- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

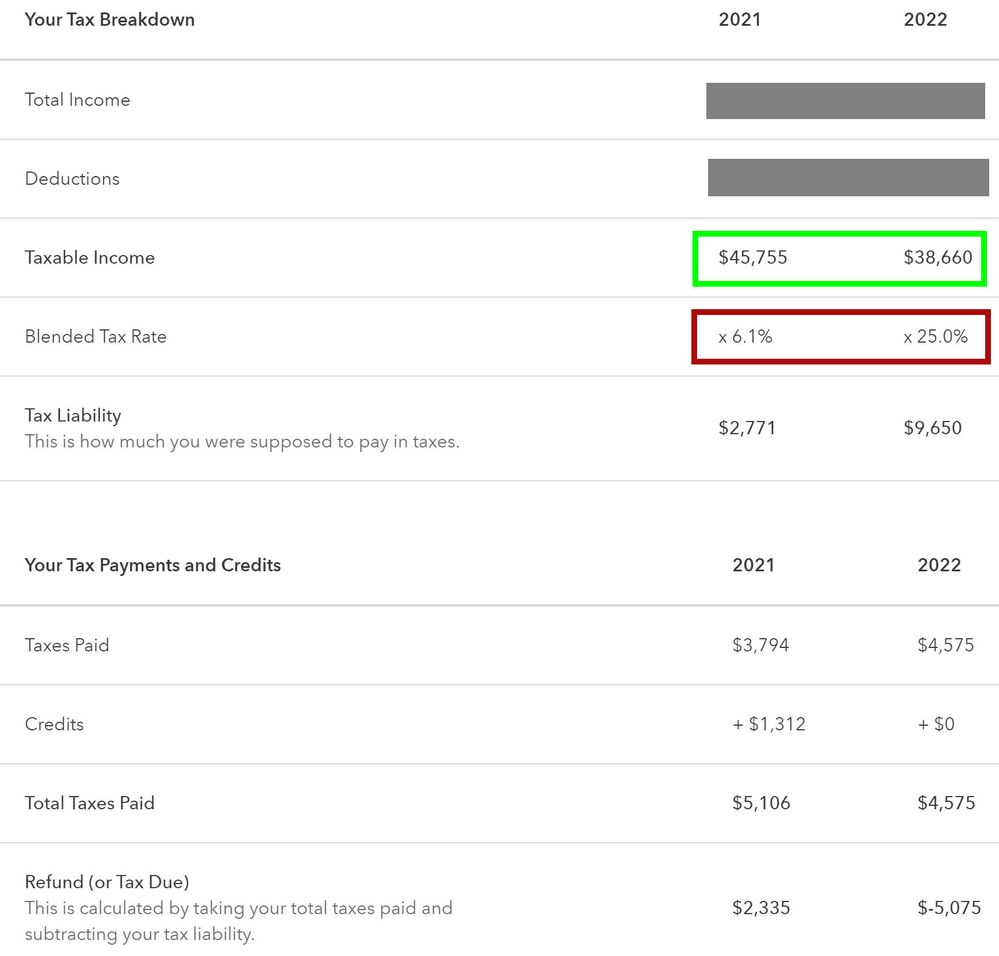

Small business owner and also a new W-2 employee in 2022. My blended tax rate went from 6.1% in 2021 to 25% in 2022. Could this be correct, even if my taxable income is lower than last year?

I've been a self-employed small business owner for 20 years - no employees. In April of 2022, I also took a full-time job with another company and receive a W-2 from them. I still put a lot of hours into my own business on nights and weekends and have several 1099-MISC that I report for the business. I make quarterly payments for estimated taxes for the business income. After filling out the Federal portion, my taxable income is less for 2022 than 2021, but the blended tax rate is showing 25% vs 6.1%. Filing as "Married Filing Jointly" - can this be correct? According to the Tax Bracket Calculator from TT, I'm nowhere close to the 24% bracket for taxable income.

I appreciate your time and expertise in trying to help me understand this. Screenshot below: