- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: How do I enter 1099-R forms

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter 1099-R forms

In 2020 neither my wife nor I were required to take MRDs from our IRAs. However, we did take some payments before we learned that we did not have to. Accordingly, we reversed all distributions taken with a rollover of the full amounts taken deposited back into our IRAs. Later in the year, we converted some of the money in our IRAs to our Roth IRAs. Also, I made several Qualified Charitable gifts from my IRA. Our 1099-R forms show the total amount taken from each IRA. In my case this includes the amount taken and deposited back, the amount converted to my Roth and my charitable gift. How do I fill out the 1099-R forms in Turbotax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter 1099-R forms

Each person must enter the 1099-R for their own account separately.

So you have a 1099R with the total distribution part of which was converted to a Roth IRA, part was a QCD and the remained was rolled back.

This is a situation that is not directly supported by TurboTax on a single 1099-R - you cannot have two different destinations on one 1099-R so it must be broken into two 1099-R's. (That makes no difference to the IRS since they do not see your inputs, they only get the resulting 1040 form with the correct numbers on it.)

Use the same information on both 1099-R's that are on the original except for the box 1 and 2a amounts.

For one 1099-R enter into box 1 and 2a the amount converted to a Roth.

In the interview say "NONE of this was a RMD", say NO to the QCD question, and then say the money was moved to another (or same) account and choose "A combination of things" . Enter the amount of the Roth conversion amount (the box 1 amount) into the bottom convert box and continue to the summary screen where you can add another 1099-R.

For the 2nd 1099-R enter the remaining box 1 and 2a amounts and again answer the RMD question that "NONE of this was a RMD", then answer yes to the QCD questions and enter the amount of the QCD, then say the money was moved to another (or same) account and choose that you rolled all the money over, then continue to the end.

That should place the original 1099-R amount on the 1040 line 4a and the taxable amount of the conversion on 4b with a statement that will be attached that shows the rollover and QCD amounts.

Do the same thing for the other spouses 1099-R.

[One other thing - if you DO NOT get the RMD and QCD question then there is a software bug.

2020 TurboTax presently has a bug the prevents it from asking the necessary question for those with birthdates between July 1, 1949 and June 30, 1950. As a workaround for this, with the CD/download version you can provide the QCD-amount information on the 1099-R in forms mode or in any version of TurboTax you can temporarily change your birthdate in TurboTax to something before July 1, 1949, edit the 1099-R form in TurboTax and answer the question asking how much was transferred to charity, then change your birthdate in TurboTax back to your actual birthdate.]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter 1099-R forms

I am using on line version, I changed my DOB and then I got asked the QCD question. When I changed my DOB back, that portion disappeared, so for the on Line version, this work around does NOT work. TT needs to fix this huge bug ASAP

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter 1099-R forms

@TelcoEd wrote:

I am using on line version, I changed my DOB and then I got asked the QCD question. When I changed my DOB back, that portion disappeared, so for the on Line version, this work around does NOT work. TT needs to fix this huge bug ASAP

The age change workaround works fine online - I just tried it. Delete the 1099-R, change the year of birth to 1948 of before, enter the 1099-R, check the box that you has a QCD, answer that NONE of the distribution was a RMD, complete the 1099-R interview and then change the DOB back to the correct DOB.

DO NOT revisit the 1099-R.

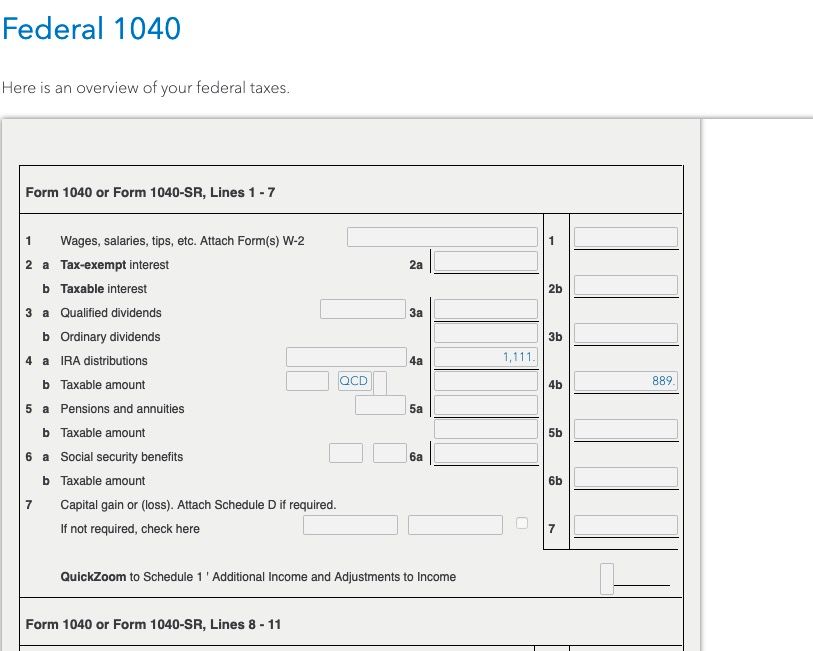

Print the 1040 and it should look like this with the 1099-R line 1 amount online 4a the amount of distribution taken minus the QCD amount on line 4b (taxable amount) and QCD printed next to it.

(In my example the total distribution was $1,111, the QCD amount was $222 and $889 taken in cash.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter 1099-R forms

Thank you for advising that you got it to work. I had tried multiple times and did not get the QCD question. After reading your info I deleted all 1099's, changed my birth date, re-entered the 1099's and followed your instructions from there. It worked. Of course, it would have been easier if Turbo Tax had just fixed the bug but I appreciate the help.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jackcpatrick

New Member

mjivanoff90

New Member

clhunt490

New Member

zipdiss

New Member

Drausch

New Member