- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inherited IRA (10-year rule applies)

My Dad died in 2020 and Mom inherited his 401k from which he had been taking regular RMD's. Mom rolled the 401k into an IRA and took RMD's from it in 2021 and 2022. Mom died in 2022 after taking that RMD, and the balance was distributed to me and my two sisters as beneficiaries. We each opened Inherited IRA Brokerage accounts with the funds we inherited from her IRA.

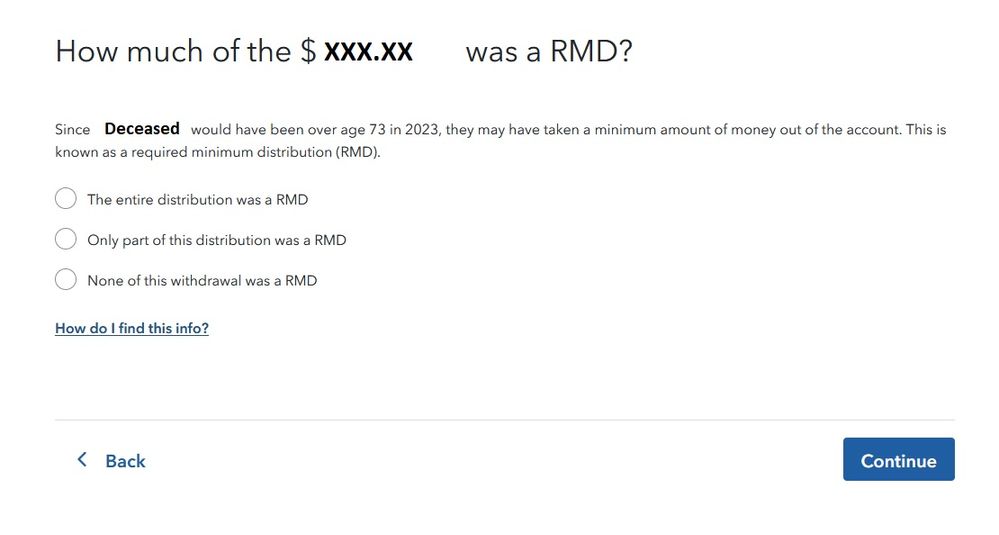

Based on our situation(s), we've determined our respective Inherited IRA's are subject to the 10-year rule. I plan to liquidate mine over the course of the next 3-4 years, and withdrew about 20% of the funds in 2023. I received a 1099-R showing the amount of the distribution I took along with the Federal income tax I had withheld. I've reached this point in the TT program:

My question is, since the program already knows this is MY inherited IRA, and asked what year Mom died (2022), why is it asking how much (if any) of the amount I withdrew was a RMD for 2023? Again, she had been taking RMD's out of her IRA, but this isn't her IRA anymore, it's my Inherited IRA and it's only subject to “withdrawals”, not RMD's.

I assume I should answer the question "None of this withdrawal was a RMD", correct?