- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: When will TurboTax handle 2020 CARES act Waivers?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will TurboTax handle 2020 CARES act Waivers?

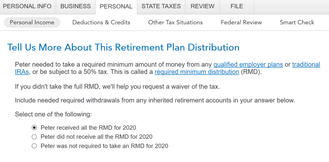

The CARES Act waives almost all RMD's for IRAs and more in 2020.

TurboTax apparently knows NOTHING about this:

* It is not in the help

* In my case, there is no mention of such a possibility.

My path:

* Roth Inheritance IRA

* Borrowed a COVID early distribution and rolled it 100% back in

* Once that part is entered, the next page acts like I *must* take RMD, and makes no mention of CARES.

See below.

Not sure if I should "request a waiver" or say it was not required. In either case, it ought to be CARES-aware.

Thoughts?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will TurboTax handle 2020 CARES act Waivers?

Simpler:

Don't say it was RMD returned (if I do that, it could trigger something... because the amount removed was WAY bigger than any RMD ever will be 😉 )

YES for now use the "don't call it inherited" workaround.

I learned that supposedly TurboTax will be fixed for this... but we're past their promise date.

This is easy to replicate: do it w/o calling it inherited. Then check and uncheck the inherited box on the TurboTax 1099-R worksheet... "ROLLOVER" will disappear and reappear 😉

The question still remains, why the CARES act isn't even mentioned. Oh well. That's what happens with one-time only special tax laws 😉

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will TurboTax handle 2020 CARES act Waivers?

Delete the 1099-R you entered and re-enter.

Answer the RMD question that "None of this distribution was a RMD" or "RMD not required" depending on the TurboTax version - because it was NOT a RMD, there were no 2020 RMD's.

If this is an inherited IRA then answer the "Is this IRA inherited" with NO. The purpose of that question is to PREVENT rolling an inherited IRA over, but is allowed for 2020 only.

Then you will get the screen to say it was "moved" and all rolled over.

Also check the box that this was NOT a COVID related distributions - it was a RMD that was returned.

That will put the 1099-R box 1 amount on the 1040 form line 4a with the word ROLLOVER next to it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will TurboTax handle 2020 CARES act Waivers?

Simpler:

Don't say it was RMD returned (if I do that, it could trigger something... because the amount removed was WAY bigger than any RMD ever will be 😉 )

YES for now use the "don't call it inherited" workaround.

I learned that supposedly TurboTax will be fixed for this... but we're past their promise date.

This is easy to replicate: do it w/o calling it inherited. Then check and uncheck the inherited box on the TurboTax 1099-R worksheet... "ROLLOVER" will disappear and reappear 😉

The question still remains, why the CARES act isn't even mentioned. Oh well. That's what happens with one-time only special tax laws 😉

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

darryl15

New Member

randy5419

Level 3

Pluto33

Level 1

MUSE2111

New Member

mmparkins

New Member