- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Small business owner and also a new W-2 employee in 2022. My blended tax rate went from 6.1% in 2021 to 25% in 2022. Could this be correct, even if my taxable income is lower than last year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Small business owner and also a new W-2 employee in 2022. My blended tax rate went from 6.1% in 2021 to 25% in 2022. Could this be correct, even if my taxable income is lower than last year?

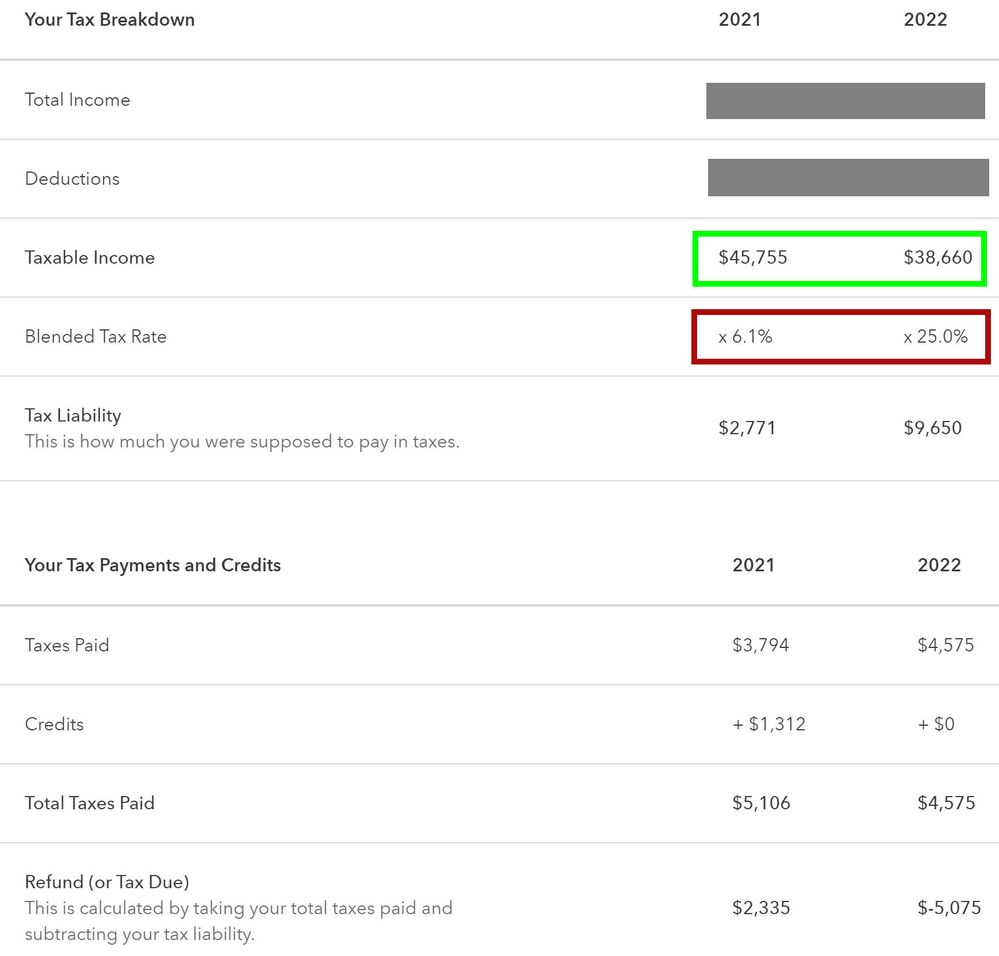

I've been a self-employed small business owner for 20 years - no employees. In April of 2022, I also took a full-time job with another company and receive a W-2 from them. I still put a lot of hours into my own business on nights and weekends and have several 1099-MISC that I report for the business. I make quarterly payments for estimated taxes for the business income. After filling out the Federal portion, my taxable income is less for 2022 than 2021, but the blended tax rate is showing 25% vs 6.1%. Filing as "Married Filing Jointly" - can this be correct? According to the Tax Bracket Calculator from TT, I'm nowhere close to the 24% bracket for taxable income.

I appreciate your time and expertise in trying to help me understand this. Screenshot below:

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Small business owner and also a new W-2 employee in 2022. My blended tax rate went from 6.1% in 2021 to 25% in 2022. Could this be correct, even if my taxable income is lower than last year?

Your blended tax rate includes self-employment tax. Self-employed individuals pay income tax + Social Security and Medicare tax.

Since SSI and Medicare was not withheld from your pay, it's added to your tax return on Form 1040, Schedule 2, line 4 and Schedule SE. Since it's part of your tax return, it becomes part of your blended tax.

Last year, your employer withheld SSI and Medicare so it was not part of your blended tax.

Please feel free to reach out to TurboTax Community if you need additional help or click here for information on Turbo Tax Support. You can connect with a Live Agent over the phone and share your screen.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Small business owner and also a new W-2 employee in 2022. My blended tax rate went from 6.1% in 2021 to 25% in 2022. Could this be correct, even if my taxable income is lower than last year?

Hello @ErnieS0, thank you for your response. I should have been more clear in my previous question. Since I've been a small business owner for 20 years, I understand that there are additional taxes paid by a business owner. In 2021 (with only a small business), my blended tax rate was 6.1% as shown by TT. In 2022, I continue to operate as a small business and also accepted a full-time W-2 position with another company. My new employer takes out all the necessary taxes on the W-2, so there shouldn't be any new taxes from the employer. Which leaves me wondering why the business taxes and employee taxes combined went from 6.1% to 25%? Keeping in mind that I paid business taxes on roughly the same income of 6.1% the year prior (2021). Why does adding a W-2 job to my business income in 2022, increase my blended tax rate from 6.1% to 25%? The employer already takes out all the necessary taxes on the W-2 and I should be left with paying the additional taxes due from the small business. What am I missing? Any help is appreciated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Small business owner and also a new W-2 employee in 2022. My blended tax rate went from 6.1% in 2021 to 25% in 2022. Could this be correct, even if my taxable income is lower than last year?

Your blended rate depends on the type of income shown on Schedule 1.

However, based on the Screenshot, it appears your blended rate for 2021 might not be carryover incorrectly. Please print your 2021 return and review the blended to see if it was indeed 6.1%.

You can access your 2021 return by following the steps below:

For TurboTax Online:

- Sign in to your TurboTax account and open your return by selecting Continue or Pick up where you left off

- Select Tax Tools from the left menu, then Print Center (on mobile devices, tap in the upper left corner to expand the menu)

- Select Print, save, or preview this year's return, and follow any additional instructions

- Once your PDF opens in Adobe Acrobat Reader, select the printer icon near the top

- Make any adjustments in the Print window and then select Print at the bottom

If you would like to print your return filed in the TurboTax CD/Download software please see the link below:

How to Print a Copy of the Return filed in TurboTax

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

ms44444

Returning Member

ataguchi

Level 1

carolynpaine

New Member

69billabong69

New Member

VAer

Level 4