in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Reverse Rollover + Backdoor Roth in Same Year: How to Report

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reverse Rollover + Backdoor Roth in Same Year: How to Report

Hi all,

This year, I performed the following (in this order, all within 2019):

- Reverse rollover of all funds in a Traditional IRA into my employer Traditional 401(k), resulting in $0 balance in the Traditional IRA (apparently will not receive 1099-R)

- Non-deductible contributions into Traditional IRA for tax year 2018 and 2019 (reported the 2018 tax year contribution already with my 2018 tax return)

- Traditional IRA to Roth IRA conversion (completed a few days after step 2; received 1099-R)

I used this very helpful article to properly enter my Backdoor Roth (steps 2 and 3 above) into Turbotax, and I'm pretty sure it's done correctly because I have taxable income of only a few dollars (the investment gain over a few days) as a result.

Question: The article linked above does not describe how to properly report step 1, and my brokerage (Betterment) did not issue a 1099-R for this reverse-rollover (reasoning that they don't need to because it was a direct transfer and is therefore not taxable). Is anyone able to provide step-by-step instructions for reporting the reverse rollover properly in TurboTax? I imagine I'll need to act as if I'm reporting another 1099-R, selecting the option that the brokerage didn't issue the form, but not sure where to go from there.

Any help available is much appreciated!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reverse Rollover + Backdoor Roth in Same Year: How to Report

Betterment is wrong. They are required by law to provide a 1099-R that reports a direct rollover from a IRA to an employer plan.

See: https://www.irs.gov/pub/irs-pdf/i1099r.pdf page 6 [highlights added]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reverse Rollover + Backdoor Roth in Same Year: How to Report

If Betterment refuses to comply, I would submit a Substitute 1099-R (form 4852) with the rolled over amount in box 1, 0 in box 2a and a code G in box 7 and check the IRA/SEP/SIMPLE box and explain when the interviews asks the reason you are filing the substitute and the steps yiu took to get Betterment to issue a correct form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reverse Rollover + Backdoor Roth in Same Year: How to Report

The only reason that Betterment would be correct in not reporting the movement of funds from the traditional IRA is if the receiving plan was not a 401(k) but was a SEP plan or a SIMPLE-IRA plan. Even if the employer's plan is truly a 401(k) plan, if the request to Betterment was made improperly (perhaps by requesting a "transfer" instead of a direct rollover) they might have thought they were doing a trustee-to-trustee transfer to an IRA-based plan, not a direct rollover to a qualified retirement plan. Trustee-to-trustee transfers between IRAs are not reportable. (Of course doing a trustee-to-trustee transfer to an IRA-based employer plan does you no good since it's just another IRA that must be included in the year-end balance on Form 8606 line 6.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reverse Rollover + Backdoor Roth in Same Year: How to Report

I left out one step in the substitute 1099-R since it is a Traditional IRA that was transfer then the IRA/SEP/SIMPLE box shoukd also be checked. (I edited the answer to add that).

I agree with @dmertz and was going to post as an after-thought...are you sure that the Traditional IRA money actually ended up in your employer 401(k) plan and Betterment did not just transfer it to another IRA account which would not help your backdoor roth at all. Check your 401(k) balance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reverse Rollover + Backdoor Roth in Same Year: How to Report

@dmertz @macuser_22 thanks for the super thorough, helpful responses!

It was indeed a rollover into a 401(k). Separately from the missing 1099-R issue, is there anything else I need to consider to ensure that the return is prepared properly given that I’m filing two 1099-Rs in the same year? For example, I know that if I hadn’t done the reverse rollover prior to the backdoor Roth, that Roth conversion could be taxable (due to the mixed pre and post-tax funds that would otherwise be present in the Traditional IRA). How do I demonstrate to the IRS that I had emptied the Traditional IRA first? It doesn’t seem like the date of the reverse rollover and subsequent temporary balance of $0 is actually indicated on any forms in the prepared return? Very possible that I’m missing something simple and overcomplicating things.

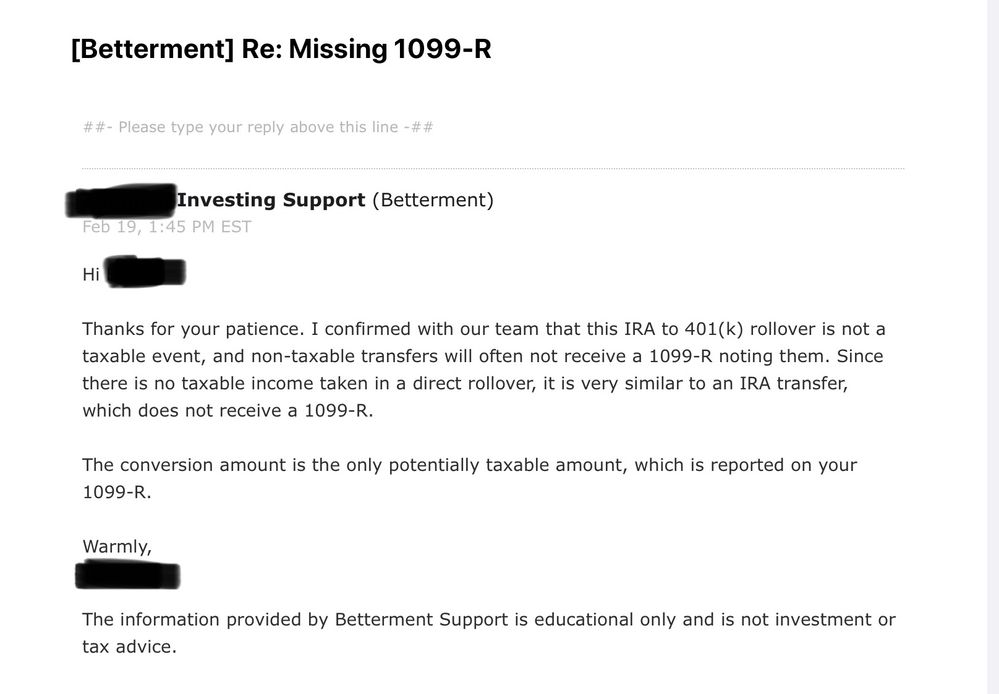

FWIW, here was Betterment’s initial reply re: the missing 1099-R (I’ve since written back including the referenced IRS guidance):

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reverse Rollover + Backdoor Roth in Same Year: How to Report

The IRS is not likely to question the timing of events but you should keep statements that show the dates of the transfers.

Betterment is correct that it is not a taxable event ( most trustee-to-trustee transfers are not taxable), but it certainly is a reportable event and must be reported on your tax return with a 1099-R.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reverse Rollover + Backdoor Roth in Same Year: How to Report

The timing of the events is irrelevant as far as the IRS and the tax code are concerned. The rollover to the 401(k) could have been done after the nondeductible traditional IRA contribution and the conversion to Roth and the reportable result and taxable result would be the same. You could even have done the Roth conversion followed by the traditional IRA contribution followed by the rollover to the 401(k) as long as all of the amounts remained unchanged (although it could get a bit off if gains and losses in the traditional IRA are different).

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

gagan1208

Level 1

tcondon21

Returning Member

fpho16

New Member

EKrish

Level 2

amit-mahajan12

Level 2