- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Taxes on UNJSPF payments made to US citizens living abroad.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes on UNJSPF payments made to US citizens living abroad.

Hi. I'm happy to be getting monthly pension payments from the UN Joint Staff Pension Fund (UNJSPF), but I'm confused about my taxes. I'm a US citizen but live in Denmark. As a Danish resident, I'm obligated to pay taxes to Denmark on my worldwide income, including from the UN pension fund.

Since the US and Denmark have a tax treaty, I understand I can take a Foreign Tax Credit using Form 1116 on my US taxes. Yes?

If so, what category of income do I use: (a) income re-sourced by treaty, (b) passive category income, (c) general category income, or something else? Thanks for your help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes on UNJSPF payments made to US citizens living abroad.

If you pay taxes on foreign income to both the IRS and foreign government, you may claim a foreign tax credit on your return.

You are advised to select Lump-sum distribution or General Category. Please continue to read:

LUMP-SUM DISTRIBUTIONS

You can take a foreign tax credit for taxes paid or accrued on a foreign source lump-sum distribution from a pension plan. Special formulas may be used to figure a separate tax on a qualified lump-sum distribution for the year in which the distribution is received. See IRS Publication 575 for more information.

GENERAL CATEGORY INCOME

Any income that does not fit any of the above categories is general category income. The following list is not all-inclusive, but general category income may include:

- Wages, salary, and overseas allowances of an individual as an employee

- Income earned in the active conduct of a trade or business

- Gains from the sale of inventory or depreciable property used in a trade or business

- High-Taxed Income (or High Tax Kickout)

INCOME RE-SOURCED BY TREATY

Many nations have tax treaties with the United States that specify how certain items will be treated for income tax purposes. In some cases, income earned in one country will be treated as if it was earned in another country. This is called re-sourcing income. An example might be a US professor who teaches a semester in another country, but under a treaty agreement all of the wages are treated as through they were actually earned in the US, and not subject to tax in a foreign country.

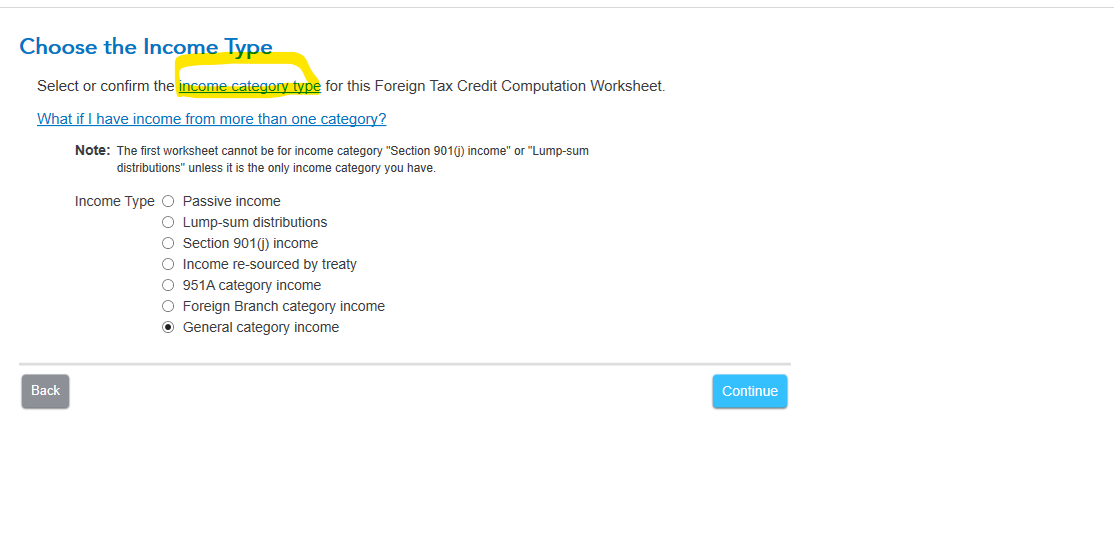

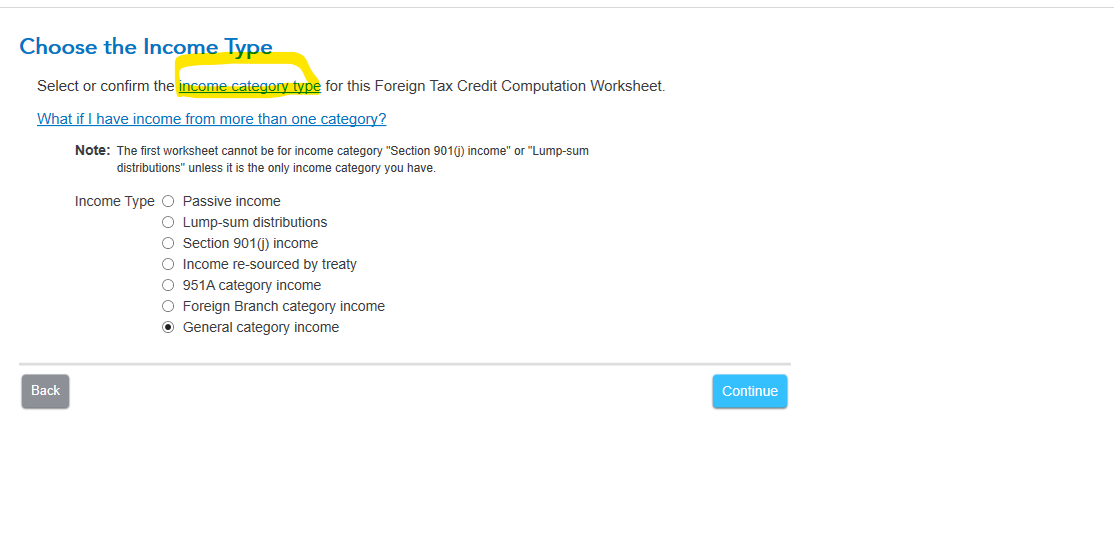

To learn more about each category, please click on the blue link income category type on the screen. See image below:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes on UNJSPF payments made to US citizens living abroad.

If you pay taxes on foreign income to both the IRS and foreign government, you may claim a foreign tax credit on your return.

You are advised to select Lump-sum distribution or General Category. Please continue to read:

LUMP-SUM DISTRIBUTIONS

You can take a foreign tax credit for taxes paid or accrued on a foreign source lump-sum distribution from a pension plan. Special formulas may be used to figure a separate tax on a qualified lump-sum distribution for the year in which the distribution is received. See IRS Publication 575 for more information.

GENERAL CATEGORY INCOME

Any income that does not fit any of the above categories is general category income. The following list is not all-inclusive, but general category income may include:

- Wages, salary, and overseas allowances of an individual as an employee

- Income earned in the active conduct of a trade or business

- Gains from the sale of inventory or depreciable property used in a trade or business

- High-Taxed Income (or High Tax Kickout)

INCOME RE-SOURCED BY TREATY

Many nations have tax treaties with the United States that specify how certain items will be treated for income tax purposes. In some cases, income earned in one country will be treated as if it was earned in another country. This is called re-sourcing income. An example might be a US professor who teaches a semester in another country, but under a treaty agreement all of the wages are treated as through they were actually earned in the US, and not subject to tax in a foreign country.

To learn more about each category, please click on the blue link income category type on the screen. See image below:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jsefler

New Member

Asorsen

New Member

gciriani

Level 2

mark-blaauwhara

New Member

oceanrest92

New Member