- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Inherited IRA (10-year rule applies)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inherited IRA (10-year rule applies)

My Dad died in 2020 and Mom inherited his 401k from which he had been taking regular RMD's. Mom rolled the 401k into an IRA and took RMD's from it in 2021 and 2022. Mom died in 2022 after taking that RMD, and the balance was distributed to me and my two sisters as beneficiaries. We each opened Inherited IRA Brokerage accounts with the funds we inherited from her IRA.

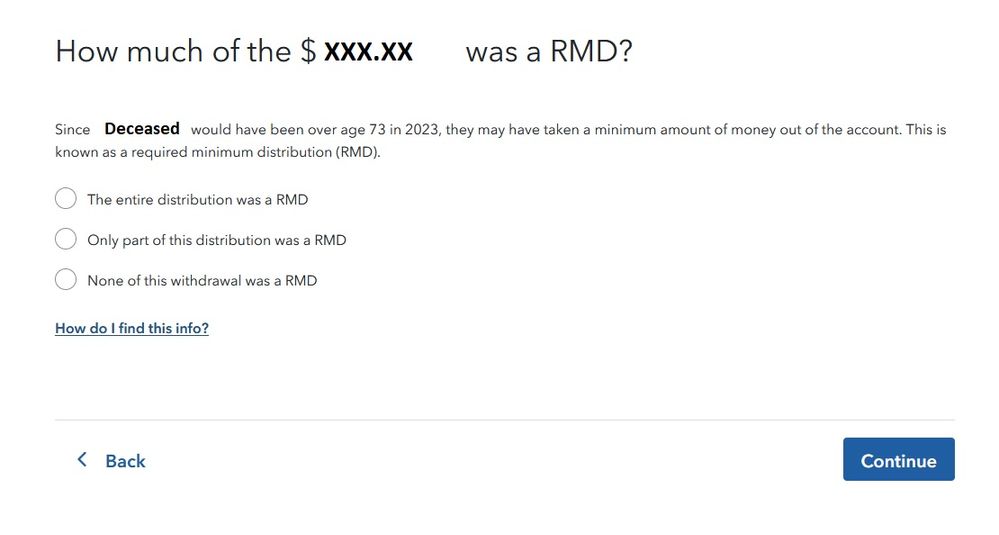

Based on our situation(s), we've determined our respective Inherited IRA's are subject to the 10-year rule. I plan to liquidate mine over the course of the next 3-4 years, and withdrew about 20% of the funds in 2023. I received a 1099-R showing the amount of the distribution I took along with the Federal income tax I had withheld. I've reached this point in the TT program:

My question is, since the program already knows this is MY inherited IRA, and asked what year Mom died (2022), why is it asking how much (if any) of the amount I withdrew was a RMD for 2023? Again, she had been taking RMD's out of her IRA, but this isn't her IRA anymore, it's my Inherited IRA and it's only subject to “withdrawals”, not RMD's.

I assume I should answer the question "None of this withdrawal was a RMD", correct?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inherited IRA (10-year rule applies)

The 10 year rule includes 2 parts. You must withdraw all the money within 10 years, AND you must take RMDs based on your own lifespan until the account is closed, assuming the previous owner was older than their own RMD beginning age. However, the RMD rule has not been finalized and the IRS has indicated it will not penalize anyone who fails to take an RMD for 2021, 2022 or 2023. Expect that you and your sister will be required to take RMDs for 2024. (Because the rule is not finalized, it is not written into the instructions, either. But it is definitely coming.)

So you should probably indicate that part of the withdrawal was an RMD, and use the tables in publication 590-B to determine how much your RMD was.

However, the only effect of telling Turbotax that part of your withdrawal was an RMD, is that RMDs are not eligible for rollover or for contributing to your own IRA, and turbotax will check that for you to make sure you had enough other income to allow a contribution. If you did not rollover the IRA, and did not make new IRA contributions (or your compensation is enough to cover any new IRA contributions), then your return won't be affected if you were to answer "none".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inherited IRA (10-year rule applies)

As Opus 17 said, TurboTax only asks this question to determine how much of the distribution might be eligible for rollover, so TurboTax is really asking how much is ineligible for rollover. In the case of a non-spouse beneficiary, the entire amount is ineligible for rollover. Although the appropriate answer to the question would be to indicate that it is all RMD (all ineligible for rollover), it really doesn't matter what answer you give since TurboTax already knows that a distribution from an inherited IRA to a non-spouse beneficiary is ineligible for rollover and will always behave as if you said it was all RMD.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inherited IRA (10-year rule applies)

The 10 year rule includes 2 parts. You must withdraw all the money within 10 years, AND you must take RMDs based on your own lifespan until the account is closed, assuming the previous owner was older than their own RMD beginning age. However, the RMD rule has not been finalized and the IRS has indicated it will not penalize anyone who fails to take an RMD for 2021, 2022 or 2023. Expect that you and your sister will be required to take RMDs for 2024. (Because the rule is not finalized, it is not written into the instructions, either. But it is definitely coming.)

So you should probably indicate that part of the withdrawal was an RMD, and use the tables in publication 590-B to determine how much your RMD was.

However, the only effect of telling Turbotax that part of your withdrawal was an RMD, is that RMDs are not eligible for rollover or for contributing to your own IRA, and turbotax will check that for you to make sure you had enough other income to allow a contribution. If you did not rollover the IRA, and did not make new IRA contributions (or your compensation is enough to cover any new IRA contributions), then your return won't be affected if you were to answer "none".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inherited IRA (10-year rule applies)

As Opus 17 said, TurboTax only asks this question to determine how much of the distribution might be eligible for rollover, so TurboTax is really asking how much is ineligible for rollover. In the case of a non-spouse beneficiary, the entire amount is ineligible for rollover. Although the appropriate answer to the question would be to indicate that it is all RMD (all ineligible for rollover), it really doesn't matter what answer you give since TurboTax already knows that a distribution from an inherited IRA to a non-spouse beneficiary is ineligible for rollover and will always behave as if you said it was all RMD.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inherited IRA (10-year rule applies)

Thanks, Opus 17 and dmertz. However, unless I'm misinterpreting Pub 590-B, the Appendix A-1 (Worksheet for Determining Required Minimum Distributions) appears to be for filers who are already at least age 72, when they would be required to commence taking RMD's. I am 65, and since there is no Appendix A worksheet for people age 65, how do I calculate the RMD? NOTE: I ended up using an online “Inherited IRA & beneficiary tool” calculator.

What I'm hearing from you both is that the 10-year rule requires--or will require--RMD's even if the owner of the Inherited IRA has yet to reach age 72. According to the table (Appendix B, 2022 version) in Pub 590-B, at age 65 my life expectancy is 22.7 years. So as an example, if the balance of the IRA was $50,000 at the end of 2023, I would divide that amount by 22.7 to calculate the RMD, which is approximately $2200. The above mentioned calculator confirmed this result.

Since my 20% withdrawal was well in excess of the RMD amount, I guess it can't hurt to indicate that “Only part of this distribution was a RMD”. It just seems superfluous when TT already knows from my previous inputs that a distribution from this inherited IRA is ineligible for rollover.

Thanks again to you both for the support!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inherited IRA (10-year rule applies)

Pub 590-B has not yet been updated to reflect the proposed regulations issued on February 24, 2022.

"What I'm hearing from you both is that the 10-year rule requires--or will require--RMD's even if the owner of the Inherited IRA has yet to reach age 72."

I don't think either of us said that.

As you point out, under these circumstances TurboTax ignores your answer. TurboTax really shouldn't even be asking the question under these circumstances, but software developers don't always do the sensible thing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inherited IRA (10-year rule applies)

Actually, Opus 17 said "The 10 year rule includes 2 parts. You must withdraw all the money within 10 years, AND you must take RMDs based on your own lifespan until the account is closed, assuming the previous owner was older than their own RMD beginning age". That is, once the rule is finalized. You didn't mentioned it at all. Sorry for implying otherwise! ;>)

And we're in complete agreement that TurboTax needn't have asked the question.

Thanks again, and cheers!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inherited IRA (10-year rule applies)

Opus 17 said, "... assuming the previous owner was older than their own RMD beginning age." not the clearest way to say it, but intended to mean that it applies if the participant died after the RBD.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.