- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: 2020 RMD Reversal

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 RMD Reversal

Good... I'll roll with that and see what happens.....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 RMD Reversal

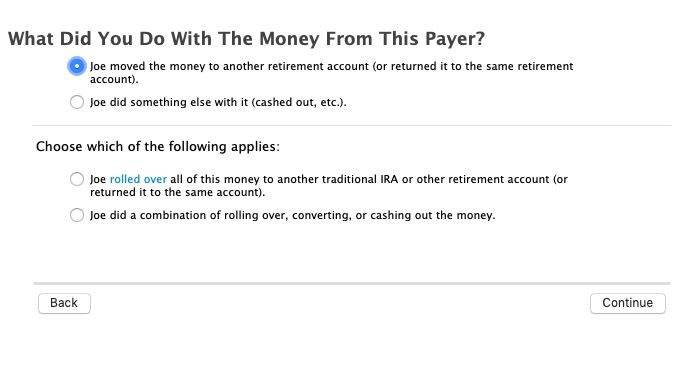

I reversed my RMD after the CARES Act was passed also. TT tried to edit their instructions re: this but didn't succeed.

They did add parenthetical text to address the 2020 situation:

What did you do with the money?

__Moved the money to another retirement account (or returned it to the same account)

But then,

Choose which of the following applies:

__rolled over all of the money OR

__rolled over a partial amount of the money.

The problem is that TT defines "rollover" as "moving the money to a different retirement account." In my case, I moved it to the same account, but the software would not let me ignore the "Choose which " question since it doesn't address my situation.

As a guy who spent much of his career parsing contract language, I am not comfortable with checking "rolled over all of the money", but am just going to chalk it up to sloppy editing on TT's part and forget about it.

Just sayin'

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 RMD Reversal

@tho5 wrote:

I reversed my RMD after the CARES Act was passed also. TT tried to edit their instructions re: this but didn't succeed.

They did add parenthetical text to address the 2020 situation:

What did you do with the money?

__Moved the money to another retirement account (or returned it to the same account)

But then,

Choose which of the following applies:

__rolled over all of the money OR

__rolled over a partial amount of the money.

The problem is that TT defines "rollover" as "moving the money to a different retirement account." In my case, I moved it to the same account, but the software would not let me ignore the "Choose which " question since it doesn't address my situation.

As a guy who spent much of his career parsing contract language, I am not comfortable with checking "rolled over all of the money", but am just going to chalk it up to sloppy editing on TT's part and forget about it.

Just sayin'

A rollover does not specify the account that it was rolled to. It can be the same account an in the case of a returned RMD probably will be the same account. The only thing that goes on the tax return is the amount on line 4 of the 1040 for with the word ROLLOVER next it. The account is irrelevant.

"Rolled over all the money" simply means that all of the 1099-R box 1 amount was rolled over.

"Rolled over a partial amount' means that only some of box 1 was roller over and the rest was kept by you.

This part of the 1099-R interview has not changed for many years.

The desktop version looks like this - seems clear enough to me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 RMD Reversal

That's exactly what I did to get the result of not having the money reported as taxable income and the notation, "Rollover" on line 4b.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 RMD Reversal

They did add parenthetical text to address the 2020 situation:

Where is this ?

I find there's a problem linking 1099R with 1040 ....1040 line 4a should be linked to 1099 1 Gross Distribution.

Also if you don't check 2b Taxable not determine, the amount on line 2a should go to 1040 L4a ...it doesn't.

Any amount in 1099 #1 to goes to 1040 L4b.

The proper way to report RMD partial reversal is to report the Gross L4a and taxable amount on L4a and write "Rollover" on L4b.

Any suggestions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 RMD Reversal

RMD's are not eligible for rollover, but there was not 2020 ROM, so yiu must answer the RMD questions that "None of this distribution was a RMD" or "RMD not required".

Then you should get the screen to roll it over.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 RMD Reversal

Thanks ..... I did that before and it didn't work?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 RMD Reversal

Delete and reenter the Form 1099-R. If you ever told TurboTax that it was an RMD, simply editing and changing the answer will not work.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 RMD Reversal

It seems there are two ways to deal with this conundrum:

l. enter gross distribution on line 4a, 0 as taxable amount on 4b, and write "rollover" next to line 4b so the IRS knows why the numbers don't match. Problem here is in order to take this approach return must be sent by mail. this means any other state forms must also be sent by mail.

2. e-file the form showing 4a gross amount, 0 in 4b. Then wait to see if you hear from IRS as to why numbers don't match.

any other ideas would be appreciated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 RMD Reversal

Entered as described earlier in this thread there is no conundrum because TurboTax will include the gross amount of the IRA distributions on Form 1040 line 4a and will exclude from taxable income on line 4b the amount rolled over, with no need to alter anything produced by TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 RMD Reversal

agree there is no need to alter the turbo tax results. the issue is disclosing to the IRS the reason for the mismatch. Kiplinger offered the solution of writing "rollover" next to 4b for IRS disclosure. but that means you would need to file manually.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 RMD Reversal

You will not need to paper file. TurboTax types the word rollover for you in the instance of any IRA rollover, as required per IRS instructions. When you review your tax return before filing, you will see it there.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 RMD Reversal

As said several time in the thread, any IRA distribution in 2020 was NOT an RMD, so the RMD question must be answered that "none of this distribution was a RMD" or "RMD not required". The yiu get the screen to say it was rolled over that will put it on the 1040 form line 4a with the word "ROLLOVER" next to it.

Delete the 1099-R to reset the prior answers and re-enter (also it was NOT COVID related).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 RMD Reversal

TT doesn't ask me if I reinvested the money back to and IRA. It seems like I spend more time playing games with TT then if I just did my taxes on paper.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 RMD Reversal

Delete the 1099-R you entered and re-enter.

Answer the RMD question that "None of this distribution was a RMD" or "RMD not required" depending on the TurboTax version - because it was NOT a RMD, there were no 2020 RMD's.

If this is an inherited IRA then answer the "Is this IRA inherited" with NO. The purpose of that question is to PREVENT rolling an inherited IRA over, but is allowed for 2020 only.

Then you will get the screen to say it was "moved" and all rolled over.

Also check the box that this was NOT a COVID related distributions - it was a RMD that was returned.

That will put the 1099-R box 1 amount on the 1040 form line 4a with the word ROLLOVER next to it.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17718157531

New Member

frankharry

Level 3

anonymouse1

Level 6

dan-richardson29

New Member

VolvoGirl

Level 15