- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Roth IRA excess contribution in 2021 , found it in 2023(now)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth IRA excess contribution in 2021 , found it in 2023(now)

hello . I need your Expertise~~~~.

I made excess contribution in 2021. (I didn't report Roth IRA in 2021 file)

I didn't know it when I was filing 2021 tax return in 2022.

I found out 2021 MAGI is over than Roth IRA limitation recently in 2023.

(Accountant filed my 2021 tax return in 2022, so I didn't know the Roth IRA limitation)

I asked banker to remove my contribution $6000 one month ago. and they did. but they will send 1099 R in January 2024. (I've withdrawn at around mid of March 2023)

- for withdrawing I've sell stocks and net is loss, not gain as below.

one stock gain : $1012

the other stock loss : $1847

- and banker withdrawn $6000 and transfer it to my check account

in my view I have to pay 6% penalty and 10% penalty belong to earnings, but I think there is no earnings.

questions ,

1. should I consider $6000 as 'distribution' ? there are some fields related to IRA distribution. I wonder this is distribution or not...

2. how can I make 1099 R manually ?

3. if I don't make manual 1099 R and I would like to amend 2022 tax file when I got 1099 R in Jan-2024 then could I file just penalty at this time and then amend 1099 R information in Jan-2024?

4. what if 1099 R has some earning information then can I amend 2020 tax return file in Jan-2024 ?

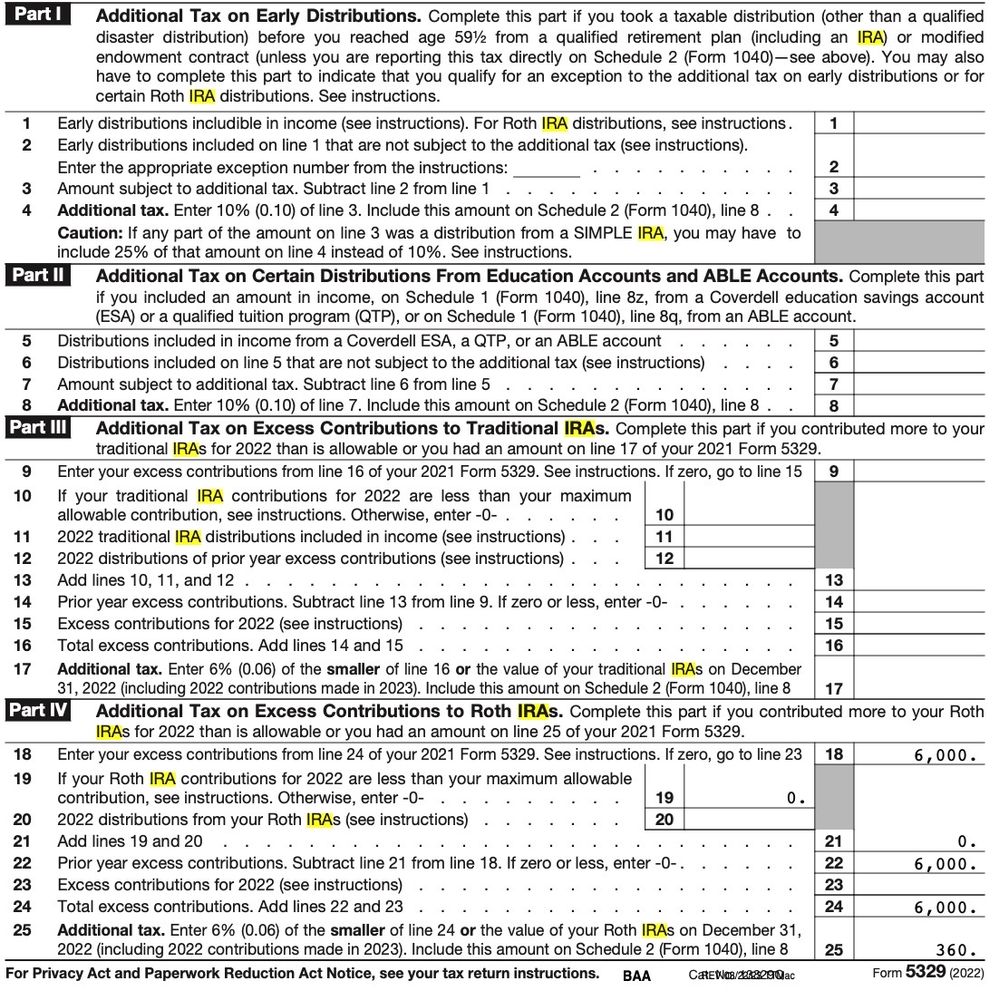

I've made 5329 via TT >

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth IRA excess contribution in 2021 , found it in 2023(now)

Correcting this excess contribution requires a regular distribution of exactly $6,000 reported with code J, not a return of contribution before the due date of your 2021 tax return. Because the distribution is being made after there due date of your 2021 tax return, neither you nor the IRA custodian are to make any adjustment for gain or loss.

There is nothing you can do now to avoid the 6%, $360 penalty for 2021 and the 6%, $360 penalty for 2022. The penalty will be eliminated on your 2023 tax return when the regular distribution of $6,000 appears on line 20 of your 2023 Form 5329.

Note that some IRA custodians are ignorant of the proper way to correct an excess contribution after the due date of the tax return, so make sure that they are doing a distribution that will have just code J, not codes J and P. When making a corrective distribution after the due date of the tax return it's best to not even tell the IRA custodian why you are obtaining the distribution so that they can't mess it up.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth IRA excess contribution in 2021 , found it in 2023(now)

Correcting this excess contribution requires a regular distribution of exactly $6,000 reported with code J, not a return of contribution before the due date of your 2021 tax return. Because the distribution is being made after there due date of your 2021 tax return, neither you nor the IRA custodian are to make any adjustment for gain or loss.

There is nothing you can do now to avoid the 6%, $360 penalty for 2021 and the 6%, $360 penalty for 2022. The penalty will be eliminated on your 2023 tax return when the regular distribution of $6,000 appears on line 20 of your 2023 Form 5329.

Note that some IRA custodians are ignorant of the proper way to correct an excess contribution after the due date of the tax return, so make sure that they are doing a distribution that will have just code J, not codes J and P. When making a corrective distribution after the due date of the tax return it's best to not even tell the IRA custodian why you are obtaining the distribution so that they can't mess it up.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth IRA excess contribution in 2021 , found it in 2023(now)

thanks dmertz,

oh~ I have to pay 6% penalty on 2021 as well as 2022.

actually I removed excess in 2023..

if I make 1099 R manually in 2022 filing then could I avoid 6% penalty on 2022 ?

(fill $6,000 distribution on From 5329 line 20 in 2022 tax return)

thanks for your help in advance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth IRA excess contribution in 2021 , found it in 2023(now)

"if I make 1099 R manually in 2022 filing then could I avoid 6% penalty on 2022 ? "

No. As I said, the penalty for 2022 is unavoidable (unless you are eligible to apply the excess as a Roth IRA contribution for 2022, but if that was the case you probably would have done that instead of requesting the distribution).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth IRA excess contribution in 2021 , found it in 2023(now)

QQ, @dmertz

code J seems early distribution.

what is difference between J and J&P on box 7 distribution code?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth IRA excess contribution in 2021 , found it in 2023(now)

Code J is for a regular distribution which would correct an excess contribution after the due date of the tax return for the year for which the contribution was made. This eliminates the excess-contribution penalty for the year in which the distribution is made and beyond.

Codes J and P together would be for a distribution that is a return of contribution before the due date of the tax return for the year for which the contribution was made. This makes it as though the contribution that is returned was never contributed to begin with.

Because the corrective distribution for your 2021 excess contribution was made in 2023, well after the (extended) due date of your 2021 tax return, the excess must be corrected with a code-J distribution of exactly the amount of the excess, with no adjustment for investment gain or loss. This will go on your 2023 tax return on Form 5329 line 20 to eliminate the excess for 2023 and beyond, but not for 2021 or 2022.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

tocguy

Level 3

sunshineInTheRain

Level 3

Fuzzy Red Baron

Returning Member

rocba62-

New Member

rpmm

New Member