- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

@tho5 wrote:

I reversed my RMD after the CARES Act was passed also. TT tried to edit their instructions re: this but didn't succeed.

They did add parenthetical text to address the 2020 situation:

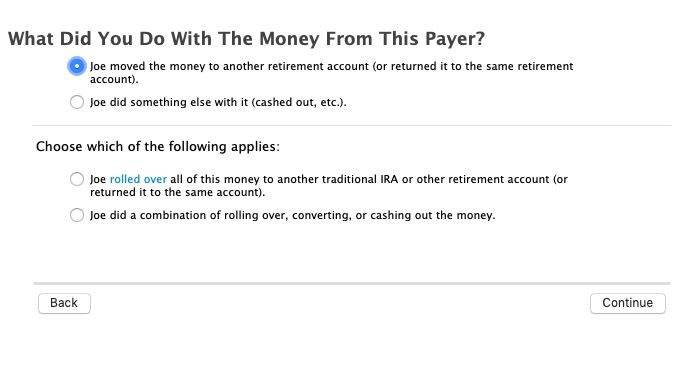

What did you do with the money?

__Moved the money to another retirement account (or returned it to the same account)

But then,

Choose which of the following applies:

__rolled over all of the money OR

__rolled over a partial amount of the money.

The problem is that TT defines "rollover" as "moving the money to a different retirement account." In my case, I moved it to the same account, but the software would not let me ignore the "Choose which " question since it doesn't address my situation.

As a guy who spent much of his career parsing contract language, I am not comfortable with checking "rolled over all of the money", but am just going to chalk it up to sloppy editing on TT's part and forget about it.

Just sayin'

A rollover does not specify the account that it was rolled to. It can be the same account an in the case of a returned RMD probably will be the same account. The only thing that goes on the tax return is the amount on line 4 of the 1040 for with the word ROLLOVER next it. The account is irrelevant.

"Rolled over all the money" simply means that all of the 1099-R box 1 amount was rolled over.

"Rolled over a partial amount' means that only some of box 1 was roller over and the rest was kept by you.

This part of the 1099-R interview has not changed for many years.

The desktop version looks like this - seems clear enough to me.