- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Cares Act Covid-19 distribution from 401k 2020 broken up over 3 years (2020, 2021, 2022) Did ...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Covid-19 distribution from 401k 2020 broken up over 3 years (2020, 2021, 2022) Did not receive a new 1099-R for 2021. Turbo tax doesn't ask for info for this?

Same here. My taxes due does not change after following the steps completely. And also, I still see the “Needs Review” next to that section afterwards.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Covid-19 distribution from 401k 2020 broken up over 3 years (2020, 2021, 2022) Did not receive a new 1099-R for 2021. Turbo tax doesn't ask for info for this?

Yes - we had that problem We actually upgraded to get the tax expert. We had to fool around with the answers to the questions.. I think it is the one that asks the amount of the 2020 distribution ( whole amount not the 1/3) Try putting zero there I think that’s what she had to do to make it work. Will finish filing today and amend this answer if that’s incorrect.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Covid-19 distribution from 401k 2020 broken up over 3 years (2020, 2021, 2022) Did not receive a new 1099-R for 2021. Turbo tax doesn't ask for info for this?

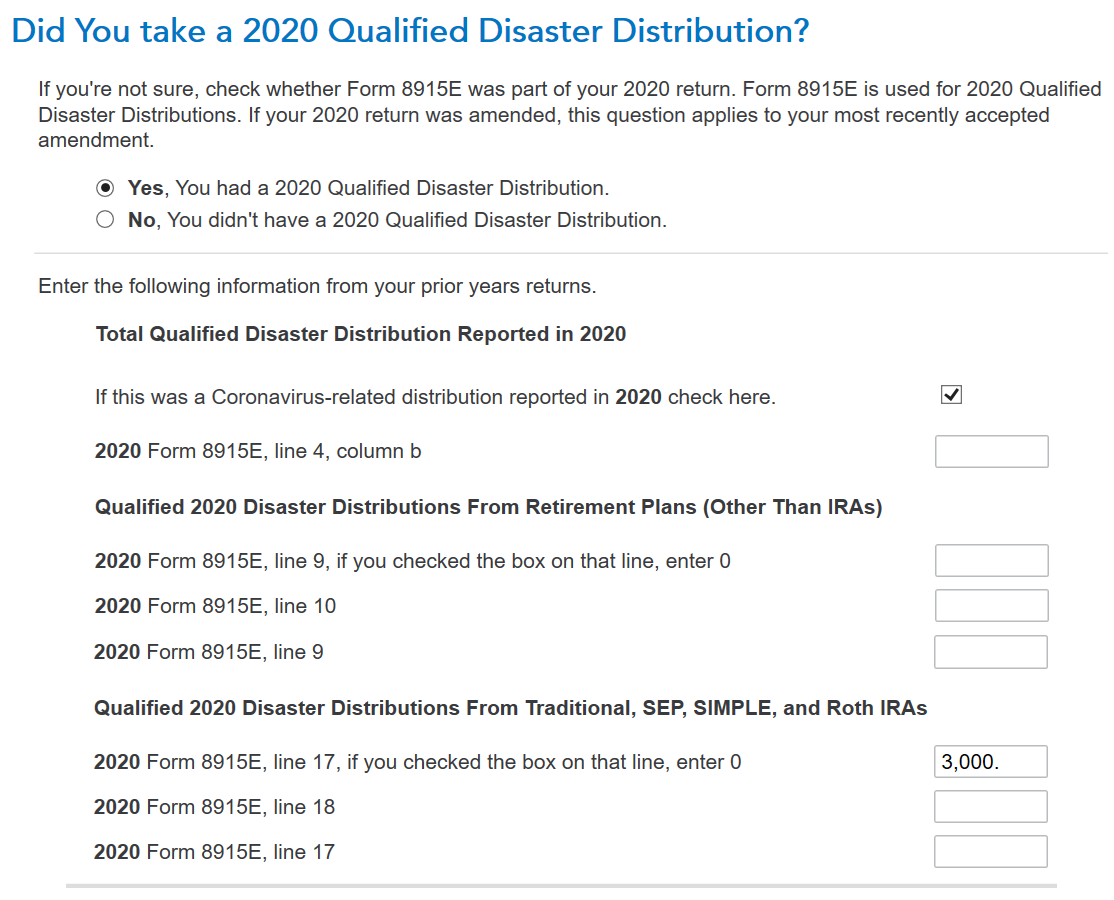

Review the steps and see the images below. The following steps should be used to enter your COVID qualifying distribution. Do Not enter a FEMA code because this doesn't have one. You must have your Form 8915-E from your 2020 tax return.

- Wages & Income > Retirement Plans and Social Security >

- IRA, 401(k), Pension Plan Withdrawals (1099-R) > Start, Revisit or Update > Continue

- Answer Yes 'Have you ever taken a disaster distribution before 2021?

- Answer Yes, You had a 2020 Qualified Disaster Distribution

- Complete the Information using your 2020 Tax return > Continue (use either section but not both (Pension or IRA depending on your situation)

- Enter any amount you may have repaid in 2021, if applicable

- Finish the entry for your spouse if applicable or just click Continue

- Complete any additional retirement questions as you move through this section

- Continue until you have finished and returned back to the Wages & Income Screen.

- Do NOT stop and change sections without completing it.

If the 2020 distribution was from an account that was Not an IRA

- 2020 Form 8915E Line 9 - Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 9

If the 2020 distribution was from an IRA account

- 2020 Form 8915E Line 17 - Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 17

Do not enter anything in the other boxes, leave them blank (empty).

@fivejs

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Covid-19 distribution from 401k 2020 broken up over 3 years (2020, 2021, 2022) Did not receive a new 1099-R for 2021. Turbo tax doesn't ask for info for this?

Ok in the area where you enter your “ qualified disaster distribution from 2020 “ ( 8915 E line 4 ) make sure you leave that blank . TurboTax has added a line instructing that the total amount not be included.

When we took that figure out everything worked. I hope that makes sense.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Covid-19 distribution from 401k 2020 broken up over 3 years (2020, 2021, 2022) Did not receive a new 1099-R for 2021. Turbo tax doesn't ask for info for this?

Revisit the section where you are asked if you had a 2020 qualified disaster distribution On the second line where it asks you for the figure from 2020 1099 for l line 4 column B - leave blank . I noticed that TurboTax has added that instruction. See if when you proceed the tax due will change .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Covid-19 distribution from 401k 2020 broken up over 3 years (2020, 2021, 2022) Did not receive a new 1099-R for 2021. Turbo tax doesn't ask for info for this?

I use the online version. Is it possible Turbotax may have already transferred the information from my previous year's return? I say this because when I zero out Line 9, it reduces my tax so it must be accounting for that amount. I also noticed when I started this section, Line 9 was already pre-populated with the 1/3rd amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Covid-19 distribution from 401k 2020 broken up over 3 years (2020, 2021, 2022) Did not receive a new 1099-R for 2021. Turbo tax doesn't ask for info for this?

I’m not sure where you are seeing line 9 but if your 1/3 amount shows up on page one of your return on line 4b as part of taxable income (assuming you didn’t have any additional retirement withdrawals in 2021 ) then I I think you are good . I’m not sure why your tax would’ve gone down though.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Covid-19 distribution from 401k 2020 broken up over 3 years (2020, 2021, 2022) Did not receive a new 1099-R for 2021. Turbo tax doesn't ask for info for this?

Did your issue get resolved. This is happening to me, even when I answer NO, I did not receive a 1099-R in 2021 the section still shows as Needs Review.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Covid-19 distribution from 401k 2020 broken up over 3 years (2020, 2021, 2022) Did not receive a new 1099-R for 2021. Turbo tax doesn't ask for info for this?

- Yes! We were able to complete and file . Did you get to the section where you are asked “ Did you take a 2020 disaster distribution ?” TurboTax has added an instruction pertaining to line 4 column b . This is the space to leave blank ( even though line 4 column B of the 2020 8915 E does show an amount ) When we did this everything worked out. I hope this helps

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Covid-19 distribution from 401k 2020 broken up over 3 years (2020, 2021, 2022) Did not receive a new 1099-R for 2021. Turbo tax doesn't ask for info for this?

Is this form 8915F available in TT yet?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Covid-19 distribution from 401k 2020 broken up over 3 years (2020, 2021, 2022) Did not receive a new 1099-R for 2021. Turbo tax doesn't ask for info for this?

@dlipps wrote:

Is this form 8915F available in TT yet?

The Form 8915-F was included in the TurboTax online editions in the early evening of 03/23

The Form 8915-F was included as a software update for All the TurboTax desktop editions on 03/24

If you are using the desktop editions, update your software. Click on Online at the top of the desktop program screen. Click on Check for Updates.

You must go to the Retirement Income section of the program for a Form 1099-R to be able to enter your 2nd year of the 2020 distribution -

Click on Federal

Click on Wages & Income

Scroll down to Retirement Plans and Social Security

On IRA, 401(k), Pension Plan Withdrawals (1099-R), click on the Start or Revisit button

On the screen Did you get a 1099-R in 2021? Click on NO, if you did not receive a 2021 Form 1099-R in 2022

Answer Yes when asked Have you ever taken a disaster distribution before 2021?

Answer Yes when asked if you took a Qualified 2020 Disaster Distribution

Check the box that this was a Coronavirus-related distribution reported in 2020

In the box 2020 Form 8915-E, line 4, column b - Leave blank or enter a 0

This is not required on a Form 8915-F for a Coronavirus-related distribution

If the 2020 distribution was from an account that was Not an IRA

Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 9

2020 Form 8915E, line 9, if you checked the box on that line, enter 0

2020 Form 8915E Line 9

If the 2020 distribution was from an IRA account

Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 17

2020 Form 8915E, line 17, if you checked the box on that line, enter 0

2020 Form 8915E Line 17

Do not enter anything in the other boxes, leave them blank (empty) or enter a 0

The 1/3 of the amount from the 2020 distribution will be entered on the 2021 Form 1040 Line 4b if from an IRA or on Line 5b if from a retirement plan other than an IRA

After completing the Wages & Income section you will land on a screen Did you take a disaster distribution at any time between 2018 and 2020?

Answer NO since you have already completed the entering the 1/3 of the 2020 distribution.

You can view your Form 1040 at any time using the online editions. Click on Tax Tools on the left side of the online program screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

Using the desktop editions click on Forms. Open the Form 1040

You should not receive the "Needs Review" in the Federal Review section if -

You Leave blank or enter a 0 in the box for 2020 Form 8915-E, line 4, column b

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Covid-19 distribution from 401k 2020 broken up over 3 years (2020, 2021, 2022) Did not receive a new 1099-R for 2021. Turbo tax doesn't ask for info for this?

Outstanding summary!! Thank you very much DoninGA!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Covid-19 distribution from 401k 2020 broken up over 3 years (2020, 2021, 2022) Did not receive a new 1099-R for 2021. Turbo tax doesn't ask for info for this?

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Covid-19 distribution from 401k 2020 broken up over 3 years (2020, 2021, 2022) Did not receive a new 1099-R for 2021. Turbo tax doesn't ask for info for this?

I still get "Needs Review" here. I have followed all advice.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Covid-19 distribution from 401k 2020 broken up over 3 years (2020, 2021, 2022) Did not receive a new 1099-R for 2021. Turbo tax doesn't ask for info for this?

When you got your 1/3 distribution info entered by answering all the w questions did you notice that the tax you owe went up ( or the amount if refund went down ?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Lily725

Level 2

alanealive

Level 2

augburto

Returning Member

ghouse4u

New Member

heidimay

Level 2