- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Social Security Taxable amount

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Social Security Taxable amount

For 2024, turbo tax calculated our taxable social security as 47% of the total. We trusted the calculation, but the IRS sent a notice that the computation of the taxable amount was in error. The correct amount should be 85% of the total benefit. When I reviewed our 2023 return, I see that last year, Turbot Tax did show 85% of our SS as the taxable amount. This is a huge error in Turbo Tax for 2024! I have been on the phone all day trying to find someone who could help me understand what went wrong.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Social Security Taxable amount

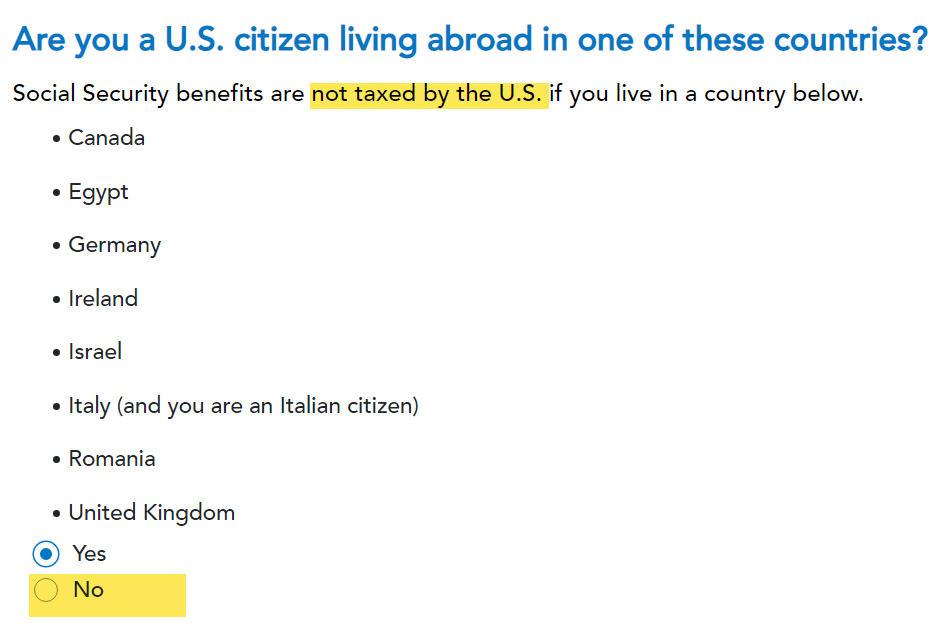

It sounds like you answered Yes on the following screen, or skipped over the question. When you entered your social security income, you would have been shown the screen below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Social Security Taxable amount

As I noted before, I am quite sure I never saw that screen nor would I have indicated Yes as the answer. In any case, TurboTax should include this as one of the “error” messages to be cleared before submitting the return.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dorothycstephenson72

New Member

SuzMarie

New Member

user17683086956

Returning Member

lydlen

Level 3

cgbes

New Member