- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Are there steps to calculate the portion for my taxable IRA's along with my basis when doing ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are there steps to calculate the portion for my taxable IRA's along with my basis when doing a Roth IRA backdoor conversion? Prmier Online keeps showing an excess contribution.

The

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are there steps to calculate the portion for my taxable IRA's along with my basis when doing a Roth IRA backdoor conversion? Prmier Online keeps showing an excess contribution.

Please don't enter the conversion amount as a Roth IRA contribution under Deductions & Credits.

Please use the following instructions to enter a "Backdoor IRA" to ensure it is calculated correctly in TurboTax.

To enter the nondeductible contribution to the traditional IRA:

- Login to your TurboTax Account

- Click on "Search" on the top right and type “IRA contributions”

- Click on “Jump to IRA contributions"

- Select “traditional IRA”

- Answer “No” to “Is This a Repayment of a Retirement Distribution?”

- Enter the amount you contributed

- Answer “No” to the recharacterized question on the “Did You Change Your Mind?” screen

- Answer the next questions until you get to “Any Nondeductible Contributions to Your IRA?” and select “Yes” if you had a nondeductible contributions before this tax year.

- If you had a basis in the Traditional IRA before then enter the amount.

- On the “Choose Not to Deduct IRA Contributions” screen choose “Yes, make part of my IRA contribution nondeductible” and enter the amount.

To enter the 1099-R distribution/conversion:

- Login to your TurboTax Account

- Click on "Search" on the top right and type “1099-R”

- Click on “Jump to 1099-R”

- Click "Continue" and enter the information from your 1099-R

- Answer questions until you get to “Tell us if you moved the money through a rollover or conversion” and choose “I converted some or all of it to a Roth IRA”

- On the "Your 1099-R Entries" screen click "continue"

- Answer "yes" to "Any nondeductible Contributions to your IRA?" if you had any nondeductible contributions in prior years.

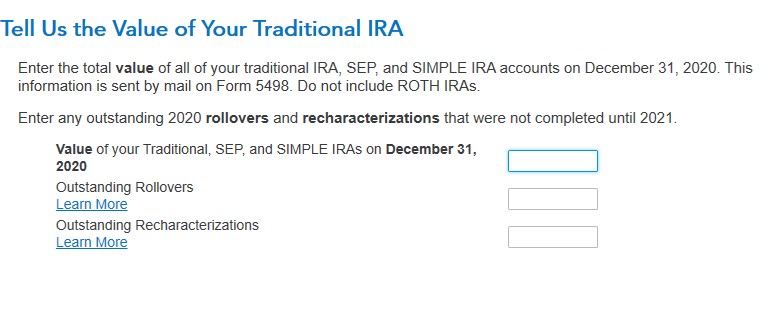

- Answer the questions about the basis and value

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are there steps to calculate the portion for my taxable IRA's along with my basis when doing a Roth IRA backdoor conversion? Prmier Online keeps showing an excess contribution.

Thank you DanaB27.

I followed the directions, but the program does not seem to be addressing a couple of things. From the research I have done, the basis can be used as a stand alone #, onlywhen a person does not still have other deductible traditional IRA's. I have other deductible IRA's. I was surprised that the software does not ask this question. From what I understand I am supposed to divide the basis (which I provided) into the total of (both deductible and non-deductible) IRA's in order to get a %, that is to be used as the % of my conversion that is taxable. I think this correlates to IRS Form 8606, but the program is not addressing this, and I think that something is wrong or I am missing something.

Also, the program seems to make the assumption that the traditional IRA and the conversion to the Roth occur in the same year, which may be the typical way, but in my case it is not being done in the same year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are there steps to calculate the portion for my taxable IRA's along with my basis when doing a Roth IRA backdoor conversion? Prmier Online keeps showing an excess contribution.

Yes, you can enter it if the contribution and conversion happen in different years. You will enter the basis from prior years either in steps 8 and 9 (if you have another contribution) or in steps 7 and 8 (after you enter your 1099-R).

TurboTax will ask about value on December 31, 2020 of all traditional IRAs after you enter the basis during the 1099-R section interview. This will be used to calculate the taxable amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17539892623

Returning Member

Dliotta

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

Al2531

Level 2

shanesnh

Level 3

user17524923356

Level 2