- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- The box on Form 1099R that is labeled TIN is the payers F...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

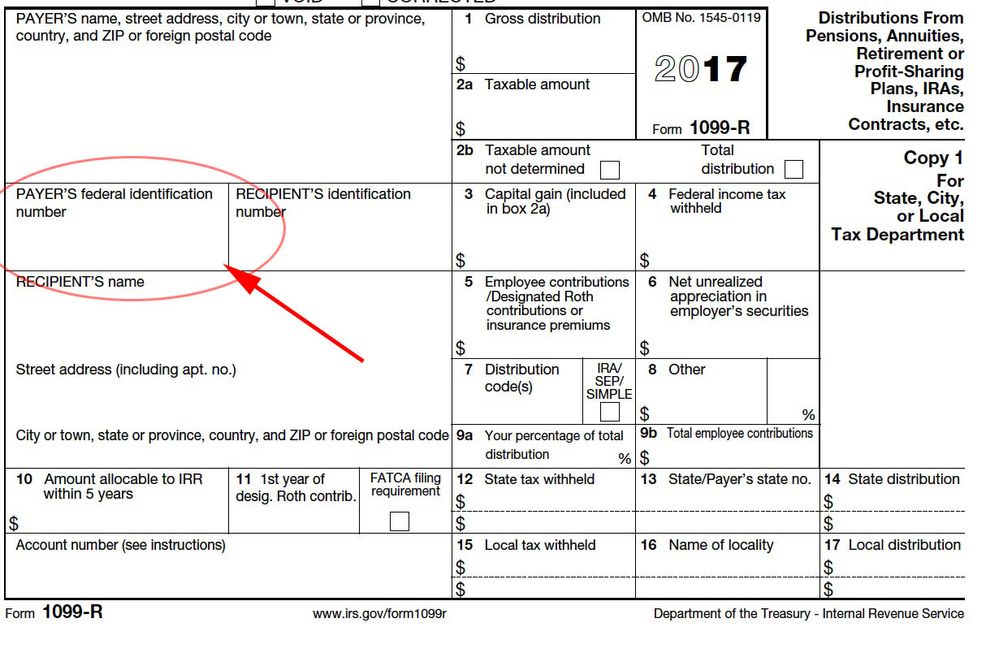

I'm trying to submit my 1099r and I can't locate the Federal ID Number on the form. Would it go by a different name like "payer's TIN"?

On the details page of the 1099r it lists the payer's TIN as Taxpayer Identification Number.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to submit my 1099r and I can't locate the Federal ID Number on the form. Would it go by a different name like "payer's TIN"?

The box on Form 1099R that is labeled TIN is the payers Federal ID Number.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to submit my 1099r and I can't locate the Federal ID Number on the form. Would it go by a different name like "payer's TIN"?

The box on Form 1099R that is labeled TIN is the payers Federal ID Number.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to submit my 1099r and I can't locate the Federal ID Number on the form. Would it go by a different name like "payer's TIN"?

On the 1099R form it has Payer's TIN. I have used that as the Federal ID number and it was rejected. What should Used?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to submit my 1099r and I can't locate the Federal ID Number on the form. Would it go by a different name like "payer's TIN"?

@tclandi wrote:

On the 1099R form it has Payer's TIN. I have used that as the Federal ID number and it was rejected. What should Used?

The Payer's TIN is the Federal EIN. It is 9 digits and in the format of 12-3456789. You only enter the 9 digits and the program will supply the 'dash'. If what you entered is correct and it is being rejected, the delete the Form 1099-R and re-enter manually.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to submit my 1099r and I can't locate the Federal ID Number on the form. Would it go by a different name like "payer's TIN"?

I did enter the 1099-R manually and still got the rejection. So now what am I supposed to enter?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to submit my 1099r and I can't locate the Federal ID Number on the form. Would it go by a different name like "payer's TIN"?

@MPURSLEY8 wrote:

I did enter the 1099-R manually and still got the rejection. So now what am I supposed to enter?

If you entered the payers EIN on the 1099-R and it rejects as an invalid EIN then contact the payer to see of they entered the wrong number.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to submit my 1099r and I can't locate the Federal ID Number on the form. Would it go by a different name like "payer's TIN"?

I thank you very much for the help; however, they only had their name and address in that box. I did get the info from google.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to submit my 1099r and I can't locate the Federal ID Number on the form. Would it go by a different name like "payer's TIN"?

If your 1090-R was missing the EIN then contact the issuer for a replacement 1099-R. A 1099-R is not valid without a EIN. They are required by law to supply a valid 1099-R.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

MuMoo

Level 1

snabblady

New Member

Thegoettls1

New Member

lnhartmann30

New Member

flanzel

New Member