- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Unable to go back to 1099-B-form input and correct it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unable to go back to 1099-B-form input and correct it

When I try to go back into the 1099-B income section I am unable to access and correct a previous 1099-B entry I get a message saying Oh Snap - we have hit a snag. Please advise. Thanks.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unable to go back to 1099-B-form input and correct it

Sometimes technical issues like you explain can be corrected by simply leaving the software and re-entering.

Second, in some cases, clearing your browser cache is helpful. See this TurboTax Help.

Finally, in other cases, simply changing the browser that you access the software will rectify the problem.

If you are unable to correct your IRS form 1099-B, and depending upon your version of TurboTax, you may be able to upload the IRS form 1099-B as a PDF file.

TurboTax Online Premium will download a PDF copy of your broker's IRS form 1099-B.

Your brokerage statement includes a summary of your transactions, grouped by sales category, for example, Box A short-term covered or Box D long-term covered, you will enter the summary info instead of each individual transaction. Follow these steps:

- Click on Federal down the left side of the screen.

- Click on Wages & Income down the left side of the screen.

- Scroll down to Investments and Savings and click the down arrow to the right.

- Click Start / Revisit to the right of Stocks, Cryptocurrency, Mutual Funds, Bonds, Other.

- Click Add investments.

- At the screen Let's import your tax info, click Enter a different way.

- Click on Stock, Bonds, Mutual funds. Click Continue.

- At the screen Which bank or brokerage is on your 1099-B, enter the information. Click Continue.

- Do these sales include any employee stock, click No.

- Do you have more than three sales on your 1099-B, click Yes.

- Do these sales include any other types of investments, click No.

- Did you buy every investment listed on your 1099-B, click Yes. Click Continue.

- At the screen Now, choose how to enter your sales, select Sales section totals. Click Continue.

- At the screen Look for your sales on your 1099-B, click Continue.

- At the screen Now enter one sales total on this 1099-B, enter information. Click Continue.

- Repeat as necessary by clicking Add another sales total. Click Continue.

- At the screen Now we'll help you upload your 1099-B since the IRS requires a copy, select Browse.

- Download the 1099-B in PDF format from your provider.

- Upload successful, click Continue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unable to go back to 1099-B-form input and correct it

Thanks for your suggestions. I am still unable to edit the manual info entered from my 1099-B. When I click the "update" icon I just get a Summary of what has already been input, which unfortunately has an error. Today I downloaded the 1099-B from my brokerage house which entered the correct info. Unfortunately it did not override the manually entered incorrect info which remained. Unless you know a way to delete the incorrect entry, I see no other solution than to start a new return. I will wait a few days before I start a new return to see if you can tell a way to delete my manually entered info which has an error. Thanks in advance for any help you can give me. i have the Premier edition.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unable to go back to 1099-B-form input and correct it

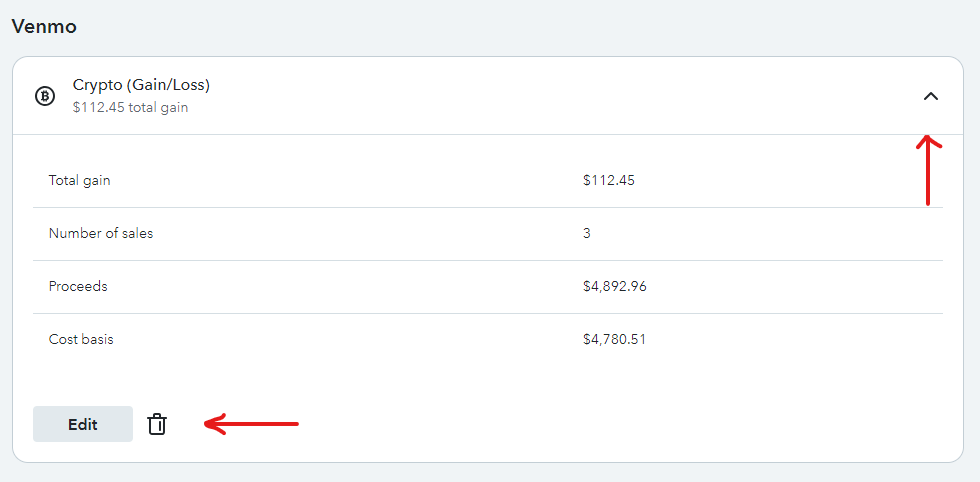

In TurboTax Online, follow these steps to delete the 1099-B information.

- Click Federal, then Wages & Income down the left side of the screen.

- Click Edit/Add to the right of Investments and Savings (1099-B).

- Click the down arrow to the right of the 1099-B income to be deleted.

- Click the trashcan to the right of the Edit button.

In TurboTax Desktop, follow these steps to delete the 1099-B information.

- Select Federal Taxes, then Wages & Income.

- Select I'll choose what I work on.

- At Your 2023 Income Summary, select Start/Update to the right of Stocks, Cryptocurrency, Mutual Funds, Bonds, Other.

- Click the trashcan to the right of the income to be removed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unable to go back to 1099-B-form input and correct it

Hi Support,

A Trouble Ticket with your development/engineering IT teams needs to be open for this. Multiple users are having issues with the Online portion of Investments and Savings (1099-B, 1099-INT, 1099-DIV, 1099-K, Crypto).

In many cases no one is able to manually enter their forms. We simply hit "Enter a different way" click continue, and promptly get the "Hit a Snag" error message.

Online imports appear to be working fine but if we have brokers who do not support that option, and we have no way of imputing it directly ourselves, then TurboTax software is useless to us. I've been a TT customer going on 20 years and this is quite frankly absurd that we can't have a Developer update telling us they are aware of the issue and are working on it.

For reference:

Multiples contacts with Live Chat and Phone Support: Resulting in 6 hours of troubleshooting with them.

Multiple browsers, computers, etc used.

All browsers cached, history, cookies, etc wiped repeatedly.

Log in, log out repeatedly tried.

Going away 5 minutes, 1 hour, 24 hours, 1 week, does nothing. Problem continues to exist despite our wishing it wouldn't.

Thanks,

Sincerely, everyone who has spent 10+ hours over the last 2 weeks trying to get through this issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unable to go back to 1099-B-form input and correct it

Also unable to enter my form 1099b’s for 2023. Using TurboTax home and business (Mac version). When I click to continue so that I can input the 1099 b, screen goes blank and no option exists to do anything further. All TurboTax updates were done. Restarted computer several times. Cleared browser. Still not working.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unable to go back to 1099-B-form input and correct it

After weeks of being unable to clear an incorrect manual entry, I finally just started a new return and first did the 1099-B section. Did not enter anything manually. All my brokers participated in the download function. Then did the rest of the return and filed ok. This section of the Mac version definitely needs attention by the TT software engineers.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unable to go back to 1099-B-form input and correct it

Was hoping to avoid having to start all over again since I had finished most of the tax return already. But I’m afraid if IT doesn’t come up with a fix soon then that is what I will have to do. Thank you for your response. May have to rethink TurboTax next year. Very frustrating. Never had an issue like this before after using TurboTax for years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unable to go back to 1099-B-form input and correct it

I have tried both of these and im still unable to change the information being automatically input. Addresses are wrong and all it lets me change is the zipcode but they dont match the state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unable to go back to 1099-B-form input and correct it

Are you referring to and IRS form 1099-B or something else? Are you using TurboTax Desktop or TurboTax Online?

Rather than downloading the form, consider deleting the entry and entering the form manually.

Delete by clicking on the down arrow to open up the transaction. Then click the delete trashcan.

To enter the form manually In TurboTax Online, follow these steps:

- Down the left side of the screen, click Federal.

- Down the left side of the screen, click Wages & Income.

- Click the down arrow to the right of Investments and Savings.

- Click to the right of Stocks, Cryptocurrency, Mutual Funds, Bonds, Other (1099-B).

- Click Add investments.

- On the Let's import your tax info screen, select Enter a different way.

- On the OK, let's start with one investment type screen, select Stocks, Bonds, Mutual Funds, then Continue.

- At the screen Which bank or brokerage, enter the information. Click Continue.

- Do these sales include any employee stock, enter No.

- Do you have more than three sales, enter No.

- Do these sales include any other types of investments, enter No.

- Did you buy every investment listed, enter Yes. Continue.

- On the screen Now, choose how to enter your sales, select One by One. Select Continue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17548300478

New Member

rogensg1

New Member

whgriffin62

New Member

joejkotowski

New Member

GolBdMS

Level 1