "employer". When I checked the maximize box under 401K or SEp/Koegh it also shows that 1002 in box 5 and 7 of the worksheet and the worksheets only differ in regard to box 21 (when maximize checked under 401k section shows 5009 and when maximized checked under Sep/Keogh box 21 show 1002). So it appears I can contribute 1002 as the "employer" contribution and if I had not already maximized contribution to my employee W-2 401k contribution I could have contributed 5009 as an employee. Now I have confirmed amount I can contribute 1002 as an "employer" I just need to ensure it gets entered into the correct box on the tax forms. Since this is a solo-401K plan do I now uncheck the maximize box in turbotax and manually enter the 1002 as a employer contribution (employer matching profit sharing) contribution under 401k section so that the information gets filled out in the correct boxes?