- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Inherited IRA gross amount flows to my form 8606.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is it correct that I do not need to include the value of inherited traditional IRAs on line 6 of Form 8606?

Now amending the return to pay tax on the gain on the excess 2018 Roth IRA contribution that I withdrew in March 2019.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is it correct that I do not need to include the value of inherited traditional IRAs on line 6 of Form 8606?

Correct, assuming that you are not a spouse beneficiary who has elected to treat the inherited IRA as your own.

If the decedent had basis in nondeductible traditional IRA contributions, the year-end value of the inherited IRA would have to go on a separate Form 8606 prepared outside of TurboTax to determine the taxable amount of any distributions from the inherited traditional IRA and then only the taxable amount determined on that form entered into TurboTax when entering the code 4 Form 1099-R reporting the distributions from the inherited IRA. If the decedent had no nondeductible traditional IRA contributions, the entire amount shown on the code 4 Form 1099-R is taxable and no Form 8606 for the inherited IRA is needed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is it correct that I do not need to include the value of inherited traditional IRAs on line 6 of Form 8606?

Correct, assuming that you are not a spouse beneficiary who has elected to treat the inherited IRA as your own.

If the decedent had basis in nondeductible traditional IRA contributions, the year-end value of the inherited IRA would have to go on a separate Form 8606 prepared outside of TurboTax to determine the taxable amount of any distributions from the inherited traditional IRA and then only the taxable amount determined on that form entered into TurboTax when entering the code 4 Form 1099-R reporting the distributions from the inherited IRA. If the decedent had no nondeductible traditional IRA contributions, the entire amount shown on the code 4 Form 1099-R is taxable and no Form 8606 for the inherited IRA is needed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is it correct that I do not need to include the value of inherited traditional IRAs on line 6 of Form 8606?

No, I was not the spouse beneficiary. I inherited traditional IRAs from my parents. They didn't have any basis in non-deductible contributions. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is it correct that I do not need to include the value of inherited traditional IRAs on line 6 of Form 8606?

Everywhere I read says that when the 1088-R has code 4 (inherited), then the gross amount should not flow to the taxpayer's 8606. Unfortunately, it does for the 2020 version of TurboTax. I can't figure out a way to make it stop.

There is no basis for my inherited IRA, so I don't need a form 8606 for the inherited IRA. I really would prefer not to override the 8606 so that my taxable amount would be correct. Since inherited IRA's are supposed to kept separate and TurboTax is not able to have a separate 8606 for inherited IRA's, I would think it would be consistent and not have the amount flow to the 8606.

Hope someone has an answer or TurboTax provides a fix.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is it correct that I do not need to include the value of inherited traditional IRAs on line 6 of Form 8606?

@bprice1946 I made an entry as you described and TurboTax did not generate a form 8606. If you are using the desktop version of TurboTax you need to make sure you have done all of the updates (Online, Check for updates).

You may be able to delete the form 8606 by using the following tabs in TurboTax online if you are sure you don't need the form:

- Tax tools (on the left menu bar)

- Tools

- Delete a form

Find form 8606 in the list and delete the form.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is it correct that I do not need to include the value of inherited traditional IRAs on line 6 of Form 8606?

TurboTax presently has a bug that is causing distributions from an inherited IRA to inappropriately appear on the beneficiary's own Form 8606, so ThomasM125's suggestion will not accomplish anything. This is being investigated by Intuit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is it correct that I do not need to include the value of inherited traditional IRAs on line 6 of Form 8606?

@bprice1946 wrote:

Hope someone has an answer or TurboTax provides a fix.

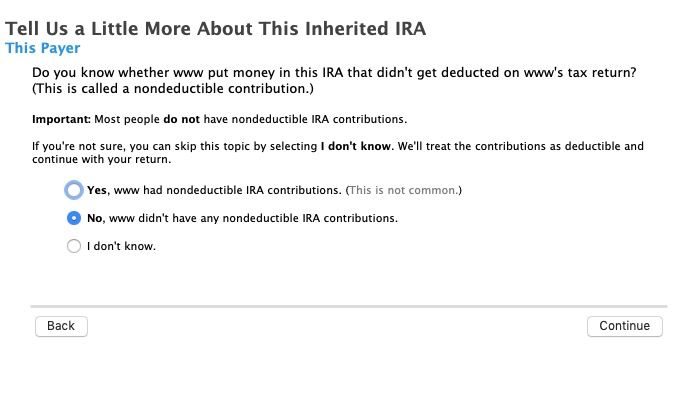

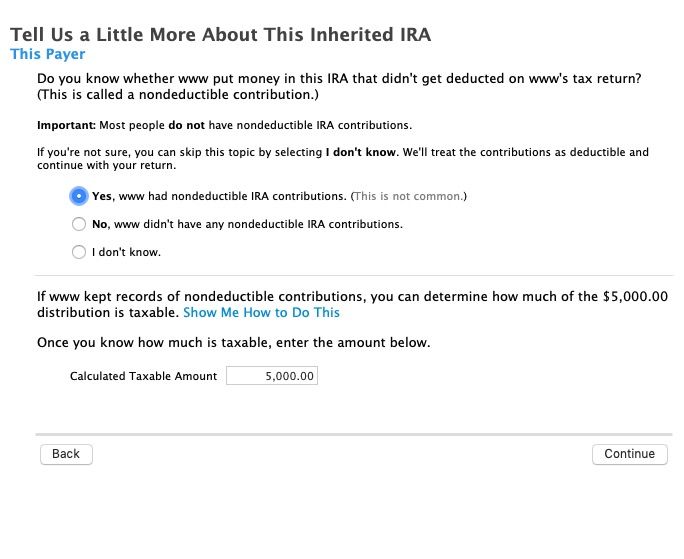

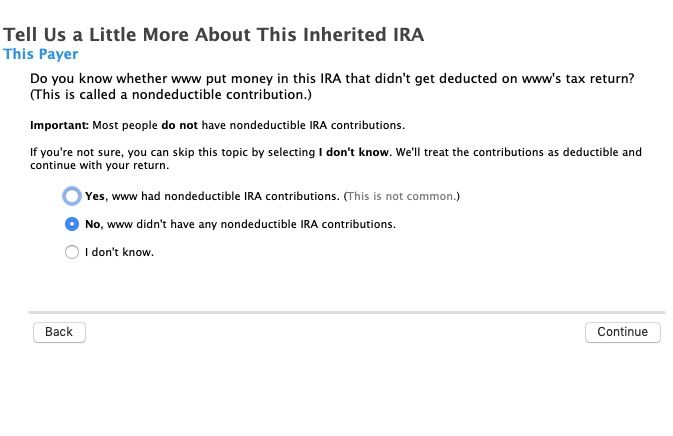

If you see the inherited IRA amount on the 8606 line 7 then try this and see if it goes away.

Just edit the inherited 1099-R and change NO to YES and back to NO. When I did that it make the incorrect 8606 line 7 amount go away.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is it correct that I do not need to include the value of inherited traditional IRAs on line 6 of Form 8606?

Thanks, macuser_22. I couldn't remember the workaround.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is it correct that I do not need to include the value of inherited traditional IRAs on line 6 of Form 8606?

@ThomasM125 I believe this bug only shows up if the taxpayer has an IRA distribution of their own IRA that has a basis and that creates the 8606-T (or -S). Adding a 1099-R with a box 7 code 4, seems to erroneously add the inherited 1099-R box 1 amount to the 8606 line 7, which results in totally incorrect taxable amounts on the 8606.

For some reason simply toggling NO to YES and back to NO on the inherited basis question removes it from the 8606.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is it correct that I do not need to include the value of inherited traditional IRAs on line 6 of Form 8606?

Thanks, that did the trick. Pretty bazar.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is it correct that I do not need to include the value of inherited traditional IRAs on line 6 of Form 8606?

All, thank you for your patience while we have been investigating. During our investigation we were able to get this to work properly by following the steps in this post: Where do I show income for an inherited IRA

Would you all mind please letting me know if you still encounter an error using those steps? Thanks again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is it correct that I do not need to include the value of inherited traditional IRAs on line 6 of Form 8606?

@Katie_B wrote:

All, thank you for your patience while we have been investigating. During our investigation we were able to get this to work properly by following the steps in this post: Where do I show income for an inherited IRA

Would you all mind please letting me know if you still encounter an error using those steps? Thanks again!

@Katie_B I believe that link is for a different problem encountered when the 1099-R is 'split" - part rolled over and part taken in cash. That is not the situation here where the inherited amount is improperly added to the taxpayers own 8606 form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is it correct that I do not need to include the value of inherited traditional IRAs on line 6 of Form 8606?

Thanks so much for the follow-up! I'll see what else I can locate

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is it correct that I do not need to include the value of inherited traditional IRAs on line 6 of Form 8606?

Nope. still treats inherited IRA (non-spouse) just like my own IRA's. Probably has been for years, but this year it is obvious to me since I didn't take an RMD from my IRA's which require form 8606. Low and behold, my inherited income (which has no basis so should not have any 8606) showed up on my 8606. The trick mentioned above of turning on and off the radio button for whether the inherited IRA has a basis helps, but you have to keep watching it since the issue comes back for no reason I can fathom, Then I just repeat the work around and all is well for awhile. Hopefully will be fine at the time that I file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is it correct that I do not need to include the value of inherited traditional IRAs on line 6 of Form 8606?

@bprice1946 wrote:

Nope. still treats inherited IRA (non-spouse) just like my own IRA's. Probably has been for years, but this year it is obvious to me since I didn't take an RMD from my IRA's which require form 8606. Low and behold, my inherited income (which has no basis so should not have any 8606) showed up on my 8606. The trick mentioned above of turning on and off the radio button for whether the inherited IRA has a basis helps, but you have to keep watching it since the issue comes back for no reason I can fathom, Then I just repeat the work around and all is well for awhile. Hopefully will be fine at the time that I file.

It will come back if you revisit the 1099-R. You want to be sure that the 8606 is correct just before you file.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Click

Level 5

tcondon21

Level 2

KHALL

New Member

userID_204

Level 2

gmakhc910

Level 2