- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: 8915F-S:Do not file the return until this part of calculation is finalized in the upcoming re...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915F-S:Do not file the return until this part of calculation is finalized in the upcoming release.

I can not efile because the CHECK THIS ENTRY.

" Form 8919F-S:_you indicated there were retirement distributions received in 2022 related to a disaster that occurred in 2021 or 2022. It requires Part I of from 8915-F which has not been finalized yet. Do not file the return until this part of calculation is finilized in the upcoming release.

May I ask what I can do? I can not efile for a long time. The dead line is closed soon.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915F-S:Do not file the return until this part of calculation is finalized in the upcoming release.

If you didn't take a disaster distribution in 2022 or prior years then please delete Form 8915 with the steps below.

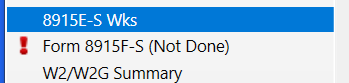

Please use these steps to delete the "Qualified 2020 Disaster Retirement Distribution and Repayment Worksheet" (8915E Wks) in TurboTax Desktop:

- Switch to Forms mode on the top

- Scroll down and select "8915E wks"

- Click "delete" and confirm the deletion

- Switch to Step-by-Step and run the smart check again

Please use these steps to delete the "Qualified 2020 Disaster Retirement Distribution and Repayment Worksheet" in TurboTax Online:

- In the left menu, select "Tax Tools" and then "Tools".

- In the pop-up window Tool Center, select "Delete a form".

- Select "Delete" next to "Qualified 2020 Disaster Retirement Distr" and follow the instructions.

- Run the federal review again

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915F-S:Do not file the return until this part of calculation is finalized in the upcoming release.

Please feel free to contact Customer Support so you can speak with someone who can assist you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915F-S:Do not file the return until this part of calculation is finalized in the upcoming release.

Form 8915-F has been updated. If you are using the desktop version of TurboTax, follow these steps to update the form:

- Click Online

- Click Check for Updates

- Run Updates

- Restart TurboTax

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915F-S:Do not file the return until this part of calculation is finalized in the upcoming release.

I did as you said.

But it is there still. "check the entry......................"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915F-S:Do not file the return until this part of calculation is finalized in the upcoming release.

To clarify, you are trying to report a 2022 or 2021 disaster distribution received in 2022?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915F-S:Do not file the return until this part of calculation is finalized in the upcoming release.

no, I do not know why I have the F_S. I just withdraw some of my retirement the pension .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915F-S:Do not file the return until this part of calculation is finalized in the upcoming release.

If you didn't take a disaster distribution in 2022 or prior years then please delete Form 8915 with the steps below.

Please use these steps to delete the "Qualified 2020 Disaster Retirement Distribution and Repayment Worksheet" (8915E Wks) in TurboTax Desktop:

- Switch to Forms mode on the top

- Scroll down and select "8915E wks"

- Click "delete" and confirm the deletion

- Switch to Step-by-Step and run the smart check again

Please use these steps to delete the "Qualified 2020 Disaster Retirement Distribution and Repayment Worksheet" in TurboTax Online:

- In the left menu, select "Tax Tools" and then "Tools".

- In the pop-up window Tool Center, select "Delete a form".

- Select "Delete" next to "Qualified 2020 Disaster Retirement Distr" and follow the instructions.

- Run the federal review again

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915F-S:Do not file the return until this part of calculation is finalized in the upcoming release.

i did as you listed, but I can not delete the 8915F.

That is weird.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915F-S:Do not file the return until this part of calculation is finalized in the upcoming release.

I have no idea what i can do.

Just mail to irs?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915F-S:Do not file the return until this part of calculation is finalized in the upcoming release.

It would be helpful to have a TurboTax ".tax2022" file that is experiencing this issue. You can send us a “diagnostic” file that has your “numbers” but not your personal information. If you would like to do this, here are the instructions for TurboTax Online:

- From the left menu select Tax Tools.

- Then select Tools below Tax Tools.

- A window will pop up which says Tools Center.

- On this screen, select Share my file with Agent.

- You will see a message explaining what the diagnostic copy is. Click okay through this screen and then you will get a Token number.

- Reply to this thread with your Token number. This will allow us to open a copy of your return without seeing any personal information.

The instructions for TurboTax Download:

- On your menu bar at the very top, click "Online"

- Select "Send Tax File to Agent"

- Click "Send"

- The pop-up will have a token number

- Reply to this thread with your Token number. This will allow us to open a copy of your return without seeing any personal information.

We will then be able to see exactly what you are seeing and we can determine what exactly is going on in your return and provide you with a resolution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915F-S:Do not file the return until this part of calculation is finalized in the upcoming release.

1112217

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915F-S:Do not file the return until this part of calculation is finalized in the upcoming release.

Thank you, I reviewed your token and I was able to remove the error with these steps in TurboTax Desktop:

- Switch to Forms mode on the top

- Scroll down and select "8915E-S wks"

- Click "delete" and confirm the deletion

- Switch to Step-by-Step and run the smart check again (it didn't show any error)

Please make sure you delete the worksheet and this will automatically delete Form 8915-F.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915F-S:Do not file the return until this part of calculation is finalized in the upcoming release.

what I can do now. I can not resolve the issue over month now~

thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915F-S:Do not file the return until this part of calculation is finalized in the upcoming release.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915F-S:Do not file the return until this part of calculation is finalized in the upcoming release.

I can not delete.

even you do that, and refresh it. It is just there again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915F-S:Do not file the return until this part of calculation is finalized in the upcoming release.

Please feel free to contact Customer Support so you can speak with someone who can assist you.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17525829981

Level 1

linkwalls

New Member

w_dye

New Member

w_dye

New Member

alex1907

Level 2