- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

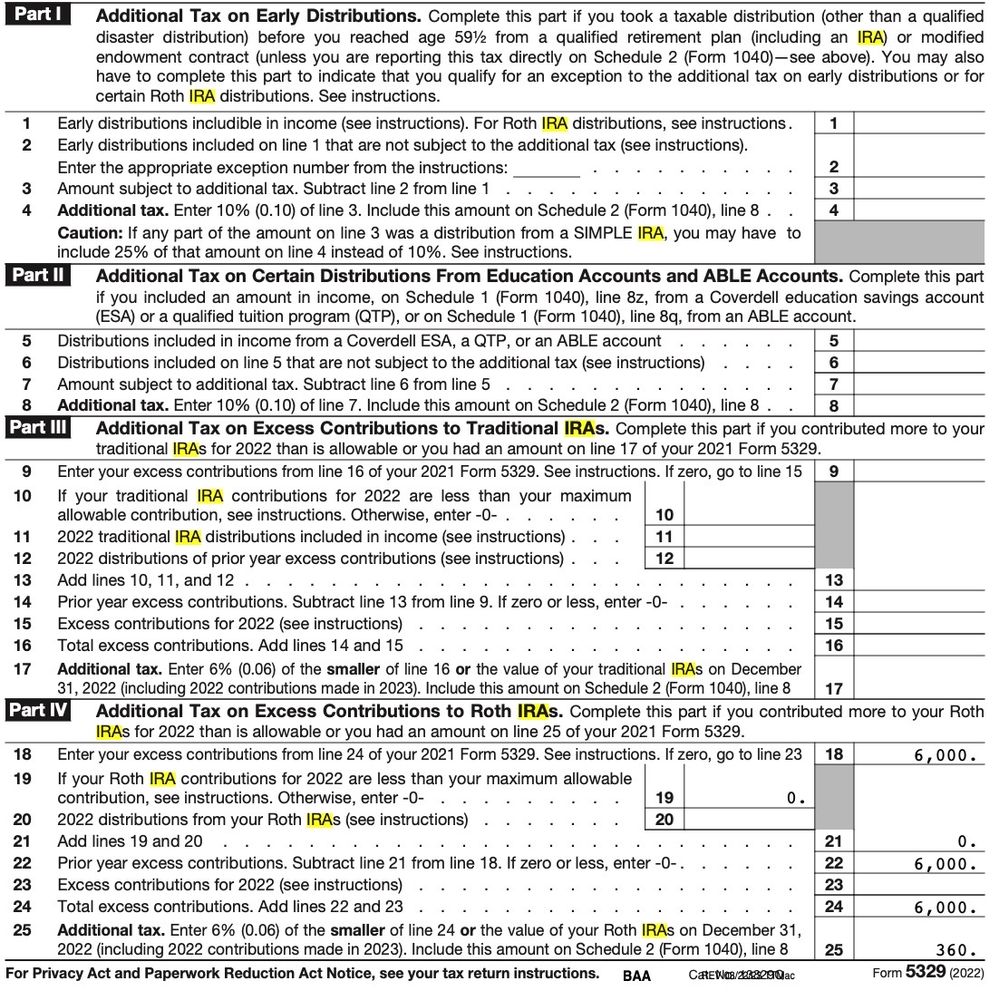

Roth IRA excess contribution in 2021 , found it in 2023(now)

hello . I need your Expertise~~~~.

I made excess contribution in 2021. (I didn't report Roth IRA in 2021 file)

I didn't know it when I was filing 2021 tax return in 2022.

I found out 2021 MAGI is over than Roth IRA limitation recently in 2023.

(Accountant filed my 2021 tax return in 2022, so I didn't know the Roth IRA limitation)

I asked banker to remove my contribution $6000 one month ago. and they did. but they will send 1099 R in January 2024. (I've withdrawn at around mid of March 2023)

- for withdrawing I've sell stocks and net is loss, not gain as below.

one stock gain : $1012

the other stock loss : $1847

- and banker withdrawn $6000 and transfer it to my check account

in my view I have to pay 6% penalty and 10% penalty belong to earnings, but I think there is no earnings.

questions ,

1. should I consider $6000 as 'distribution' ? there are some fields related to IRA distribution. I wonder this is distribution or not...

2. how can I make 1099 R manually ?

3. if I don't make manual 1099 R and I would like to amend 2022 tax file when I got 1099 R in Jan-2024 then could I file just penalty at this time and then amend 1099 R information in Jan-2024?

4. what if 1099 R has some earning information then can I amend 2020 tax return file in Jan-2024 ?

I've made 5329 via TT >