- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Required Minimum Distribution Reporting

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Required Minimum Distribution Reporting

I have reported my RMD several years using TurboTax, and the amount has always appeared on Line 15b/1040. This is my wife's first RMD year. She got an RMD distribution from an employer qualified saving plan (401K). The amount appeared on Line 16b along with our pension amounts. The difference seems tp be that 1099's with Box 2b checked as "Taxable amount not determined" end up on Line 15a/1040, whereas the 1099's with Box 2b not checked end up on Line 16b/1040.

Regular persion payments are not part of the RMD.

How does the IRS know that she took her RMD? Is the 1040 the vehicle, or are there other systems in place that tell the IRS that the RMD was taken?

We have done everything right to take our RMD's but I just don't understand how our efforts have been reported to the IRS.

Thanks,

Bob [personal info removed]

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Required Minimum Distribution Reporting

Hello,

Regular pensions can be subject to the RMD rules... However, the way the pension plans meet the RMD requirements is by creating an annuity paid periodically. By entering the forms and answering the questions about yours and your spouse's RMD you have satisfied the requirements. Your efforts are reported to the IRS by not creating form 5329, which reports penalties on undistributed RMDs, and by listing your distributions on the respective lines.

You generally have to take an RMD from any retirement account to which you have made tax-deferred contributions or had tax-deferred earnings. These accounts include:

- Traditional IRAs

- SEP IRAs

- SIMPLE IRAs

- 401(k), 403(b) and 457 retirement plans

- Pension and profit sharing plans

- Inherited beneficiary qualified accounts

As you have correctly noticed, IRA distributions are reported on line 15, whereas pension distributions are indicated on line 16.

Good luck!

I hope you have found this information helpful.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Required Minimum Distribution Reporting

Hello,

Regular pensions can be subject to the RMD rules... However, the way the pension plans meet the RMD requirements is by creating an annuity paid periodically. By entering the forms and answering the questions about yours and your spouse's RMD you have satisfied the requirements. Your efforts are reported to the IRS by not creating form 5329, which reports penalties on undistributed RMDs, and by listing your distributions on the respective lines.

You generally have to take an RMD from any retirement account to which you have made tax-deferred contributions or had tax-deferred earnings. These accounts include:

- Traditional IRAs

- SEP IRAs

- SIMPLE IRAs

- 401(k), 403(b) and 457 retirement plans

- Pension and profit sharing plans

- Inherited beneficiary qualified accounts

As you have correctly noticed, IRA distributions are reported on line 15, whereas pension distributions are indicated on line 16.

Good luck!

I hope you have found this information helpful.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Required Minimum Distribution Reporting

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Required Minimum Distribution Reporting

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Required Minimum Distribution Reporting

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Required Minimum Distribution Reporting

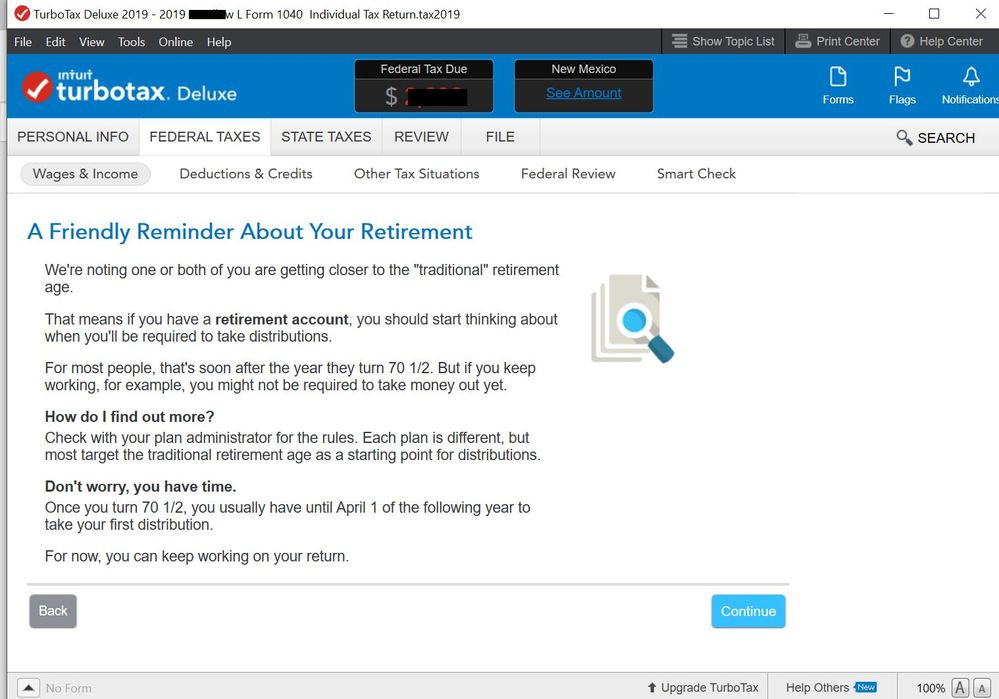

This page needs to be changed as well as the Help page in Turbo Tax 2019 Deluxe. It is 72 now!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Required Minimum Distribution Reporting

How do I report total RMD for 2019? I have listed 2 companies that I have 1099-Rs for them. One company's distribution is less than the RMD provided by my financial advisor. How am I to report the total RMD for that company. Also, I have another company where I do not have any distribution but have taken RMD. How do I report that in TurboTax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Required Minimum Distribution Reporting

When you get to the question about Required Minimum Distributions in TurboTax you indicate that you have taken at least the Required Minimum Distribution.

The reason for this is because if you have not taken the Required Minimum Distribution you may be penalized 50% of the amount you should have taken

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Required Minimum Distribution Reporting

Yes, I noticed that too last week, The help file needs to be changed to reflect the new law that went into effect last year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Required Minimum Distribution Reporting

The answer to the question about RMD on our 1099-R refers to line 15 and 16. OF WHAT? If you're referring to Turbo Tax 1099-R then my Turbo Tax is different from yours. This is a pension fund. We spent the money. We did not reinvest it. Where is that allowed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Required Minimum Distribution Reporting

Those posts are several years old. Lines 15 and 16 refers to prior years 1040 returns.

If Turbo Tax is asking if your pension is a RMD say yes. Anything your pension pays you is considered to be RMD.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dozersophie174

New Member

retiringin17

New Member

rickbj46

New Member

falconhts65

New Member

suetibbetts

New Member