in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: My Federal pension is not transferring from Federal to State of Oregon

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Federal pension is not transferring from Federal to State of Oregon

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Federal pension is not transferring from Federal to State of Oregon

Did you work any days for the federal government prior to October 1, 1991? If so, then you can put a percentage of the pension on Other Subtractions in Oregon.

If you did, then when you see the screen in the Oregon interview whose title is "Federal Pension Summary", you must Edit the pension.

When you edit the pension, you will have to enter the dates and or the points earned before and after this date.

TurboTax will use the dates or the points (it uses the points if you enter both) to calculate the percentage of pension that is deductible in Oregon.

Did you do this and still have no deduction as an Other Subtractions? If so, what was the amount of the pension, the dates you entered and/or the points you entered?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Federal pension is not transferring from Federal to State of Oregon

I receive a military pension with service before 1991 - and in the past I was able to enter those 22 years of service (360 months) on my Oregon state form. This year, I've noticed that my pension information from my federal form does not exist on the state form. Help?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Federal pension is not transferring from Federal to State of Oregon

I received a call from TT and they solved the problem. I had indicated “other sources” for my military retirement instead of “federal pension.” Once I selected federal pension I was able to see it presented in the Oregon document and I was able to edit the number of months I worked in the federal service prior to 10/1/91.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Federal pension is not transferring from Federal to State of Oregon

""Federal Pension Summary", you must Edit the pension."

My problem is there is no Edit button to click ! So I can't list my military retired pay.

Allen

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Federal pension is not transferring from Federal to State of Oregon

To get the State pension deduction, you will first have to enter the necessary information in your Federal Income tax return and then in the State income tax return.

Here are the steps to enter your exempt pension:

On the Federal Income Tax portion:

- In the search or find box, type in 1099-R

- Click on Jump to 1099-R

- Scroll down to Retirement Plans and Social Security

- At IRA,401(k), Pension Plan Withdrawals (1099-R), click Start (or Update)

- Enter your 1099-R or if you have entered it, click on Edit then Continue

- Answer the next questions until you get to the Where Is This Distribution From? screen

- Select the source [ ] and enter the information requested:

- Click on Continue

- Click on From a Qualified Plan

- Continue answering the questions

On the State return portion:

- At the Changes to Federal Income page, scroll down to Received retirement income, click Start (or Update)

- At the Retirement Distributions Summary page, click on Edit State

- If no additional information is required, click on Continue

- Click on Done

Here is a TurboTax article about retirement and military pensions.

@tonkal

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Federal pension is not transferring from Federal to State of Oregon

ReneeM7122,

Thank you very much Renee. Fixed my problem.

Regards, Allen

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Federal pension is not transferring from Federal to State of Oregon

I followed the steps to remove the check mark in my federal return that says 'not from a qualified plan.' When I returned to the Oregon return and reached the Federal Pension Summary page, there is no edit button and message is 'you haven't entered anything.'

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Federal pension is not transferring from Federal to State of Oregon

Tried every way I can think of to get an "EDIT" button. Where do I find that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Federal pension is not transferring from Federal to State of Oregon

I can not locate a "EDIT" button either

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Federal pension is not transferring from Federal to State of Oregon

Forget about EDIT button.

Here's what you do, recheck the original input on your federal return regarding the pension.

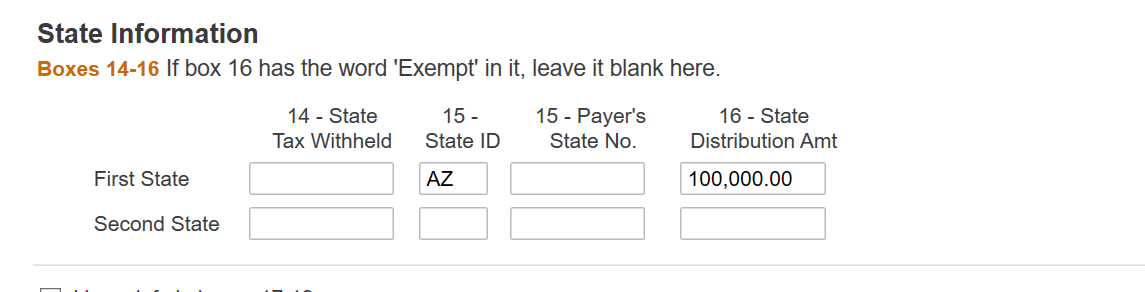

Make sure you have the state distribution amount in here

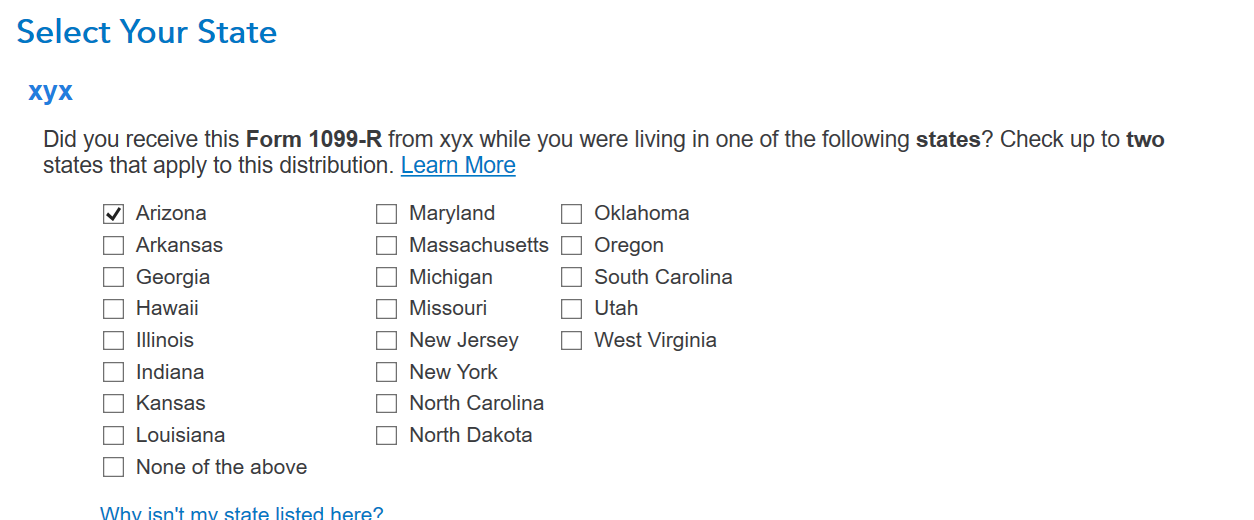

Hit continue, continue till you get to this screen, enter Arizona

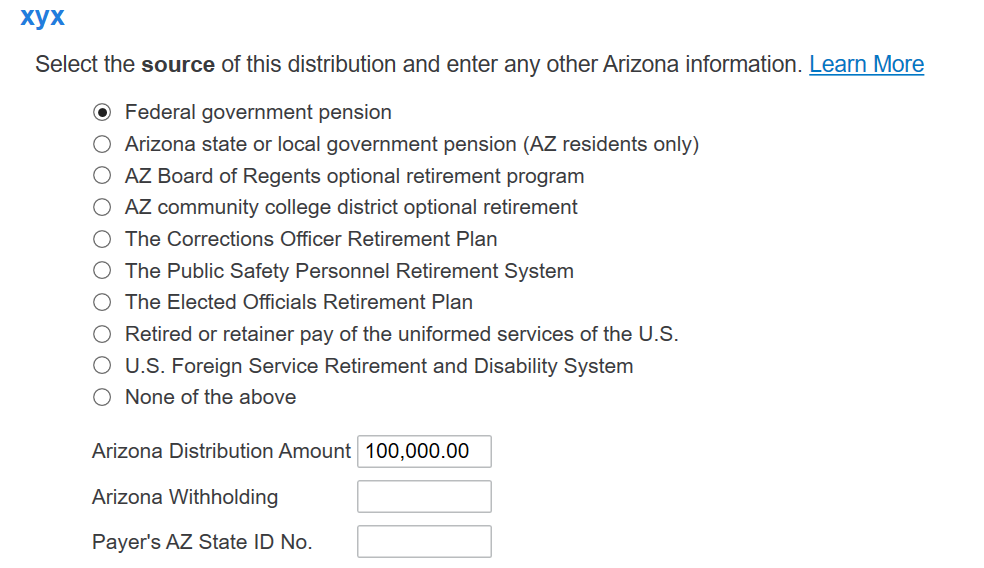

then this

the next screen will ask you from a qualified or unqualified plan, select qualified

After your'e done with rentering all the input on the federal, you'll go into the state input

You'll get to the screen which asks you for Any Subtraction adjustments, you say yes

Click on the bottom at Do you have any other Subtractions that you haven't already entered, say "yes."

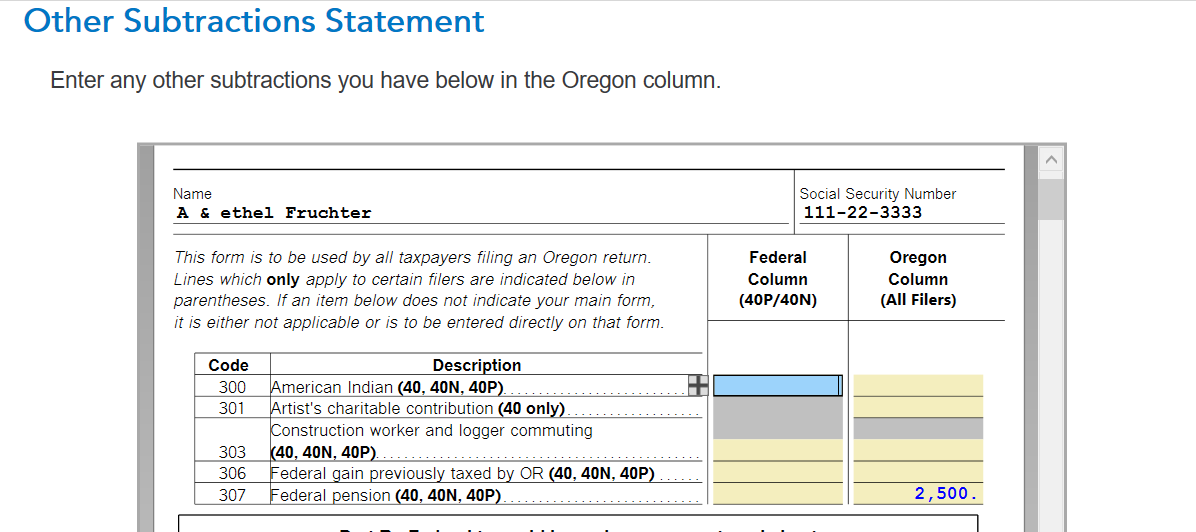

Then in the fedreal pension, under the Oregon column, you'll enter the 2,500 like this

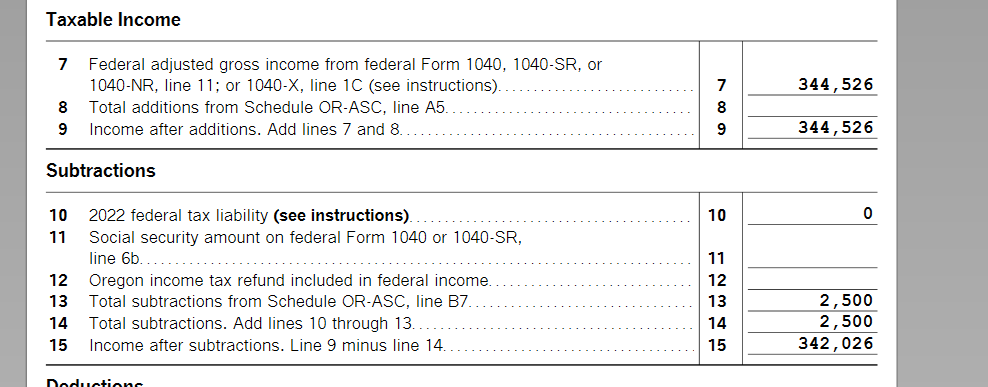

Consequently, it should flow seamlessly to Form 40, Line 13 like this

It worked well for me so I wish the same for you.

Have a nice weekend!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ajs813

Returning Member

sjcbens

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

Lukas1994

Level 2

marcmwall

New Member

cindy-zhangheng

New Member