- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: TurboTax is not exempting military retirement on the South Carolina state return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is not exempting military retirement on the South Carolina state return

I believe Turbo Tax is not exempting my military retirement on the South Carolina return. When I called in they sent me a list of states that had the military retirement taxed. South Carolina was on the list. Does Turbo Tax know that this was exempted starting with the 2022 year? It wants to take the military pension out of my $10,000 deduction. It should be keyed as exempt and not included in income. Anyone else have this problem? I am hoping for a fix.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is not exempting military retirement on the South Carolina state return

State

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is not exempting military retirement on the South Carolina state return

TurboTax will exempt your military retirement.

- After you enter your 1099-R, you will see a screen “Where is your distribution from?”

- Select Military retirement distribution.

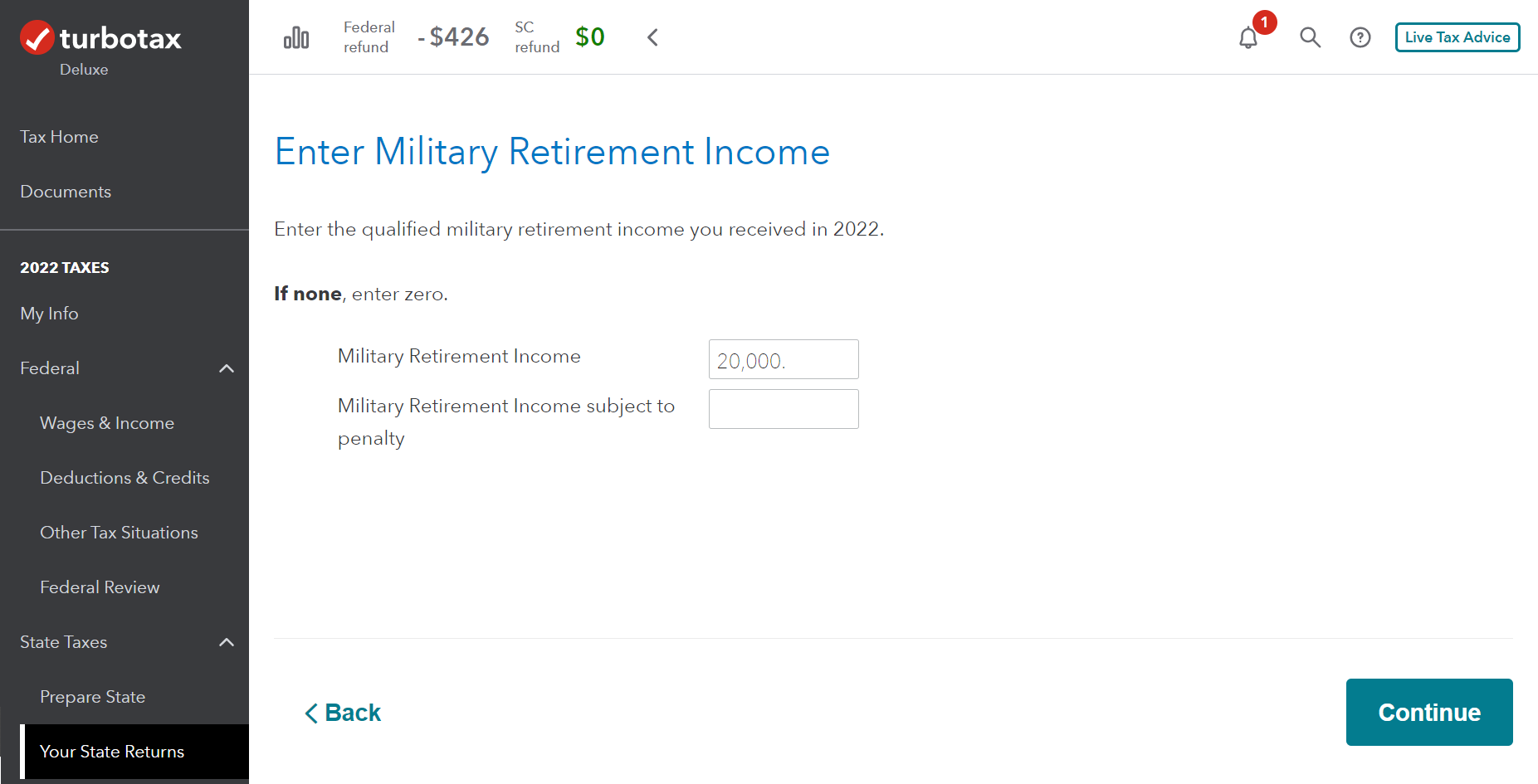

- In South Carolina, you will see a screen for “Military Retirement Income.”

- Select YES to Did you receive eligible military retirement income in 2022?, then Continue.

- On “Enter Military Retirement Income” you should see the taxable amount from the federal section. If you do not, you can adjust this number.

Governor Henry McMaster (R-S.C.) signed the Workforce Enhancement and Military Recognition Act in 2022, which exempts all military retirement pay that is included in South Carolina taxable income from the state's Income Tax, no matter the taxpayer's age.

The new exemption is effective for tax year 2022, meaning retirees can claim it next year when they fill out their Income Tax return for this year. This deduction also can be claimed by a surviving spouse receiving military retirement income from their deceased spouse.

Other Income Tax exclusions:

- Any federal tax-exempt pension or compensation provided by the U.S. Department of Veterans Affairs

- Combat pay and certain benefits not included in federal taxable income

- Retirement income paid by the U.S. government for service in the Reserves or National Guard

- Income received for service in the National Guard or the Reserves for customary annual training, weekend drills, and other inactive duty training is generally exempt

- Service pay for non-resident military personnel on active duty in South Carolina who are legal residents of other states

Additional details and examples related to these deductions and other general retirement and age-65 Income Tax deductions are found in Revenue Ruling 21-13.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Kh52

Level 2

Jeffsjams

Returning Member

alice-danclar

New Member

mary1947beth

New Member

mary1947beth

New Member